Hello awesome traders! 👑✨

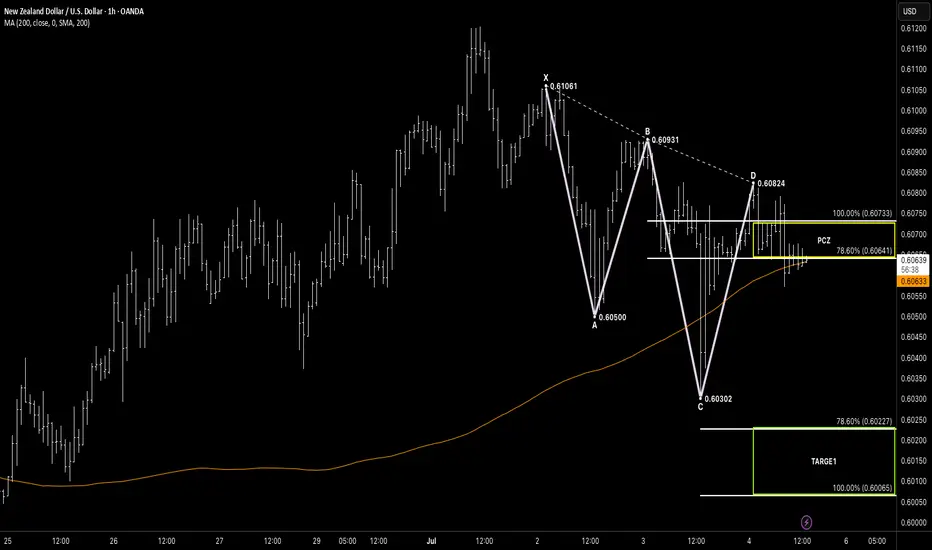

Hope you’ve enjoyed your trading week and caught some pips along the way! As we wrap up Friday, let’s spotlight NZD/USD (1H)—we’ve got a clean 121 Bearish Reversal forming on the hourly chart.

🧠 Setup Breakdown:

Price has built the 121 structure:

XA: 0.61061 → 0.60500

AB: 0.60500 → 0.60931

BC: 0.60931 → 0.60302

The Potential Completion Zone (PCZ) sits between:

78.6% BC retracement: 0.60641

100% XA extension: 0.60733

Price rallied into the PCZ, tagged D = 0.60824, and has since shown early signs of rejection under 0.60733.

🎯 Target in Sight:

TP1 Zone: 0.60065–0.60227 (100%–78.6% extension of BC)

Our playbook: Pattern → PCZ → Rejection → Measured Target. Risk is defined above D = 0.60824, with entry on a clear bearish candle close below 0.60641.

💡 What’s Next?

Entry: Short on bearish candle close < 0.60641 (lower PCZ boundary).

Stop: Above 0.60824 (just above D).

Take Profit: Scale into 0.60227–0.60065.

If price breaks back above 0.60733, we’ll stand aside and wait for the next high-probability setup.

Finish the week strong—stay disciplined, manage your risk like a pro, and let structure guide your decisions!

📊 Trade patterns like the pros.

📈 Let structure, not emotion, drive your trades.

— Your Friendly Harmonic Trading Guide

Hope you’ve enjoyed your trading week and caught some pips along the way! As we wrap up Friday, let’s spotlight NZD/USD (1H)—we’ve got a clean 121 Bearish Reversal forming on the hourly chart.

🧠 Setup Breakdown:

Price has built the 121 structure:

XA: 0.61061 → 0.60500

AB: 0.60500 → 0.60931

BC: 0.60931 → 0.60302

The Potential Completion Zone (PCZ) sits between:

78.6% BC retracement: 0.60641

100% XA extension: 0.60733

Price rallied into the PCZ, tagged D = 0.60824, and has since shown early signs of rejection under 0.60733.

🎯 Target in Sight:

TP1 Zone: 0.60065–0.60227 (100%–78.6% extension of BC)

Our playbook: Pattern → PCZ → Rejection → Measured Target. Risk is defined above D = 0.60824, with entry on a clear bearish candle close below 0.60641.

💡 What’s Next?

Entry: Short on bearish candle close < 0.60641 (lower PCZ boundary).

Stop: Above 0.60824 (just above D).

Take Profit: Scale into 0.60227–0.60065.

If price breaks back above 0.60733, we’ll stand aside and wait for the next high-probability setup.

Finish the week strong—stay disciplined, manage your risk like a pro, and let structure guide your decisions!

📊 Trade patterns like the pros.

📈 Let structure, not emotion, drive your trades.

— Your Friendly Harmonic Trading Guide

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.