Waiting for the Pullback to Join the New Bullish Momentum

The price of the NZDJPY pair received a reaction from a bullish daily order block and has broken the bearish 4H structure to the upside.

During the mitigation of this daily order block, a new 4H order block was formed, from which I am now expecting a reaction. As an additional condition for the setup, I am considering the 61.8% local Fibonacci retracement level. In the case of it being reached, the price must find acceptance above it and show confirmation of a bullish move starting on a lower timeframe.

The long idea will be invalidated if this 61.8% level is broken. In that case, I will not be considering a long from the next 78.6% level because the liquidity of the Previous Week's Low (PWL) is located just below the 4H order block, and as the price approaches it, the PWL will act as a magnet.

► Target: If a setup from the 61.8% level is formed, the target will be the lower boundary of the daily bearish order block above.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

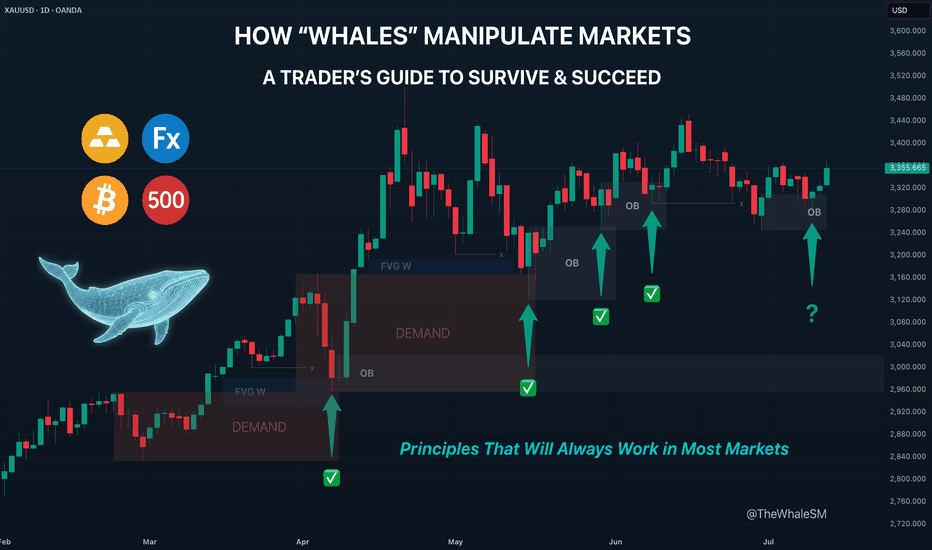

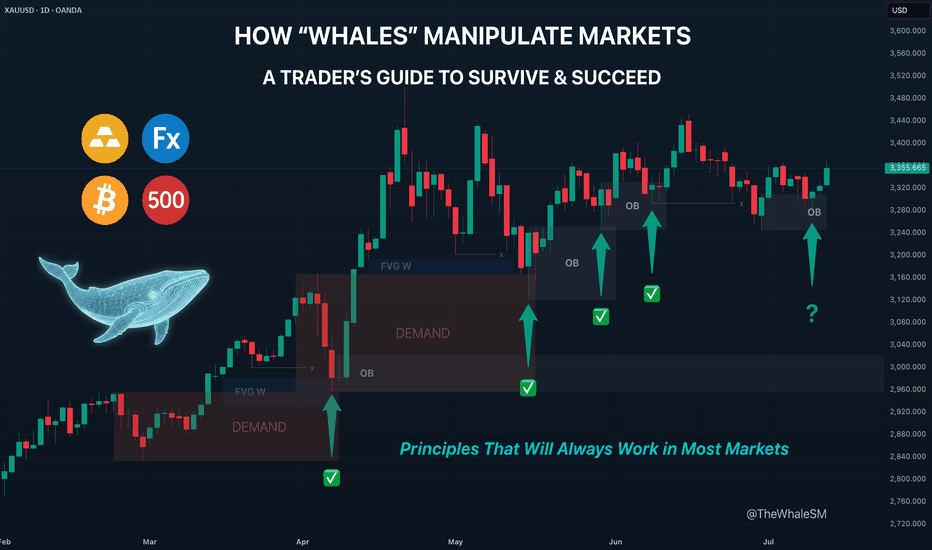

The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this insightful trading community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇

P.S. This is not a prediction of the exact price direction. It is a description of high-probability setups that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setups are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always apply a stop-loss and proper risk management. Trade smart.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments. 💬

► Follow me on TradingView for timely updates on THIS idea (entry, targets & live trade management) and not to miss my next detailed breakdown.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

During the mitigation of this daily order block, a new 4H order block was formed, from which I am now expecting a reaction. As an additional condition for the setup, I am considering the 61.8% local Fibonacci retracement level. In the case of it being reached, the price must find acceptance above it and show confirmation of a bullish move starting on a lower timeframe.

The long idea will be invalidated if this 61.8% level is broken. In that case, I will not be considering a long from the next 78.6% level because the liquidity of the Previous Week's Low (PWL) is located just below the 4H order block, and as the price approaches it, the PWL will act as a magnet.

► Target: If a setup from the 61.8% level is formed, the target will be the lower boundary of the daily bearish order block above.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this insightful trading community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇

P.S. This is not a prediction of the exact price direction. It is a description of high-probability setups that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setups are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always apply a stop-loss and proper risk management. Trade smart.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments. 💬

► Follow me on TradingView for timely updates on THIS idea (entry, targets & live trade management) and not to miss my next detailed breakdown.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Order cancelled

UPDATE: NZDJPYThe 61.8% local Fibonacci retracement level was broken, so the long setup was invalidated, and consequently, there was no entry. As I thought, upon breaking this level, the price's target became the PWL liquidity, which was ultimately swept.

Looking at the daily timeframe, you can see the instrument is close to forming a bearish daily structure, which is confirmed by the bearish order flow from the daily order blocks. Therefore, I expect a continuation of the bearish move below the August 5th low and will be monitoring for the formation of a potential short setup.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.