My ideas stand the same as I posted on my YouTube channel and the recent post I made about it.

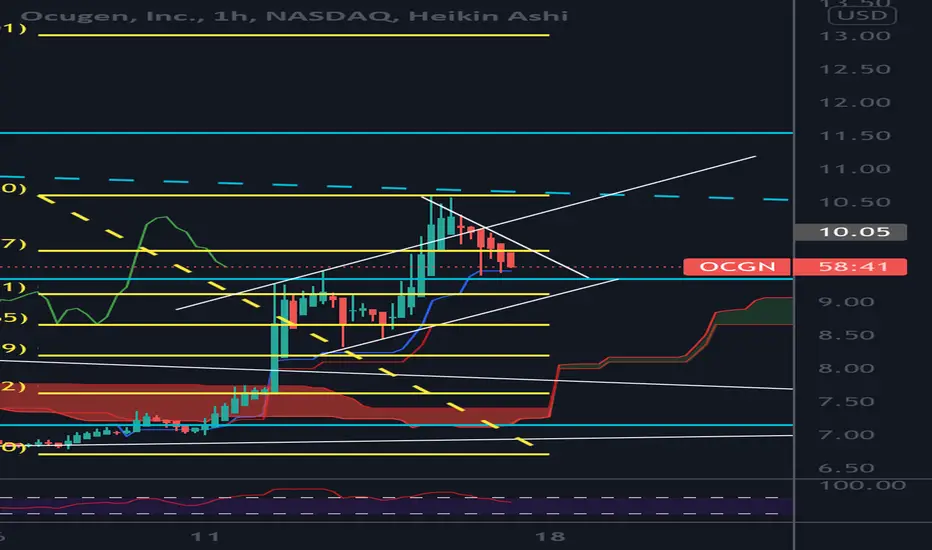

We have a long term area at 9.34$ we break through that we rip. We backtest it we lose it and fail. We have a FIb support around 9.13$ if we wicked below to stop ppl out. My trade would be a stoploss below 9.07$

We have a weekly ichumochi cloud potential suppor line at 9.48$. So I’m looking at this as a nice 1

Hour setup. We could be making a fallingnwedge within a rising chNnel. This could be a pause in the trend that springboards us up but that weekly resiatnce I talked about is HuGe at 10.50s. Clearing that is a Huge breakout which could be a safer momentum entry

So far the bearish divergents is playing out. So wait dor a confirmed hourly bounce or 4 hour Rsi bounce if anything. I have been buyig 9.38 9.48 and buy orders at 9.35. With stops below 9.07

We have a long term area at 9.34$ we break through that we rip. We backtest it we lose it and fail. We have a FIb support around 9.13$ if we wicked below to stop ppl out. My trade would be a stoploss below 9.07$

We have a weekly ichumochi cloud potential suppor line at 9.48$. So I’m looking at this as a nice 1

Hour setup. We could be making a fallingnwedge within a rising chNnel. This could be a pause in the trend that springboards us up but that weekly resiatnce I talked about is HuGe at 10.50s. Clearing that is a Huge breakout which could be a safer momentum entry

So far the bearish divergents is playing out. So wait dor a confirmed hourly bounce or 4 hour Rsi bounce if anything. I have been buyig 9.38 9.48 and buy orders at 9.35. With stops below 9.07

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.