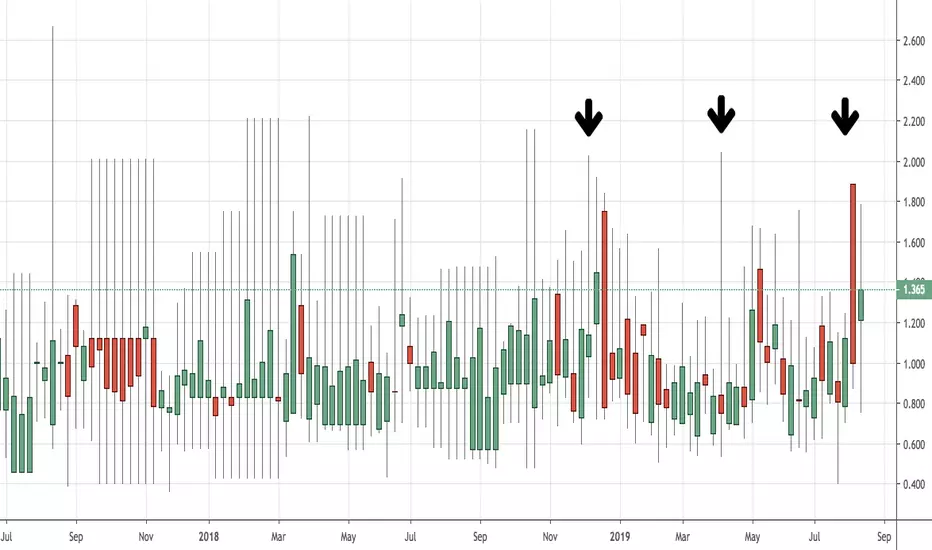

Contrary Indicator: Put/ Call Ratio Shows Urgent Put Buying

As a simple Contrary Indicator,

the Put/Call Ratio reveals trader sentiment,

and can be used as a confirming contrary indicator,

to buttress market future direction

Right now the number of puts being bought for either speculation or hedging is rising,

heading back up towards the Dec 2018 and April 2019 put peaks,

which corresponded in major price bottoms in the the S+P 500.

That is why I am not super bearish on the market right now.

When too many gloom and doomers

are out there buying puts with their own money

hand over fist,like it's the end of the world,

I assure you the market should not reward them, by collapsing right now.

Overwhelming bearish sentiment could in time be building

an important intermediate price bottom in the S+P 500,

although it is too early to say where or when, that bottom will come from.

THE_UNWIND

8/15/19

NEW YORK

the Put/Call Ratio reveals trader sentiment,

and can be used as a confirming contrary indicator,

to buttress market future direction

Right now the number of puts being bought for either speculation or hedging is rising,

heading back up towards the Dec 2018 and April 2019 put peaks,

which corresponded in major price bottoms in the the S+P 500.

That is why I am not super bearish on the market right now.

When too many gloom and doomers

are out there buying puts with their own money

hand over fist,like it's the end of the world,

I assure you the market should not reward them, by collapsing right now.

Overwhelming bearish sentiment could in time be building

an important intermediate price bottom in the S+P 500,

although it is too early to say where or when, that bottom will come from.

THE_UNWIND

8/15/19

NEW YORK

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.