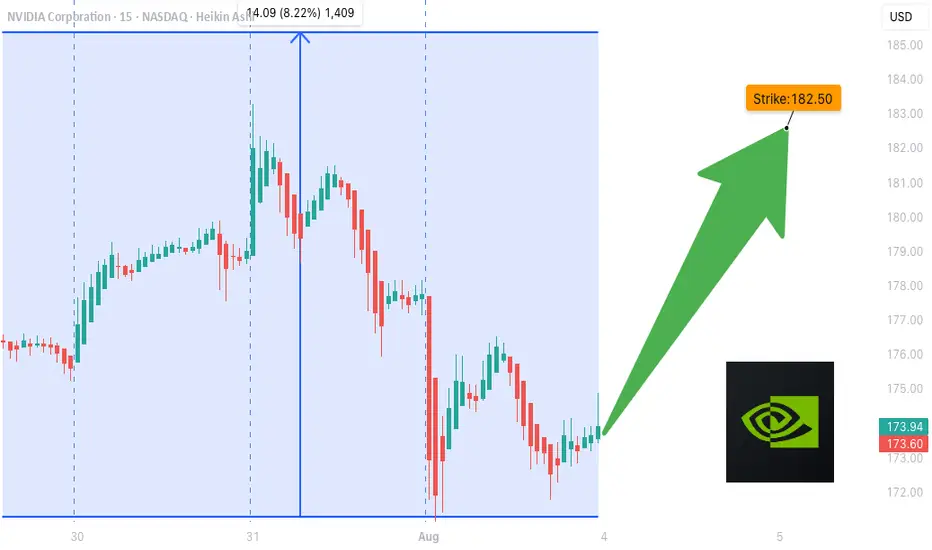

### 🟢 NVDA Weekly Trade Setup (2025-08-02)

🚀 **BULLISH CONSENSUS** across 5 top-tier models

📉 Daily RSI: Weak — but weekly trend is STRONG

💼 Institutional Volume: Confirmed accumulation

📊 Options Flow: Call/Put leaning bullish

---

### 🎯 TRADE SETUP

**💥 Direction:** CALL (LONG)

**📍 Strike:** \$182.50

**📅 Expiry:** 2025-08-08

**💵 Entry:** \$0.73

**🎯 Target:** \$1.46 (100% gain)

**🛑 Stop:** \$0.36 (50% risk cap)

**✅ Confidence:** 75%

**🕒 Entry Timing:** At market open

---

### 🧠 Model Breakdown:

✅ **Grok/xAI:** Weekly bullish, 4/5 signals green

✅ **DeepSeek:** Volume confirms; cautious on daily RSI

✅ **Google/Gemini:** Bullish weekly > bearish daily

✅ **Claude:** Weekly momentum + rising options flow

✅ **Meta/Llama:** All signals aligned for \$182.50 call

---

### ⚠️ Risk Watch:

* Falling Daily RSI = short-term drag risk

* Key Support: Watch for \$178 breakdown

* Earnings/events could spike volatility

---

### 📦 TRADE JSON (for tracking):

```json

{

"instrument": "NVDA",

"direction": "call",

"strike": 182.50,

"expiry": "2025-08-08",

"confidence": 0.75,

"profit_target": 1.46,

"stop_loss": 0.36,

"size": 1,

"entry_price": 0.73,

"entry_timing": "open",

"signal_publish_time": "2025-08-03 00:54:05 UTC-04:00"

}

```

---

🔥 *“Smart money is circling. Ride the wave, not the noise.”*

💬 Drop your thoughts below. Will NVDA break \$185 next week?

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.