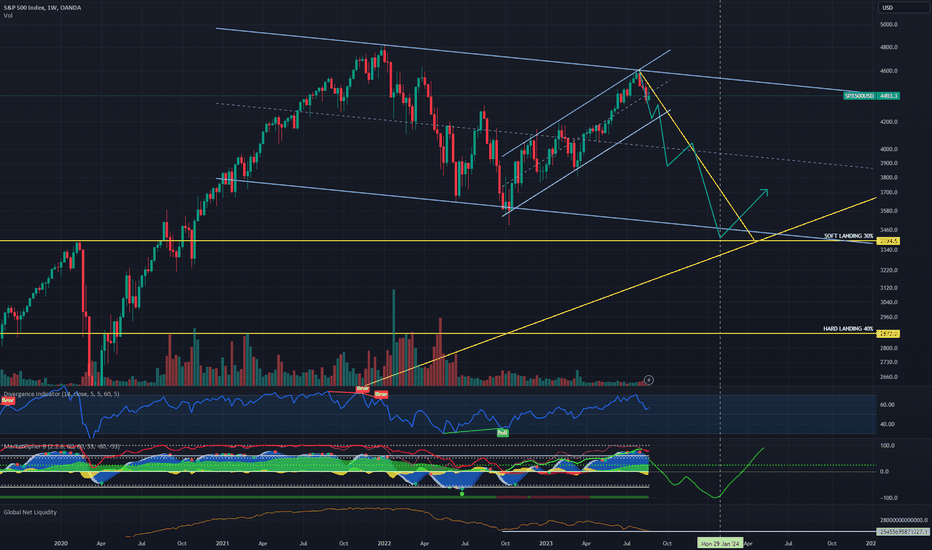

Some reasons why we could see a pullback here:

1. We are forming a bearish divergence on the daily timeframe

2. We exactly touched the fibonacci retrace level at 78.6%

3. We are at the top of a potential downward trend channel

4. Overbought

5. Red dot, indicating sell pressure

6. Global liquidity being drained

1. We are forming a bearish divergence on the daily timeframe

2. We exactly touched the fibonacci retrace level at 78.6%

3. We are at the top of a potential downward trend channel

4. Overbought

5. Red dot, indicating sell pressure

6. Global liquidity being drained

Note

Will he announce that we are in a "mild" recession today 👀Note

Rate hike relief pump has now retraced. If unemployment rate comes in hot tomorrow we might get the catalyst to the downside and confirmation of a pivot.Note

We just got a Fitch rating downgrade that can have effects on the stock market:- decreased confidence in the market

- increased borrowing costs

- market uncertainty

- impact on global markets

- weaken the U.S. dollar

We have awaited a pullback. Will this end up beeing more then a pullback?

Note

To me it looks like every pump is beeing sold in to -> big players getting exit liquidityDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.