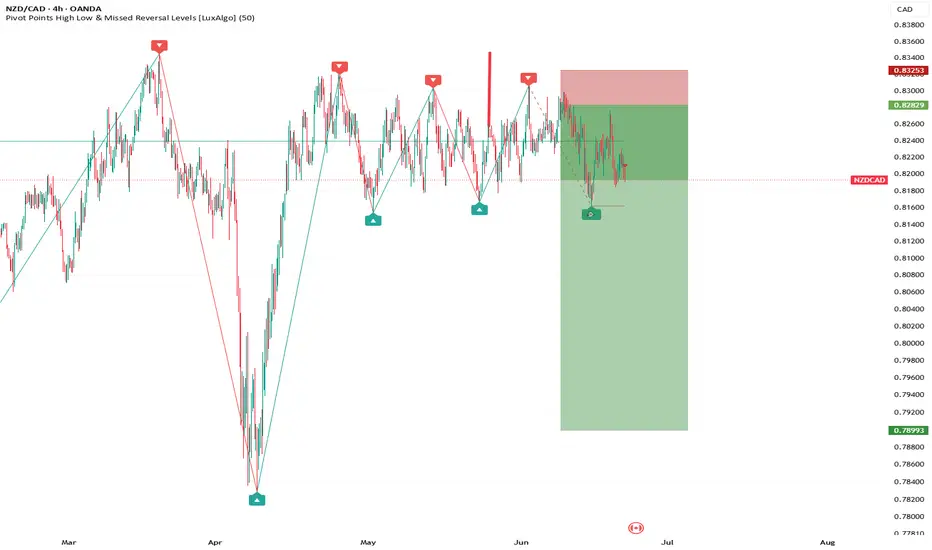

### **💡 Why Sell NZD/CAD?**

**🇳🇿 NZD – New Zealand Dollar:**

* **Global risk-off + weaker China demand**

→ *🌍📉 NZD struggles when investors avoid risk and China slows — both are happening.*

* **RBNZ cut rates to 3.25% and may cut again**

→ *🏦📉 A dovish central bank puts downward pressure on the Kiwi.*

* **June 23 GDP could move the market**

→ *📅 Until then, expectations are low — and that weighs on NZD.*

* **Dairy prices + China still weak**

→ *🐄🇨🇳 These are key parts of NZ’s economy — and both are underperforming.*

* **Sentiment: Bearish**

→ *📊 Traders are positioned short — not much appetite to buy Kiwi right now.*

---

**🇨🇦 CAD – Canadian Dollar:**

* **Oil above \$80 helps CAD**

→ *🛢️ Canada’s economy benefits from higher oil — that’s a natural support for the loonie.*

* **BoC held rates at 2.75%, not rushing to cut**

→ *⚖️ Slightly dovish, but still firmer than NZ’s approach.*

* **Core inflation still above 3%**

→ *🔥 Keeps the BoC cautious — good for CAD strength.*

* **Retail sales data coming soon**

→ *🧾 A strong print could give CAD a further push.*

* **Sentiment: Neutral to bullish**

→ *📈 Among commodity currencies, CAD is holding up the best right now.*

---

### **🔍 Outlook:**

The **fundamentals clearly favor CAD over NZD** — stronger inflation, oil support, and no aggressive easing. Unless NZ GDP surprises big on June 23, this pair likely continues to drift lower.

---

**📌 Note:**

> *“Still one of the cleanest cross plays — NZD weak, CAD stable. Slow but steady sell setup as long as the story holds.”*

**🇳🇿 NZD – New Zealand Dollar:**

* **Global risk-off + weaker China demand**

→ *🌍📉 NZD struggles when investors avoid risk and China slows — both are happening.*

* **RBNZ cut rates to 3.25% and may cut again**

→ *🏦📉 A dovish central bank puts downward pressure on the Kiwi.*

* **June 23 GDP could move the market**

→ *📅 Until then, expectations are low — and that weighs on NZD.*

* **Dairy prices + China still weak**

→ *🐄🇨🇳 These are key parts of NZ’s economy — and both are underperforming.*

* **Sentiment: Bearish**

→ *📊 Traders are positioned short — not much appetite to buy Kiwi right now.*

---

**🇨🇦 CAD – Canadian Dollar:**

* **Oil above \$80 helps CAD**

→ *🛢️ Canada’s economy benefits from higher oil — that’s a natural support for the loonie.*

* **BoC held rates at 2.75%, not rushing to cut**

→ *⚖️ Slightly dovish, but still firmer than NZ’s approach.*

* **Core inflation still above 3%**

→ *🔥 Keeps the BoC cautious — good for CAD strength.*

* **Retail sales data coming soon**

→ *🧾 A strong print could give CAD a further push.*

* **Sentiment: Neutral to bullish**

→ *📈 Among commodity currencies, CAD is holding up the best right now.*

---

### **🔍 Outlook:**

The **fundamentals clearly favor CAD over NZD** — stronger inflation, oil support, and no aggressive easing. Unless NZ GDP surprises big on June 23, this pair likely continues to drift lower.

---

**📌 Note:**

> *“Still one of the cleanest cross plays — NZD weak, CAD stable. Slow but steady sell setup as long as the story holds.”*

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.