NVDA Explodes into Gamma Cloud! Squeeze to $187 or Pullback from Supply?

🔍 GEX & Options Flow Insight (1st Image Analysis)

NVDA just broke through major resistance and is trading at $183.35, sitting in the middle of stacked Call Walls and a strong positive GEX zone. Gamma positioning is highly bullish—but a stall near current levels is possible as dealers begin to hedge less aggressively.

* Call Walls & Resistance:

* ✅ $180.00 → Highest positive NET GEX zone

* ✅ $182.5 → 2nd Call Wall (68.77%) — current area of battle

* 🧱 $187.5–190.0 → GEX9 and GEX10 zones = possible squeeze targets

* Put Support:

* 🛡️ $175.18–175.51 → Strong PUT Support zone and demand on price chart

* 🔻 $172.5 → HVL zone = invalidation for breakout thesis

* Volatility Insight:

* IVR 12.6, IVx Avg 41.7 → Neutral-to-low IV

* Calls Bias: 15.4% → Slightly bullish, but not euphoric

* GEX sentiment: 🟡🟢🟢 = Cautiously Bullish

✅ Option Trading Suggestion:

Bias: Bullish with caution around 185 Strategy: Vertical debit call spread

* Entry Idea: Buy 182.5C / Sell 187.5C for Aug 2 or Aug 9

* Stop: Close below 179.65 (trap candle base)

* Target: 187.5 (GEX9 ceiling)

Why this works: NVDA is entering a highly stacked gamma region. If bulls hold above 182.5, momentum may carry price toward the outer GEX bands at 187.5. However, IV is not stretched, so premium decay is a risk—spreads protect against it.

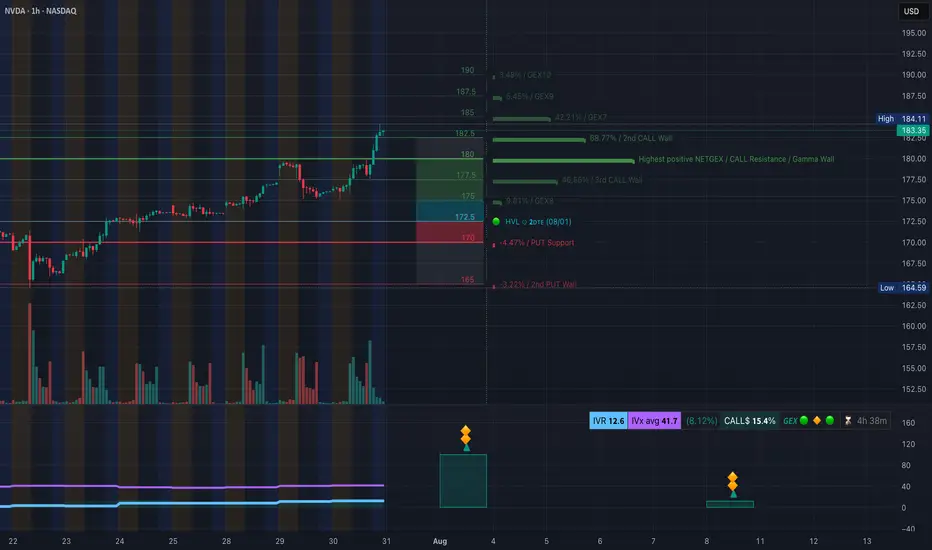

🧠 Technical Analysis (1H Chart) (2nd Image Analysis)

Market Structure & SMC:

* ✅ CHoCH → BOS → BOS confirmed since July 29

* 🚀 Strong bullish continuation from discounted OB area near 175

* NVDA is currently riding mid-upper range of an ascending channel

Trendlines:

* Perfect channel structure respected since July 25

* Currently touching upper channel resistance around 183.35–184.50

SMC Zones & Supply/Demand:

* 🟩 Demand Zone: 175.18–177.32 → Last bullish OB

* 🟥 Supply/Exhaustion Zone: 183.5–185 (purple box) → caution here

🔄 Price Action & Key Levels

* Support:

* 📌 179.65 → Key structure base (trap candle)

* ✅ 177.32–175.18 → Demand + OB + GEX Put Support

* ❗ Below 172.5 = structure breaks

* Resistance:

* 🚩 183.35–185.00 → Supply + top channel + GEX7

* 🧨 187.5–190.0 → GEX9/GEX10 extension zone = possible parabolic breakout

🧭 Scalping / Intraday Trade Setup

🟩 Bullish Setup (Preferred):

* Entry: 182.50–183.00 breakout

* Target 1: 185.00

* Target 2: 187.50

* Stop: 179.65 break & hold

🟥 Bearish Pullback Setup:

* Entry: Rejection at 184.5 supply zone

* Target 1: 180.00

* Target 2: 177.30

* Stop: New high above 185.5

🔁 Summary Thoughts

* NVDA is showing classic breakout behavior with gamma fuel behind the move.

