Chart Pattern and Technical Setup

Key Levels

Measured Move Target

Moving Averages

MACD Indicator

Volume and Momentum

Summary

Key Levels

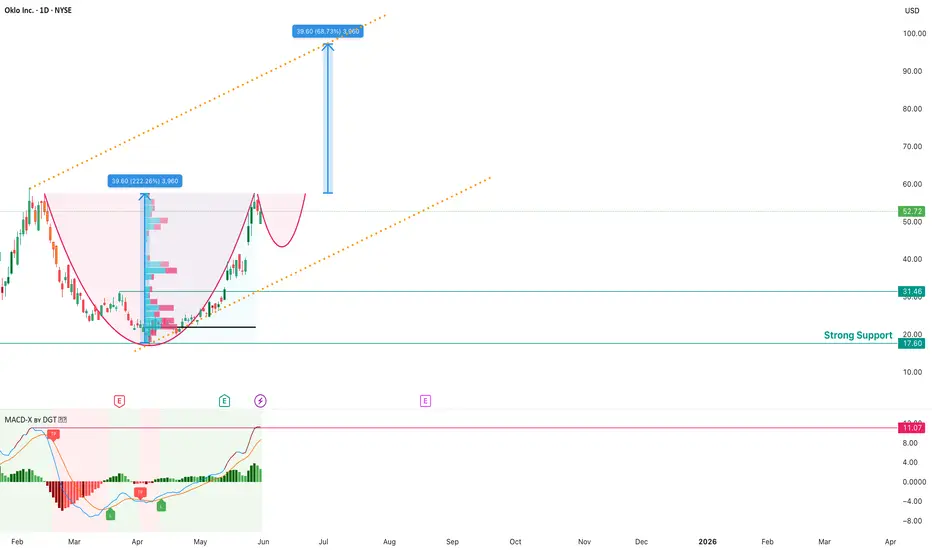

- Current Price: $52.72

- Resistance (Cup Rim): ~$54–$55

- Support Levels:

- $31.46 (intermediate support)

- $20.00 and $17.60 (strong support zone)

- ‼️ A clear cup and handle formation, a bullish continuation pattern. The cup is well-defined, with a rounded bottom and a rim near the $54–$55 level.

- 📊 The handle is forming, indicating a potential breakout if the price closes decisively above the cup rim (around $54–$55).

Measured Move Target

- The height of the cup is approximately $39.60, representing a 222.26% move from the bottom to the rim.

- If the breakout occurs, the projected target is near $94, as shown by the dotted orange trendline and the measured move arrow.

Moving Averages

- EMA 20/50/100/200 are all trending upwards, supporting the bullish momentum.

- EMA20: $40.35

- EMA50: $33.63

- EMA100: $30.33

- EMA200: $25.63

MACD Indicator

- The MACD is bullish, with the MACD line above the signal line and green histogram bars, indicating upward momentum.

- Previous MACD crossovers have coincided with significant price moves.

Volume and Momentum

- The most transactions so far have been at $21.

- The price action and MACD suggest increasing buying interest as the handle forms.

Summary

- A bullish outlook for Oklo Inc. (OKLO), with a classic cup and handle pattern pointing to a potential breakout.

- A decisive move above $54–$55 could trigger a rally toward the $94 target.

- Key support levels are at $31.46, $20.00, and $17.60, which may act as safety nets in case of a pullback.

- The overall technical setup, including rising EMAs and a bullish MACD, supports the case for further upside, provided the breakout confirms.

- Even if the markets go in the opposite direction, there is a high probability that OKLO will diverge from the market.

- Estimated timeframe to complete formation is 4 weeks (1-7 July)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.