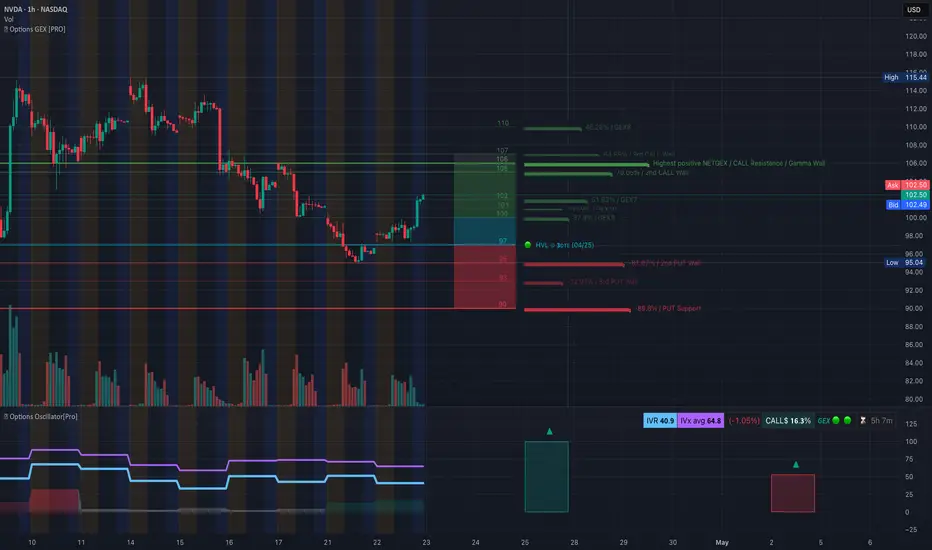

🔍 GEX Options Overview:

NVDA is experiencing a clear options-driven magnet toward 105–106, with notable call wall concentration and positive NET GEX at those levels:

* Highest positive GEX zone: 105–106 = bullish gamma magnet

* HVL for 3DTE anchored at 97 = strong bounce zone

* PUT walls stacked at 95, 93, 90 showing limited downside support but weakening pressure

* Options Oscillator confirms this bullish lean with green GEX dots, low IVX, and relatively low IVR (40.9)

Despite the macro softness, NVDA has gamma fuel to push up, especially with no strong call resistance until the 105–107 zone. This sets up a favorable risk/reward setup for short-term bullish trades.

📈 Technical Analysis & Trading Outlook:

From the SMC Co-Pilot chart, NVDA is rebounding after forming multiple BOS (Break of Structure) signals and is now consolidating under a previous CHoCH level, near the 102–103 zone.

* Trend Bias (MTF): 30m & 15m bullish, but 1h still recovering

* HTF Structure: Bullish SMC structure forming, but caution is required

* Volume: Extreme spike (1.6x) during reversal = institutions may be stepping in

* Setup Status: No trade confirmed yet – but we are in premium zone, so shorts are risky unless structure shifts

* EMA21 is the decision zone; price reclaiming and holding above would confirm further upside

🧠 My Thoughts:

This is one of those setups where the GEX setup is leading price, and technicals are just beginning to catch up. The move from 97 to 102 was gamma-fueled, and any dip toward 100 or 98 may provide high R/R re-entry zones for CALL scalps or spreads.

No trade now unless we get either:

1. A clean pullback to 99–100 and bounce with confirmation (BOS/CHoCH + volume support)

2. Break and hold above 103.5 with strength — then scalp to 106

⚠️ Avoid chasing at highs without confirmation. Volume and structure will decide whether this is a dead cat bounce or start of a new leg up.

This analysis is for educational purposes only. Always trade with a plan and proper risk management.

NVDA is experiencing a clear options-driven magnet toward 105–106, with notable call wall concentration and positive NET GEX at those levels:

* Highest positive GEX zone: 105–106 = bullish gamma magnet

* HVL for 3DTE anchored at 97 = strong bounce zone

* PUT walls stacked at 95, 93, 90 showing limited downside support but weakening pressure

* Options Oscillator confirms this bullish lean with green GEX dots, low IVX, and relatively low IVR (40.9)

Despite the macro softness, NVDA has gamma fuel to push up, especially with no strong call resistance until the 105–107 zone. This sets up a favorable risk/reward setup for short-term bullish trades.

📈 Technical Analysis & Trading Outlook:

From the SMC Co-Pilot chart, NVDA is rebounding after forming multiple BOS (Break of Structure) signals and is now consolidating under a previous CHoCH level, near the 102–103 zone.

* Trend Bias (MTF): 30m & 15m bullish, but 1h still recovering

* HTF Structure: Bullish SMC structure forming, but caution is required

* Volume: Extreme spike (1.6x) during reversal = institutions may be stepping in

* Setup Status: No trade confirmed yet – but we are in premium zone, so shorts are risky unless structure shifts

* EMA21 is the decision zone; price reclaiming and holding above would confirm further upside

🧠 My Thoughts:

This is one of those setups where the GEX setup is leading price, and technicals are just beginning to catch up. The move from 97 to 102 was gamma-fueled, and any dip toward 100 or 98 may provide high R/R re-entry zones for CALL scalps or spreads.

No trade now unless we get either:

1. A clean pullback to 99–100 and bounce with confirmation (BOS/CHoCH + volume support)

2. Break and hold above 103.5 with strength — then scalp to 106

⚠️ Avoid chasing at highs without confirmation. Volume and structure will decide whether this is a dead cat bounce or start of a new leg up.

This analysis is for educational purposes only. Always trade with a plan and proper risk management.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.