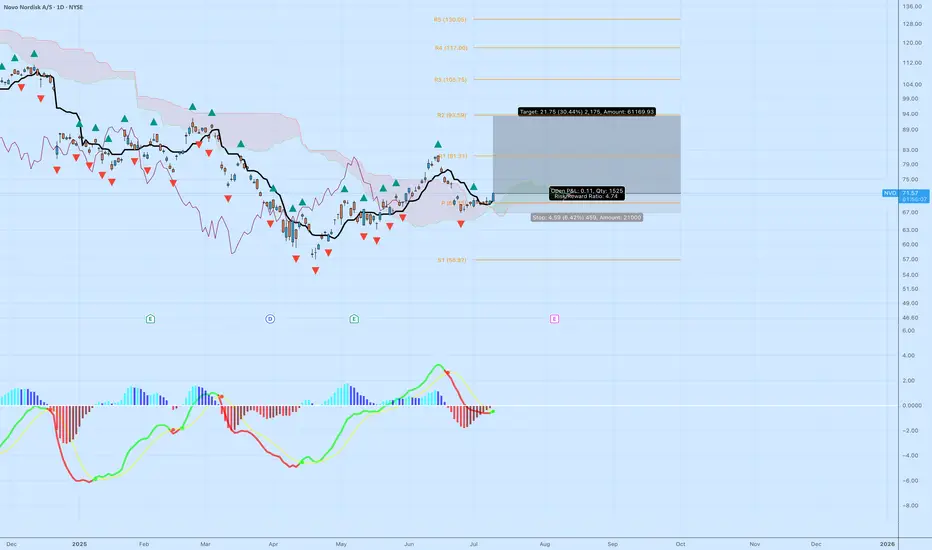

Novo Nordisk ( NVO) is showing classic strength — bouncing off the cloud, reclaiming structure, and flashing early signs of momentum rotation. This is how you catch continuation trades without chasing.

NVO) is showing classic strength — bouncing off the cloud, reclaiming structure, and flashing early signs of momentum rotation. This is how you catch continuation trades without chasing.

📊 Technical Breakdown

Ichimoku: Price reclaimed the top of the cloud and is now building above it. Kijun and Tenkan are aligned. This is the first real bullish structure since the March breakdown.

MACD: Histogram curling upward. We’re not fully bullish yet, but the pressure is shifting back to buyers.

R1 Pivot ($81.31) is the first big test. A clean break above that opens the path toward R2 and beyond.

🎯 Trade Specs

Entry: $71.58

Target: $93.33 (+30.44%)

Stop: $67.00 (–6.42%)

Risk/Reward: 4.74 — elite-level skew for a high-quality name

📊 Technical Breakdown

Ichimoku: Price reclaimed the top of the cloud and is now building above it. Kijun and Tenkan are aligned. This is the first real bullish structure since the March breakdown.

MACD: Histogram curling upward. We’re not fully bullish yet, but the pressure is shifting back to buyers.

R1 Pivot ($81.31) is the first big test. A clean break above that opens the path toward R2 and beyond.

🎯 Trade Specs

Entry: $71.58

Target: $93.33 (+30.44%)

Stop: $67.00 (–6.42%)

Risk/Reward: 4.74 — elite-level skew for a high-quality name

If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you found my trades helpful, please consider sending a tip in BTC to: bc1qr35mrh82hykpy9v6znpsyuew85x84ezjyrrf6m

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.