I am still posting Part 2 of my COT Analysis.

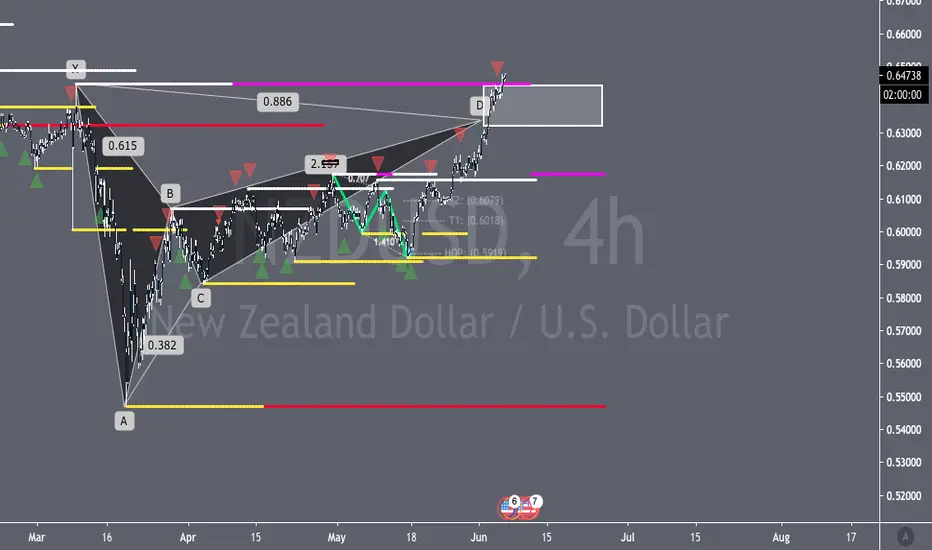

However, we have a bearish Deep Gartley that I charted what seems like months ago!

the 886 lines up with the 88 swing point and the lower and the lower part of the PRZ. PA has tested the whole PRZ the HSI and AMP RSI are both at extremes. the HSI has conducted it checkback and now im waiting for the floor to open up.

now the Fundamental Analysis:

As I have stated in my previous analysis the Dollar Index by the COT is a bit stalled but it could be the Commercials and the Non-Commercials closing positions as the Open Interest is drawing down. the 30 year Bond Yield still has plenty of room to move up...

However the Kiwi is still out weighed by the Commercials buying... however, the Non-Commercials are still selling the NZD but its slowing down too.

However, we have a bearish Deep Gartley that I charted what seems like months ago!

the 886 lines up with the 88 swing point and the lower and the lower part of the PRZ. PA has tested the whole PRZ the HSI and AMP RSI are both at extremes. the HSI has conducted it checkback and now im waiting for the floor to open up.

now the Fundamental Analysis:

As I have stated in my previous analysis the Dollar Index by the COT is a bit stalled but it could be the Commercials and the Non-Commercials closing positions as the Open Interest is drawing down. the 30 year Bond Yield still has plenty of room to move up...

However the Kiwi is still out weighed by the Commercials buying... however, the Non-Commercials are still selling the NZD but its slowing down too.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.