The RBNZ announce rates this week and as discussed in our market outlook it is likely for them to

hold their plans on hiking rates with growing concerns over global economics. Recently Consumer Price Index fell

from 0.9% to 0.1% with Employment also sinking significantly, chances of a rate hike has started to diminish.

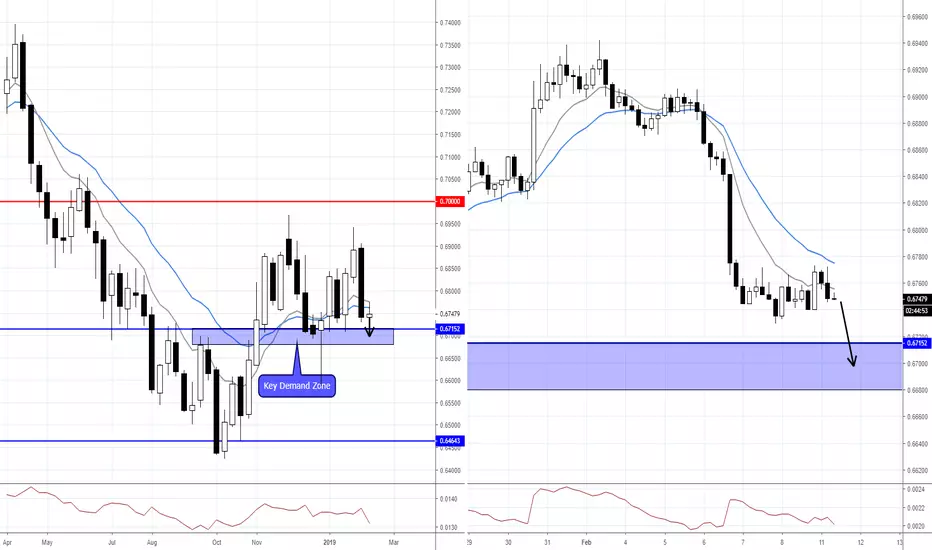

Looking at the chart technically the weekly chart closed significantly bearish sitting slightly above a key demand zone.

The current 4hr consolidation looks likely to break lower into the key demand zone. If the weekly chart can close

below the demand zone, we could see the bears really take control here.

hold their plans on hiking rates with growing concerns over global economics. Recently Consumer Price Index fell

from 0.9% to 0.1% with Employment also sinking significantly, chances of a rate hike has started to diminish.

Looking at the chart technically the weekly chart closed significantly bearish sitting slightly above a key demand zone.

The current 4hr consolidation looks likely to break lower into the key demand zone. If the weekly chart can close

below the demand zone, we could see the bears really take control here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.