Please refer to our previous post:

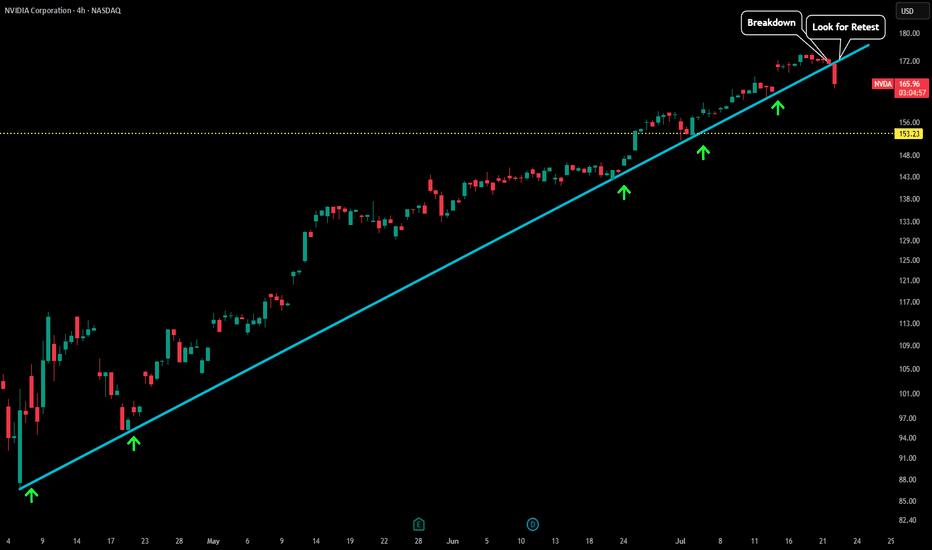

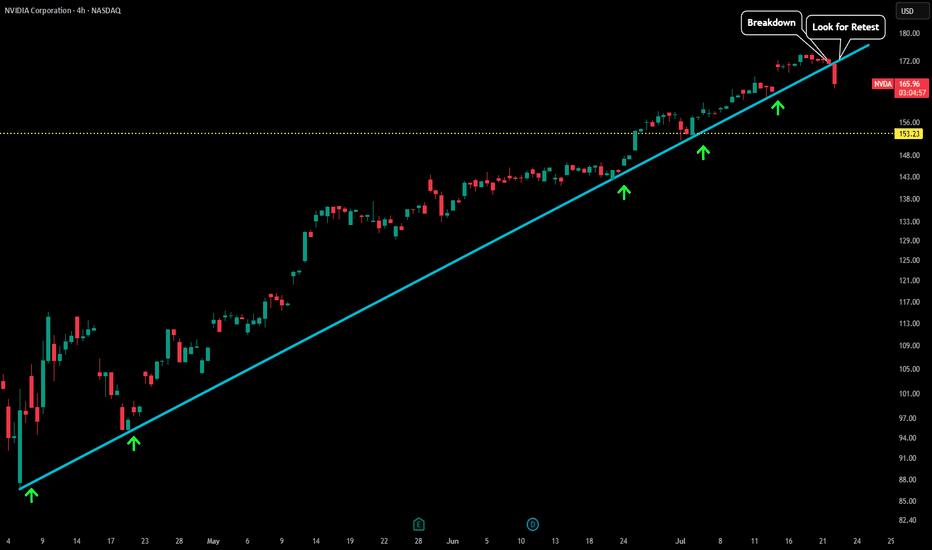

Here we were pointing out the structural break of our blue trendline on the daily. It acted as support the whole way up (green arrows) and now has been flipped into resistance so far (red arrows).

Also if you look at the chart on the right we had a MAJOR bearish signal flash. A weekly gravestone doji formed which could end up marking the top. We haven't had the confirmation yet, but depending on how price action play out this week we could have a very good idea of what next.

If we see bearish momentum and this weekly candle flip red that could be the first sign of this gravestone marking the top as it is a reversal candle. That would also send our strength on the RSI below the 70 which could look as a rejection from overbought conditions.

However, if we are able to maintain this weekly candle green (better yet break the gravestone doji high) that would show strength bouncing from overbought and send us towards that $200 target.

Here we were pointing out the structural break of our blue trendline on the daily. It acted as support the whole way up (green arrows) and now has been flipped into resistance so far (red arrows).

Also if you look at the chart on the right we had a MAJOR bearish signal flash. A weekly gravestone doji formed which could end up marking the top. We haven't had the confirmation yet, but depending on how price action play out this week we could have a very good idea of what next.

If we see bearish momentum and this weekly candle flip red that could be the first sign of this gravestone marking the top as it is a reversal candle. That would also send our strength on the RSI below the 70 which could look as a rejection from overbought conditions.

However, if we are able to maintain this weekly candle green (better yet break the gravestone doji high) that would show strength bouncing from overbought and send us towards that $200 target.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.