NZDCAD – Consolidation Within Neutral Range as Market Eyes Fed Developments

The NZDCAD currency pair is currently exhibiting strength within the confines of a well-defined neutral trading range. This stabilization is largely underpinned by the recent corrective pullback in the U.S. dollar, which has provided short-term support for the New Zealand dollar. However, questions remain about the sustainability of this momentum, especially with significant macroeconomic events looming on the horizon — most notably, the Federal Open Market Committee (FOMC) meeting and the subsequent speech by Federal Reserve Chair Jerome Powell.

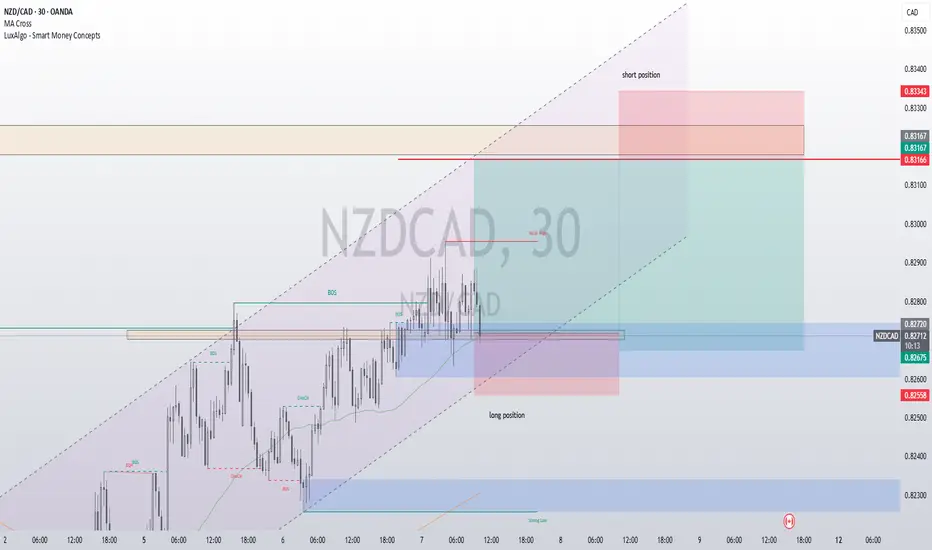

At present, NZDCAD is trading within a localized range, and price action is gravitating toward the key liquidity zone around the 0.8317 level. This area has become a focal point for market participants, as it represents a notable level of interest where prior price reactions have occurred. The pullback in the U.S. dollar has temporarily shifted sentiment in favor of the NZD, but this may prove short-lived depending on upcoming policy signals from the Federal Reserve.

From a technical standpoint, the currency pair is constrained between strong resistance at 0.83175 and a cluster of support levels located at 0.82644, 0.8235, and 0.8225. The proximity of these levels reinforces the neutral bias and increases the likelihood of short-term whipsaws or potential false breakouts. Traders should exercise caution in positioning aggressively within this zone, particularly ahead of fundamental catalysts that could swiftly reshape market dynamics.

Market sentiment is increasingly focused on the tone and direction of Fed policy. Should the FOMC or Chair Powell deliver signals that point toward a more hawkish policy trajectory — whether through immediate action or forward guidance — the U.S. dollar could regain strength rapidly. This would likely exert downward pressure on NZDCAD, potentially driving the pair back toward the lower bounds of its trading range or beyond.

Conversely, any dovish surprises or indications of policy patience could extend the current reprieve for the NZD, enabling a continued challenge of the upper resistance area. However, given prevailing expectations for a firm stance by the Fed amid ongoing inflationary concerns, the market is pricing in a scenario where dollar strength could reassert itself — possibly leading to a reversal in NZDCAD’s recent strength.

In conclusion, while NZDCAD remains technically range-bound for now, the landscape is ripe for volatility. The confluence of resistance near 0.8317 and heightened anticipation around Fed-related news points to a critical juncture for this pair. Traders should monitor price action closely, remain aware of potential false breakouts, and align short-term strategies with the broader macro narrative that will emerge following the FOMC decision and Powell’s speech.

The NZDCAD currency pair is currently exhibiting strength within the confines of a well-defined neutral trading range. This stabilization is largely underpinned by the recent corrective pullback in the U.S. dollar, which has provided short-term support for the New Zealand dollar. However, questions remain about the sustainability of this momentum, especially with significant macroeconomic events looming on the horizon — most notably, the Federal Open Market Committee (FOMC) meeting and the subsequent speech by Federal Reserve Chair Jerome Powell.

At present, NZDCAD is trading within a localized range, and price action is gravitating toward the key liquidity zone around the 0.8317 level. This area has become a focal point for market participants, as it represents a notable level of interest where prior price reactions have occurred. The pullback in the U.S. dollar has temporarily shifted sentiment in favor of the NZD, but this may prove short-lived depending on upcoming policy signals from the Federal Reserve.

From a technical standpoint, the currency pair is constrained between strong resistance at 0.83175 and a cluster of support levels located at 0.82644, 0.8235, and 0.8225. The proximity of these levels reinforces the neutral bias and increases the likelihood of short-term whipsaws or potential false breakouts. Traders should exercise caution in positioning aggressively within this zone, particularly ahead of fundamental catalysts that could swiftly reshape market dynamics.

Market sentiment is increasingly focused on the tone and direction of Fed policy. Should the FOMC or Chair Powell deliver signals that point toward a more hawkish policy trajectory — whether through immediate action or forward guidance — the U.S. dollar could regain strength rapidly. This would likely exert downward pressure on NZDCAD, potentially driving the pair back toward the lower bounds of its trading range or beyond.

Conversely, any dovish surprises or indications of policy patience could extend the current reprieve for the NZD, enabling a continued challenge of the upper resistance area. However, given prevailing expectations for a firm stance by the Fed amid ongoing inflationary concerns, the market is pricing in a scenario where dollar strength could reassert itself — possibly leading to a reversal in NZDCAD’s recent strength.

In conclusion, while NZDCAD remains technically range-bound for now, the landscape is ripe for volatility. The confluence of resistance near 0.8317 and heightened anticipation around Fed-related news points to a critical juncture for this pair. Traders should monitor price action closely, remain aware of potential false breakouts, and align short-term strategies with the broader macro narrative that will emerge following the FOMC decision and Powell’s speech.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.