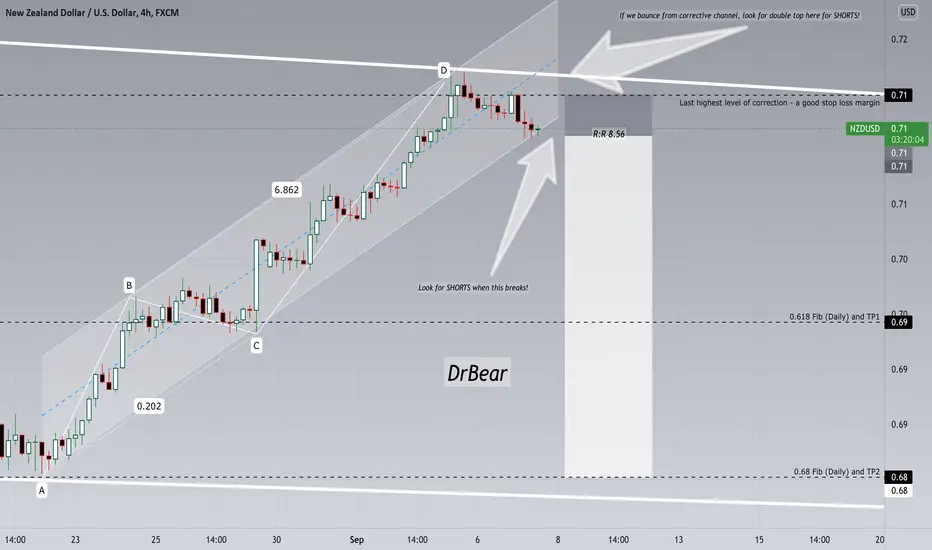

We are in a descending channel for this pair and are reaching the end of a smaller time frame daily corrective pattern, touching on a strong daily resistance level.

Given that we expect to see USD strength over the next 1-2 weeks, and that the NZD is expected to weaken - it is reasonable to look for NZDUSD shorts.

There are two possible options here:

1.) Breakout below the corrective channel. If this happens, enter short and keep SL just above the previous highest mark on correction (marked in chart)

2.) Retest of the larger structure, which will effectively result in a "Double top" on the smaller time frame - this is typically a reversal pattern. In this scenario, the SL can be extremely tight, making for potentially huge gains!

Like my ideas? Please click the like button and subscribe, for analysis every weekday.

Have fun, trade safe!

DrBear

Given that we expect to see USD strength over the next 1-2 weeks, and that the NZD is expected to weaken - it is reasonable to look for NZDUSD shorts.

There are two possible options here:

1.) Breakout below the corrective channel. If this happens, enter short and keep SL just above the previous highest mark on correction (marked in chart)

2.) Retest of the larger structure, which will effectively result in a "Double top" on the smaller time frame - this is typically a reversal pattern. In this scenario, the SL can be extremely tight, making for potentially huge gains!

Like my ideas? Please click the like button and subscribe, for analysis every weekday.

Have fun, trade safe!

DrBear

Trade closed: stop reached

I privately had an ever so higher SL, so have an active trade, but for those that trade as it is - don't worry. Small losses are acceptable, we manage our risk and only trade solid ideas. Don't chase trades!Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.