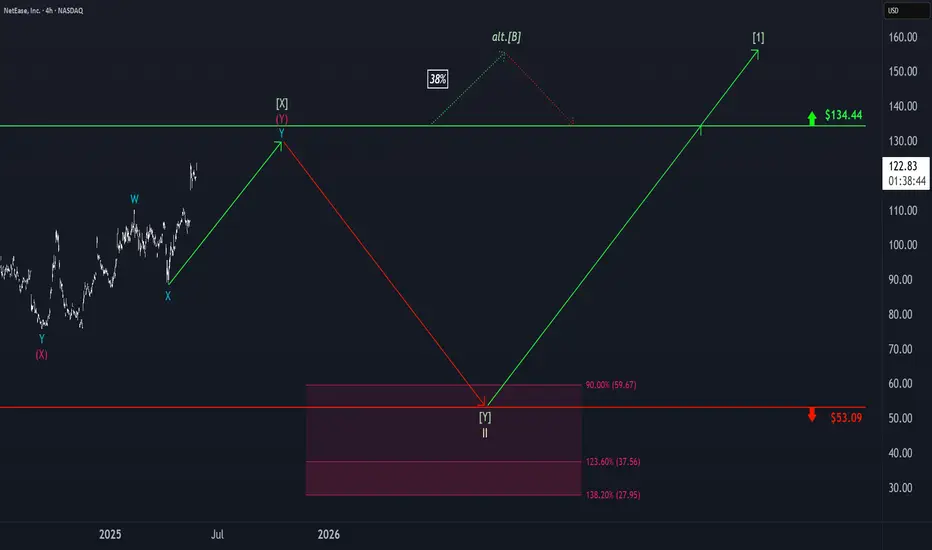

NTES generated a strong upward impulse, surging nearly 15% higher, including a gap-up. This brought the stock noticeably closer to the high of the green wave [X], which should ideally form just below the resistance at $134.44. After this peak, we anticipate significant sell-offs down to the $53.09 support level, where the beige wave II should conclude. Since a sustainable uptrend should follow this low, we have highlighted a magenta Target Zone (coordinates: $59.67 – $27.95), which is suitable for long entries. Once the zone is completed, the price should reach levels above the resistance at $134.44 during the subordinate green wave [1]. This mark also plays a role in our alternative scenario (probability: 38%). If the price rises above the $134.44 resistance without previously reaching the Target Zone, we will have to consider an alternative corrective wave structure, with the price currently in the green wave alt.[B].

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

📊 Free daily market insights combining macro + Elliott Wave analysis

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📊 Free daily market insights combining macro + Elliott Wave analysis

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.