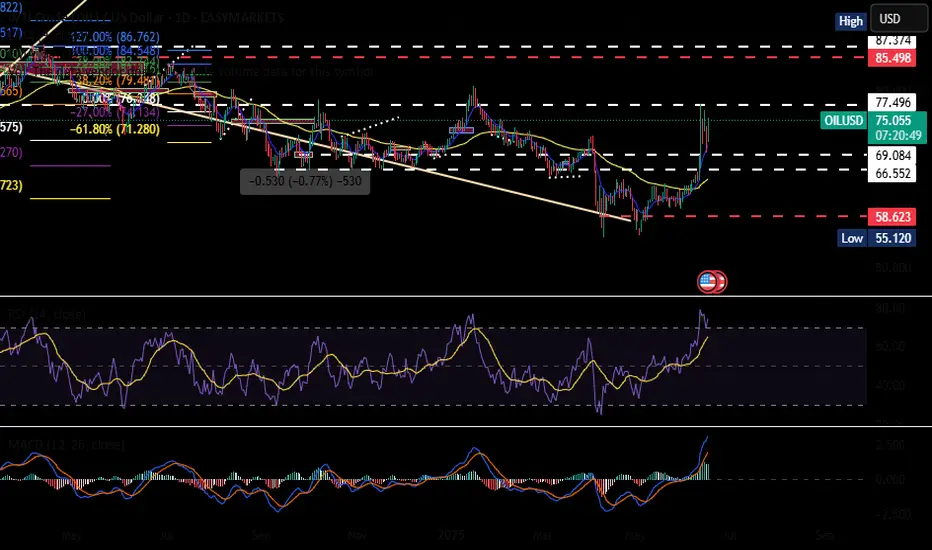

🛢️ Oil is caught in an unbalanced price zone due to rising global tensions.

Prices have spiked and with that, inflation risks are back on the table.

Now here's the play I see forming:

📌 The Fed might choose not to cut interest rates as a way to cool inflation without printing more money.

📌 This also puts pressure on China to act since rising oil prices hurt their economy too, they may push Iran to scale back aggression in order to stabilize global markets.

Everything is connected. This isn’t just about oil it’s about global strategy, inflation control, and power dynamics.

Prices have spiked and with that, inflation risks are back on the table.

Now here's the play I see forming:

📌 The Fed might choose not to cut interest rates as a way to cool inflation without printing more money.

📌 This also puts pressure on China to act since rising oil prices hurt their economy too, they may push Iran to scale back aggression in order to stabilize global markets.

Everything is connected. This isn’t just about oil it’s about global strategy, inflation control, and power dynamics.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.