Greetings Traders,

In today’s analysis of NZDCHF, recent price action confirms the presence of bearish institutional order flow. As a result, we aim to align ourselves with this directional bias by identifying strategic selling opportunities.

🔍 Key Observations on H4:

📈 Trading Plan:

For a detailed market walkthrough and in-depth execution zones, be sure to watch this week’s Forex Market Breakdown:

Stay disciplined, trust your confirmations, and manage your risk wisely.

Kind regards,

The Architect 🏛️📉

In today’s analysis of NZDCHF, recent price action confirms the presence of bearish institutional order flow. As a result, we aim to align ourselves with this directional bias by identifying strategic selling opportunities.

🔍 Key Observations on H4:

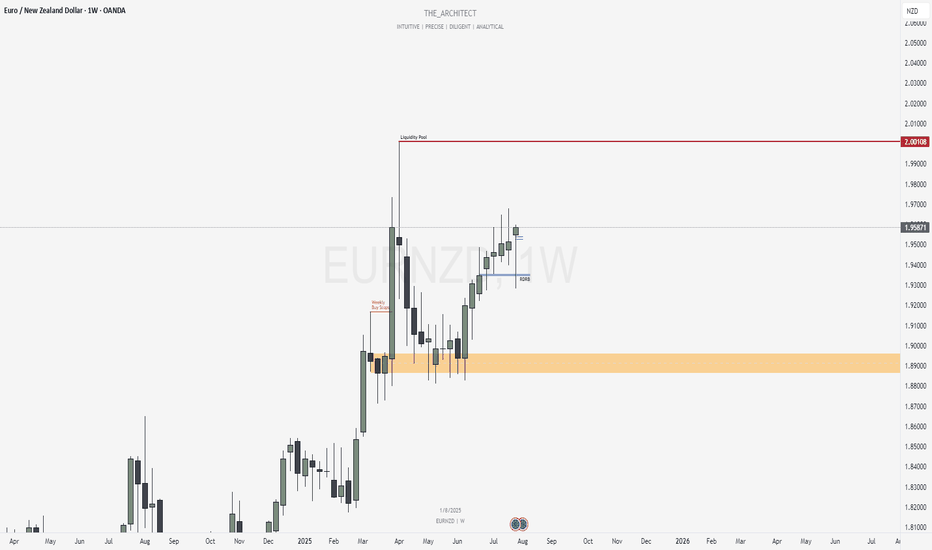

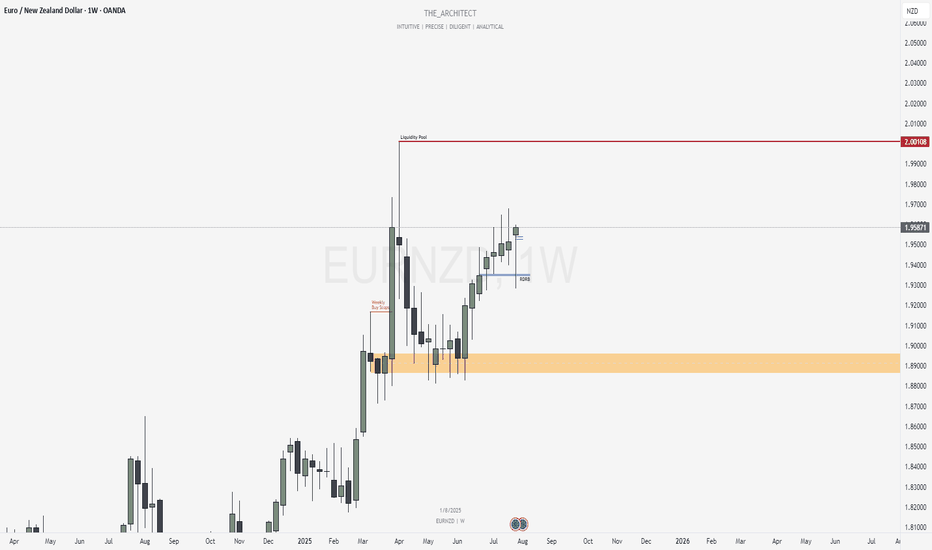

- Bearish Market Structure Shift

The H4 timeframe has confirmed a bearish shift in market structure, giving us a solid framework to seek short setups aligned with institutional momentum. - Bearish Order Block

Price has recently reached a bearish order block, expected to act as a strong resistance zone for potential downside continuation. - Liquidity Engineering

Buy stops on H4 have been taken out—this sweep may be used to order the pair against liquidity, favoring bearish continuation.

📈 Trading Plan:

- Entry Strategy

Monitor lower timeframes (e.g., M15 and below) for bearish confirmation setups within or near the bearish order block. - Target Objective

Our draw on liquidity remains the liquidity pool located at deeper discount levels, in alignment with the prevailing short bias.

For a detailed market walkthrough and in-depth execution zones, be sure to watch this week’s Forex Market Breakdown:

Stay disciplined, trust your confirmations, and manage your risk wisely.

Kind regards,

The Architect 🏛️📉

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.