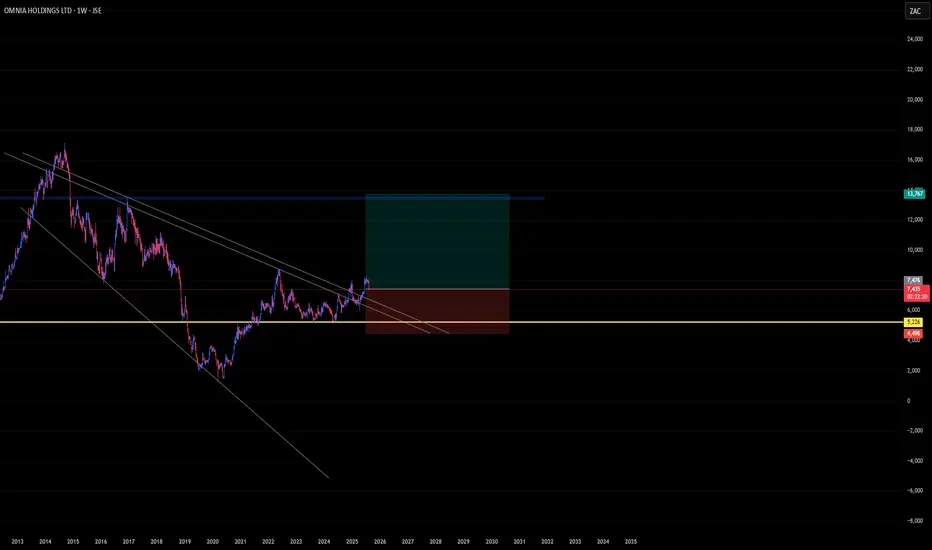

Evidently as we can see on the chart, the stock has been recovering and creating HH since the brink of COVID. Price was supported at 5200 ZAC and broke through our resisting trendline, which then signals a possible bullish move.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.