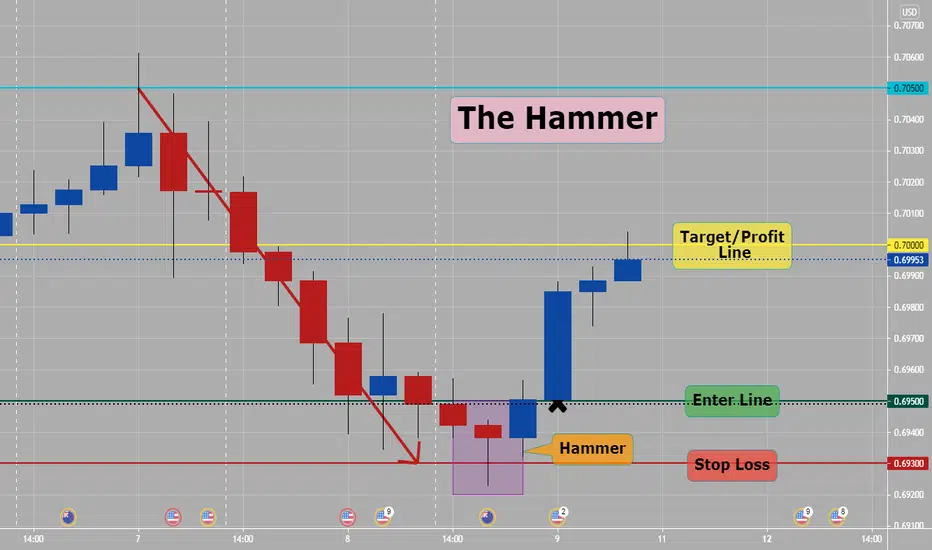

The hammer:

Puts in its appearance after prolonged downtrend. On the day of the hammer candle, there is strong selling, often beginning at the 3rd/4 hour candle of session. As the session goes on, however, the market recovers and closed near the unchanged mark, or in some cases even higher. In these cases the market potentially is "hammering" out a bottom.

In order for the Hammer signal to be valid, the following conditions must exist:

The FX pair must have been in a definite downtrend before this signal occurs. This can be visually seen on the chart.

The lower shadow must be at least twice the size of the body.

The 4 hour (example candle, see chart) after the Hammer is formed, one should witness continued buying

There should be no upper shadow or a very small upper shadow. The color of the body does not matter, but a blue/green body would be more positive than a red body.

Make sure pattern on 4 hour time frames happen during Tokyo session, can be on 1 hour time frame if they happen during London or NY session. (fyi)

Puts in its appearance after prolonged downtrend. On the day of the hammer candle, there is strong selling, often beginning at the 3rd/4 hour candle of session. As the session goes on, however, the market recovers and closed near the unchanged mark, or in some cases even higher. In these cases the market potentially is "hammering" out a bottom.

In order for the Hammer signal to be valid, the following conditions must exist:

The FX pair must have been in a definite downtrend before this signal occurs. This can be visually seen on the chart.

The lower shadow must be at least twice the size of the body.

The 4 hour (example candle, see chart) after the Hammer is formed, one should witness continued buying

There should be no upper shadow or a very small upper shadow. The color of the body does not matter, but a blue/green body would be more positive than a red body.

Make sure pattern on 4 hour time frames happen during Tokyo session, can be on 1 hour time frame if they happen during London or NY session. (fyi)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.