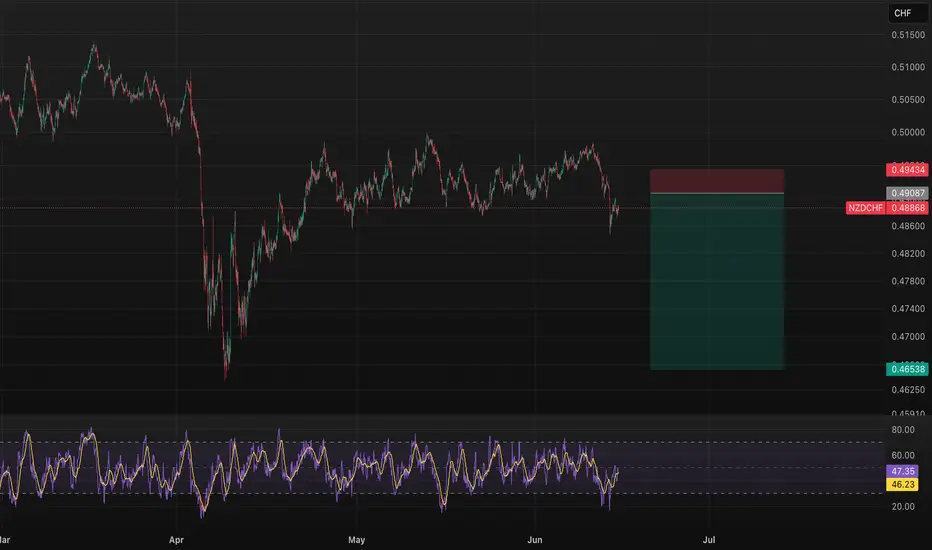

For the week ahead, NZD/CHF presents a sell opportunity from a fundamental perspective. The economic calendar is light for both the New Zealand dollar and the Swiss franc, with only minor sentiment and current account data for NZD and Swiss PPI data for CHF, neither of which typically spark major market moves.

When newsflow is quiet, the market often defaults to macro themes and risk sentiment. The Swiss franc, as a traditional safe haven, tends to outperform higher-yield, risk-sensitive currencies like the New Zealand dollar in these circumstances—especially when there is any degree of uncertainty in global markets.

With no strong catalysts to push NZD higher, and CHF retaining its position as a stable, defensive currency, the environment favors continued or renewed downside for NZD/CHF this week.

**In summary:**

Expect NZD/CHF to trade with a bearish bias, as macro conditions and the absence of significant data support CHF strength over NZD weakness.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.