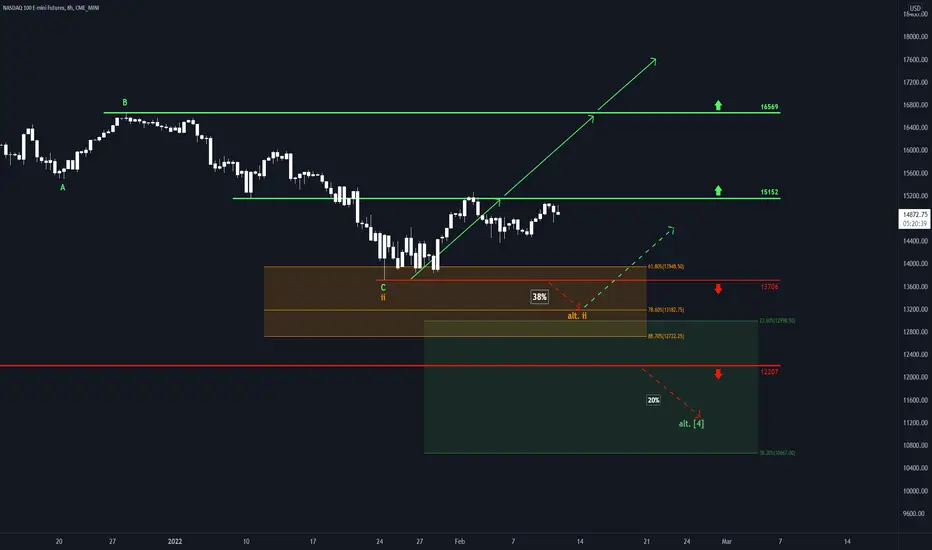

After it has risen from the upper edge of the orange zone between 12722 and 13948 points, Nasdaq is currently snaking along below the resistance line at 15152 points. However, it should soon surmount this mark and thus gain power for a continued upwards movement, which should lead the tech-index above 16569 points.

Still, as long as Nasdaq keeps up its snake moves and has not safely made it above 15152 points, there remains a 38% chance that the index could tumble below the support at 13706 points. In this case, it should fall a bit deeper into the lower half of the orange zone before rising up again. If the index drops even below 12207 points, there is a 20% chance for further downward movement.

Still, as long as Nasdaq keeps up its snake moves and has not safely made it above 15152 points, there remains a 38% chance that the index could tumble below the support at 13706 points. In this case, it should fall a bit deeper into the lower half of the orange zone before rising up again. If the index drops even below 12207 points, there is a 20% chance for further downward movement.

📊 Free daily market insights combining macro + Elliott Wave analysis

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📊 Free daily market insights combining macro + Elliott Wave analysis

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.