* SMC and structure are fully bullish, supported by rising channel and BOS continuation.

* Price is approaching a key exhaustion zone, so either it breaks through to 187.5 or pulls back to retest 179–177.

* Intraday long trades are favored above 182.5. Swing traders should wait for a dip to demand or a clean breakout above 185.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

🔍 GEX & Options Flow Insight (1st Image Analysis)

NVDA just broke through major resistance and is trading at $183.35, sitting in the middle of stacked Call Walls and a strong positive GEX zone. Gamma positioning is highly bullish—but a stall near current levels is possible as dealers begin to hedge less aggressively.

* Call Walls & Resistance:

* ✅ $180.00 → Highest positive NET GEX zone

* ✅ $182.5 → 2nd Call Wall (68.77%) — current area of battle

* 🧱 $187.5–190.0 → GEX9 and GEX10 zones = possible squeeze targets

* Put Support:

* 🛡️ $175.18–175.51 → Strong PUT Support zone and demand on price chart

* 🔻 $172.5 → HVL zone = invalidation for breakout thesis

* Volatility Insight:

* IVR 12.6, IVx Avg 41.7 → Neutral-to-low IV

* Calls Bias: 15.4% → Slightly bullish, but not euphoric

* GEX sentiment: 🟡🟢🟢 = Cautiously Bullish

✅ Option Trading Suggestion:

Bias: Bullish with caution around 185 Strategy: Vertical debit call spread

* Entry Idea: Buy 182.5C / Sell 187.5C for Aug 2 or Aug 9

* Stop: Close below 179.65 (trap candle base)

* Target: 187.5 (GEX9 ceiling)

Why this works: NVDA is entering a highly stacked gamma region. If bulls hold above 182.5, momentum may carry price toward the outer GEX bands at 187.5. However, IV is not stretched, so premium decay is a risk—spreads protect against it.

🧠 Technical Analysis (1H Chart) (2nd Image Analysis)

Market Structure & SMC:

* ✅ CHoCH → BOS → BOS confirmed since July 29

* 🚀 Strong bullish continuation from discounted OB area near 175

* NVDA is currently riding mid-upper range of an ascending channel

Trendlines:

* Perfect channel structure respected since July 25

* Currently touching upper channel resistance around 183.35–184.50

SMC Zones & Supply/Demand:

* 🟩 Demand Zone: 175.18–177.32 → Last bullish OB

* 🟥 Supply/Exhaustion Zone: 183.5–185 (purple box) → caution here

🔄 Price Action & Key Levels

* Support:

* 📌 179.65 → Key structure base (trap candle)

* ✅ 177.32–175.18 → Demand + OB + GEX Put Support

* ❗ Below 172.5 = structure breaks

* Resistance:

* 🚩 183.35–185.00 → Supply + top channel + GEX7

* 🧨 187.5–190.0 → GEX9/GEX10 extension zone = possible parabolic breakout

🧭 Scalping / Intraday Trade Setup

🟩 Bullish Setup (Preferred):

* Entry: 182.50–183.00 breakout

* Target 1: 185.00

* Target 2: 187.50

* Stop: 179.65 break & hold

🟥 Bearish Pullback Setup:

* Entry: Rejection at 184.5 supply zone

* Target 1: 180.00

* Target 2: 177.30

* Stop: New high above 185.5

🔁 Summary Thoughts

* NVDA is showing classic breakout behavior with gamma fuel behind the move.

* SMC and structure are fully bullish, supported by rising channel and BOS continuation.

* Price is approaching a key exhaustion zone, so either it breaks through to 187.5 or pulls back to retest 179–177.

* Intraday long trades are favored above 182.5. Swing traders should wait for a dip to demand or a clean breakout above 185.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.