Crude Oil DTF Technical & Fundamental Analysis

Oil prices surged by 6–10% within minutes, with Brent and WTI recording the largest daily gains since May 2022. This spike followed Israel's airstrikes on Iran’s nuclear and military facilities, which reportedly killed senior commanders and scientists. Iran, which plays a top oil player and gatekeeper of the Strait of Hormuz—a passageway for nearly 20% of global oil supply—has declared a state of emergency, and any retaliation that threatens tanker movement or damages infrastructure in key Gulf nations (Saudi Arabia, UAE, Iraq) could push oil prices toward $120+/barrel as a risk premium is being priced in.

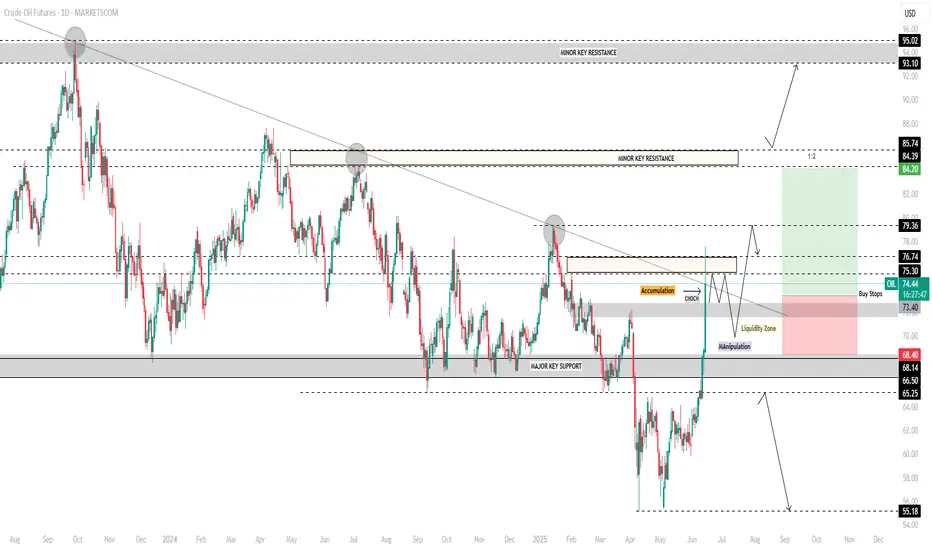

On the technical side (DTF): Price broke the major key support level at 67.00, followed by accumulation and heavy sell positioning. As expected, price hunted for liquidity and triggered sell-side stop losses. However, due to the sudden geopolitical news, price failed to break lower and instead spiked, breaking the next minor resistance level at 72.00, indicating a change of character.

Currently, we are watching for accumulation above the breakout, expecting a liquidity grab below the liquidity zone, then a move up toward distribution. Our area of interest lies at 73.40, after liquidity is formed and a minor key level is broken. Stop loss is set at 68.40 (below liquidity), and take profit at 84.20, the next minor key resistance.

Fundamental Outlook:

Middle East Tensions

-Israel launched airstrikes on Iran targeting nuclear and military sites (Tehran, Natanz, IRGC headquarters).

-Key IRGC generals and nuclear scientists reported killed.

-Iran declared a state of emergency and is expected to retaliate imminently.

Supply Risk – Strait of Hormuz

-Iran controls the Strait of Hormuz, a critical chokepoint for ~20% of global oil supply.

-Any military action or blockades here could immediately tighten global supply and trigger a surge toward $100–$120/barrel.

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

Oil prices surged by 6–10% within minutes, with Brent and WTI recording the largest daily gains since May 2022. This spike followed Israel's airstrikes on Iran’s nuclear and military facilities, which reportedly killed senior commanders and scientists. Iran, which plays a top oil player and gatekeeper of the Strait of Hormuz—a passageway for nearly 20% of global oil supply—has declared a state of emergency, and any retaliation that threatens tanker movement or damages infrastructure in key Gulf nations (Saudi Arabia, UAE, Iraq) could push oil prices toward $120+/barrel as a risk premium is being priced in.

On the technical side (DTF): Price broke the major key support level at 67.00, followed by accumulation and heavy sell positioning. As expected, price hunted for liquidity and triggered sell-side stop losses. However, due to the sudden geopolitical news, price failed to break lower and instead spiked, breaking the next minor resistance level at 72.00, indicating a change of character.

Currently, we are watching for accumulation above the breakout, expecting a liquidity grab below the liquidity zone, then a move up toward distribution. Our area of interest lies at 73.40, after liquidity is formed and a minor key level is broken. Stop loss is set at 68.40 (below liquidity), and take profit at 84.20, the next minor key resistance.

Fundamental Outlook:

Middle East Tensions

-Israel launched airstrikes on Iran targeting nuclear and military sites (Tehran, Natanz, IRGC headquarters).

-Key IRGC generals and nuclear scientists reported killed.

-Iran declared a state of emergency and is expected to retaliate imminently.

Supply Risk – Strait of Hormuz

-Iran controls the Strait of Hormuz, a critical chokepoint for ~20% of global oil supply.

-Any military action or blockades here could immediately tighten global supply and trigger a surge toward $100–$120/barrel.

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.