🔬 GEX (Options Sentiment) Breakdown:

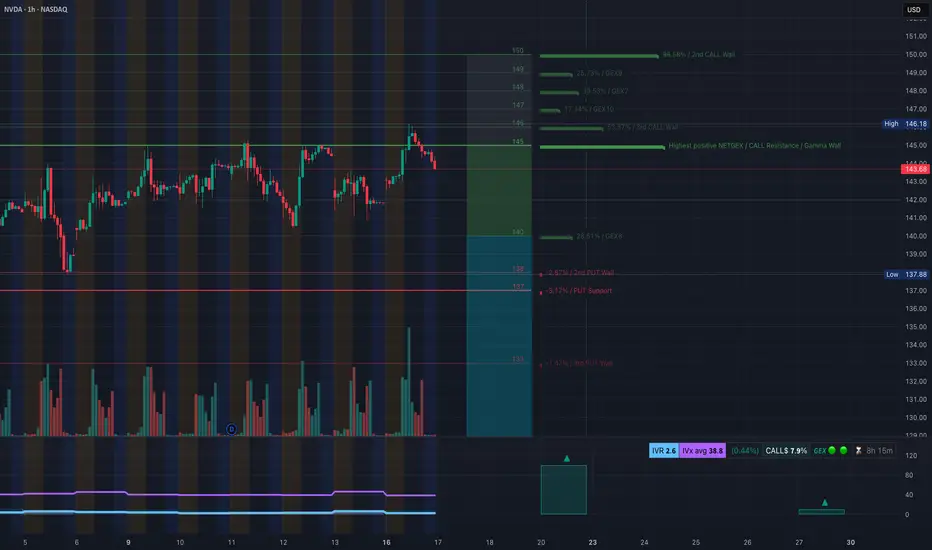

* Key Gamma Levels:

* CALL Walls / Resistance:

* $146.18 = Gamma Wall (currently rejected)

* $148.84 → 2nd CALL Wall

* $150+ = Higher GEX levels but unlikely short-term without breakout

* PUT Support Zones:

* $143 → active support (currently being tested)

* $140 → key gamma flip zone (GEX8)

* Below $140 → $138 / $135 → deep gamma pit

* GEX Metrics:

* IVR: 2.6 (extremely low = possible vol expansion coming)

* IVx avg: 38.8

* Calls Flow: 7.9% (weak call interest)

* GEX Sentiment: 🟢🟢🟢 (neutral-to-bullish positioning)

* Interpretation:

* NVDA is struggling at $146–147 gamma wall — rejection could cause dealer de-hedging toward $143 or even $140.

* IV is extremely suppressed → any large move could expand volatility and create rapid price shifts.

📊 15-Minute SMC Chart Breakdown:

* Current Price: $145.20

* Structure:

* Price broke bullish structure early session and reached supply near $146.18 → then CHoCH triggered at the top.

* Now pulling back into a minor demand box ($143.68–144.27).

* If demand fails here → eyes on deeper demand at $141.97 and $140.86.

* Major volume spike on pullback shows institutional selling near top.

* Trendline:

* Broke rising wedge → momentum flattening.

* Volume divergence (price up, volume down) followed by breakdown = warning.

🧭 Trade Setups:

🟥 Bearish Setup:

* Trigger: Break below $143.50

* Target 1: $141.97

* Target 2: $140 (GEX zone)

* Stop-loss: $146.20 (back inside supply = invalid)

Dealers could unwind hedges if price stays under $144, accelerating toward gamma-supported downside.

🟩 Bullish Reclaim Setup:

* Trigger: Reclaim and hold $146.20

* Target 1: $148.84 (2nd CALL Wall)

* Target 2: $150+

* Stop-loss: $143.60

This would trap late shorts and could cause a gamma squeeze toward $149–$150.

🧠 My Thoughts:

* NVDA is at the inflection, sandwiched between dealer defense at $146 and GEX vacuum under $143.

* If SPY/QQQ break lower tomorrow, NVDA could lead downside toward $140.

* Volatility is cheap (IVR 2.6), making options attractive if directional bias is strong.

* Ideal trade: wait for confirmation at $144–143 area before entering PUTs.

📌 Conclusion:

NVDA is showing short-term weakness under heavy gamma resistance at $146. A clean breakdown below $143.50 opens the door to $140 fast. Only a reclaim above $146.20 flips bias bullish again.

Disclaimer: This analysis is for educational purposes only. Always trade your own plan and manage risk accordingly.

* Key Gamma Levels:

* CALL Walls / Resistance:

* $146.18 = Gamma Wall (currently rejected)

* $148.84 → 2nd CALL Wall

* $150+ = Higher GEX levels but unlikely short-term without breakout

* PUT Support Zones:

* $143 → active support (currently being tested)

* $140 → key gamma flip zone (GEX8)

* Below $140 → $138 / $135 → deep gamma pit

* GEX Metrics:

* IVR: 2.6 (extremely low = possible vol expansion coming)

* IVx avg: 38.8

* Calls Flow: 7.9% (weak call interest)

* GEX Sentiment: 🟢🟢🟢 (neutral-to-bullish positioning)

* Interpretation:

* NVDA is struggling at $146–147 gamma wall — rejection could cause dealer de-hedging toward $143 or even $140.

* IV is extremely suppressed → any large move could expand volatility and create rapid price shifts.

📊 15-Minute SMC Chart Breakdown:

* Current Price: $145.20

* Structure:

* Price broke bullish structure early session and reached supply near $146.18 → then CHoCH triggered at the top.

* Now pulling back into a minor demand box ($143.68–144.27).

* If demand fails here → eyes on deeper demand at $141.97 and $140.86.

* Major volume spike on pullback shows institutional selling near top.

* Trendline:

* Broke rising wedge → momentum flattening.

* Volume divergence (price up, volume down) followed by breakdown = warning.

🧭 Trade Setups:

🟥 Bearish Setup:

* Trigger: Break below $143.50

* Target 1: $141.97

* Target 2: $140 (GEX zone)

* Stop-loss: $146.20 (back inside supply = invalid)

Dealers could unwind hedges if price stays under $144, accelerating toward gamma-supported downside.

🟩 Bullish Reclaim Setup:

* Trigger: Reclaim and hold $146.20

* Target 1: $148.84 (2nd CALL Wall)

* Target 2: $150+

* Stop-loss: $143.60

This would trap late shorts and could cause a gamma squeeze toward $149–$150.

🧠 My Thoughts:

* NVDA is at the inflection, sandwiched between dealer defense at $146 and GEX vacuum under $143.

* If SPY/QQQ break lower tomorrow, NVDA could lead downside toward $140.

* Volatility is cheap (IVR 2.6), making options attractive if directional bias is strong.

* Ideal trade: wait for confirmation at $144–143 area before entering PUTs.

📌 Conclusion:

NVDA is showing short-term weakness under heavy gamma resistance at $146. A clean breakdown below $143.50 opens the door to $140 fast. Only a reclaim above $146.20 flips bias bullish again.

Disclaimer: This analysis is for educational purposes only. Always trade your own plan and manage risk accordingly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.