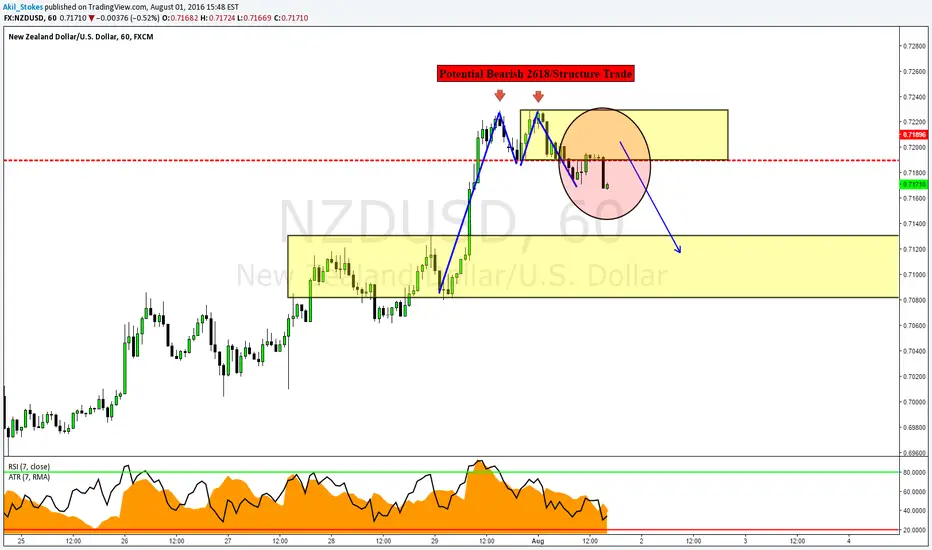

Just shot a video breaking this one down to our Syndicate members. What we're looking at is a potential 2618/Structure short opportunity on the NZDUSD.

IF we get a break & close below our previous structure lows (see last bearish candle), we will be given multiple ways to enter this short opportunity, both involving waiting for a retracement back into our previous double top formation.

Ultimately based off of my daily chart analysis, I would predict a bearish day tomorrow and a potential move down to the 0.7120's to 0.7060's level before seeing some more bullish involvement.

I'm not currently involved in this move, but will certainly have it high on my trading radar as we move into Tuesday's trading session. I'll keep you guys updated if anything changes that is worth noting.

Traders looking to potentially get involved tonight just keep an eye out for NZD Inflation Expectations news 11pm NY Time (as there are still high expectations of a Rate Cut in a few weeks) & RBA Cash rate/ Rate Statement

Akil Stokes

Chief Currency Analyst & Head Trading Coach

TradeEmpowered.com -The Premier Online Trading Education Company

Akil@TradeEmpowered.com

Trade Empowered on YouTube goo.gl/IscNch

Facebook: goo.gl/VTQngr

Twitter: goo.gl/FlH33l

Instagram: goo.gl/UUyMPl

Periscope: goo.gl/WDqr2W

IF we get a break & close below our previous structure lows (see last bearish candle), we will be given multiple ways to enter this short opportunity, both involving waiting for a retracement back into our previous double top formation.

Ultimately based off of my daily chart analysis, I would predict a bearish day tomorrow and a potential move down to the 0.7120's to 0.7060's level before seeing some more bullish involvement.

I'm not currently involved in this move, but will certainly have it high on my trading radar as we move into Tuesday's trading session. I'll keep you guys updated if anything changes that is worth noting.

Traders looking to potentially get involved tonight just keep an eye out for NZD Inflation Expectations news 11pm NY Time (as there are still high expectations of a Rate Cut in a few weeks) & RBA Cash rate/ Rate Statement

Akil Stokes

Chief Currency Analyst & Head Trading Coach

TradeEmpowered.com -The Premier Online Trading Education Company

Akil@TradeEmpowered.com

Trade Empowered on YouTube goo.gl/IscNch

Facebook: goo.gl/VTQngr

Twitter: goo.gl/FlH33l

Instagram: goo.gl/UUyMPl

Periscope: goo.gl/WDqr2W

Note

Traders looking to potentially get involved tonight just keep an eye out for NZD Inflation Expectations news 11pm NY Time (as there are still high expectations of a Rate Cut in a few weeks) & RBA Cash rate/ Rate StatementCoaching, Courses & Community

tieronetrading.com/

The Trading Coach Podcast

anchor.fm/thetradingcoachpodcast

Free Trading Computer Buyers/Builders Guide - tradingcomputerbuyersguide.com/optin-629312741738938873920

tieronetrading.com/

The Trading Coach Podcast

anchor.fm/thetradingcoachpodcast

Free Trading Computer Buyers/Builders Guide - tradingcomputerbuyersguide.com/optin-629312741738938873920

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Coaching, Courses & Community

tieronetrading.com/

The Trading Coach Podcast

anchor.fm/thetradingcoachpodcast

Free Trading Computer Buyers/Builders Guide - tradingcomputerbuyersguide.com/optin-629312741738938873920

tieronetrading.com/

The Trading Coach Podcast

anchor.fm/thetradingcoachpodcast

Free Trading Computer Buyers/Builders Guide - tradingcomputerbuyersguide.com/optin-629312741738938873920

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.