🔍 Market Structure Overview (15m + 1h Combo)

* NVDA showed bullish BOS and CHoCH structure earlier today, reclaiming mid-range after tapping demand.

* The current CHoCH (purple box) is forming just under the $145 rejection area.

* A strong bounce off the green OB demand box around 142.00–142.04, holding this zone keeps upside potential alive.

* The upward trendline still valid unless we break under the green demand zone.

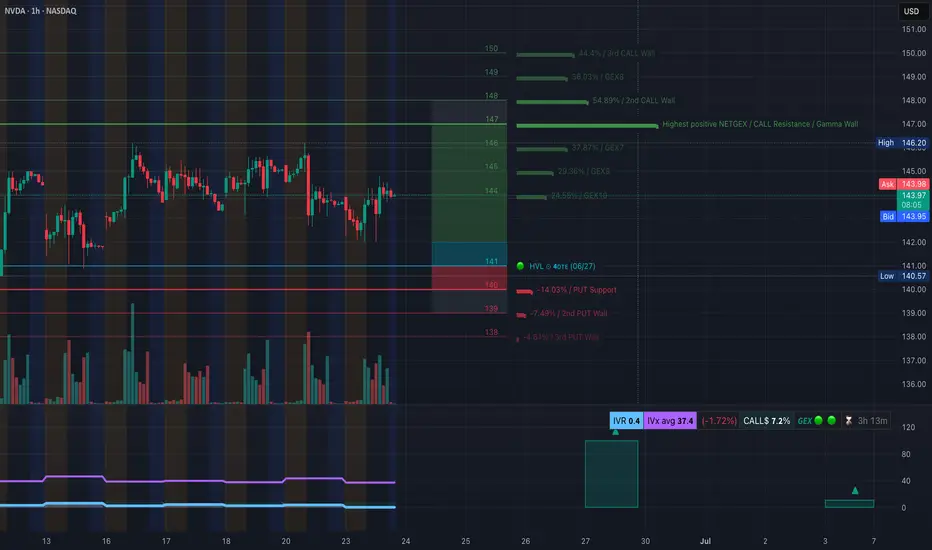

📊 GEX + Options Sentiment (1H Chart)

* Highest Net GEX / Call Resistance: $147 — strong resistance area.

* Second Call Wall: $148

* Gamma Wall Confluence: $146.20–147 zone –> expect rejection or a squeeze trigger.

* Put Walls: 140 / 139 / 138 — stacked gamma support.

* IVX avg: 37.4 (low volatility), IVR: 0.4 → cheap premium environment.

* CALL bias: 7.2%, 3 Green Dots = Bullish Bias w/ room to run.

🧠 Smart Money Concepts (15m)

* BOS to upside already confirmed.

* New CHoCH forming within a micro consolidation zone between $144–$145.

* Price is currently dancing around mid-supply zone.

* Liquidity still resting above 146.20, creating fuel if breakout sustains.

📌 Trade Scenarios

Bullish Case:

* Trigger: Break and hold above 145.00

* Target 1: $146.20 (first resistance)

* Target 2: $147–$148 (Call Wall + Net GEX)

* Invalidation: Break below 143.00

* Optional Call entry: Above 145, SL below 143.80

Bearish Case:

* Trigger: Rejection at $145 + CHoCH breakdown confirmation

* Target 1: $142.00 (Demand OB)

* Target 2: $140 (PUT Wall)

* Put entry: below $143.50, with volume surge and failed retest of 144

🎯 Final Thoughts:

NVDA is building energy in a tight CHoCH range. A push above $145 opens the gate to a gamma squeeze into $147+. Watch the reaction at 144.78 and 145 zone closely — it’s make or break. Under 143.00 and this flips bearish fast.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.