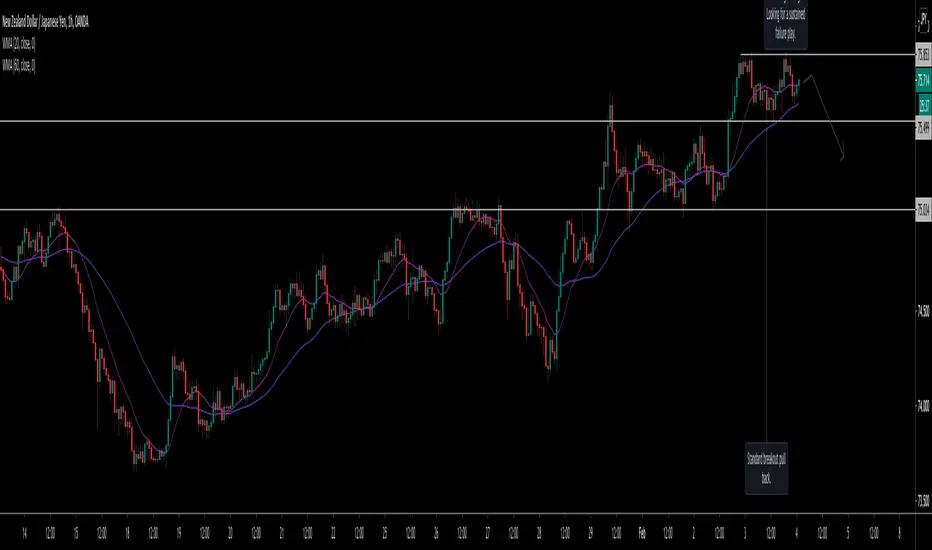

See Signposts for key price action details.

- 75.5 level unlikely to hold supported. Payoff is greater on the downside as level looks to invalidate.

- Position size reduced as this is counter-fundamentals

- NZD is a relatively stronger currency as new Zealand's Q4 unemployment hints at V-shape recovery potential.

- On the other hand, Japan is one of three countries at risk of a double-dip recession. While all central banks are looking to keep their currencies at relatively lower values, this will be more so the case with BOJ.

Note

Note: Ideas published represent my viewpoints on anticipated structural directional moves. I do not post trade parameters (i.e. entry, take profit, stop loss, alternative exit points, etc.) as actual execution may differ from the respective trade idea published. My trades evolve around my expectancy with certain planned R-multiple and win rate. Use as your own discretion.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.