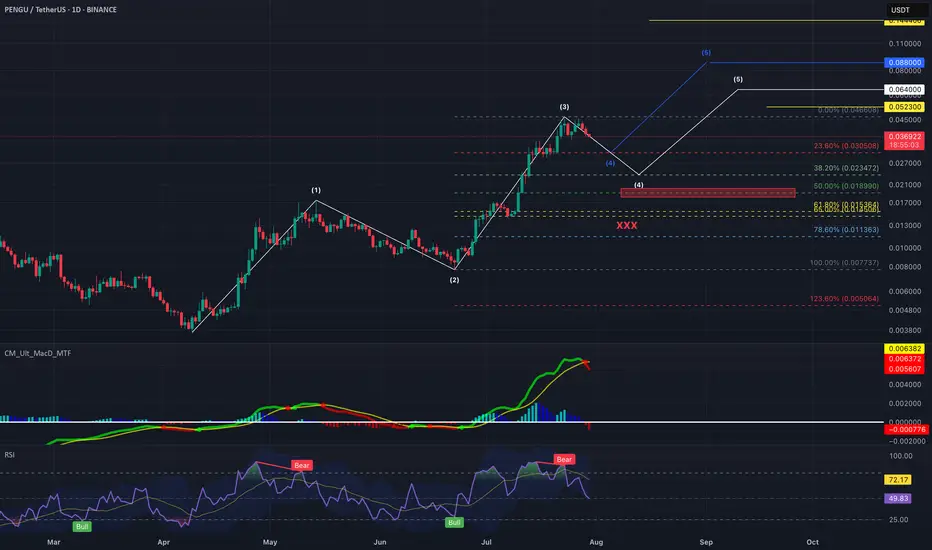

Our original analysis anticipated this pullback and it’s playing out beautifully. Wave 3 wrapped up at 0.0466, and we’re now seeing signs of a healthy Wave 4 retracement.

Current Structure

Wave 3 completed from 0.0077 to 0.0466. Really strong wave 3.

Now retracing with:

- MACD bearish crossover

- RSI bearish divergence

And Wave 4 pullback zone is likely between 0.0305 – 0.0255 (Fib 0.236–0.382 of Wave 3)

We're now in the cool-down phase, with momentum indicators rolling over. The red box around 0.0185–0.0200 is key support. If that holds (Wave 1 high), structure remains valid for a Wave 5 extension.

Wave 5 Upside Targets are

0️⃣ $0.0438 – $0.0473 (Base case recovery)

1️⃣ $0.0523 (Typical Wave 5 projection)

2️⃣ $0.0640 (Extended Wave 5)

3️⃣ $0.0880 Parabolic (FOMO scenario, 10% chance)

Breakdown below Wave 1 invalidates the count (red box region). PENGU has been leading the meme sector this cycle, and there’s no more "positive" news around

PENGU has been leading the meme sector this cycle, and there’s no more "positive" news around  PUMP to drain liquidity yet. So, I believe we might actually see a shallow pullback.

PUMP to drain liquidity yet. So, I believe we might actually see a shallow pullback.

This Wave 4 is likely the last dip before a clean leg up. Unless macro FUD derails the market, we expect continuation into Wave 5.

Patience is key. Let the retrace finish. Then… maybe moon. 🌝

Current Structure

Wave 3 completed from 0.0077 to 0.0466. Really strong wave 3.

Now retracing with:

- MACD bearish crossover

- RSI bearish divergence

And Wave 4 pullback zone is likely between 0.0305 – 0.0255 (Fib 0.236–0.382 of Wave 3)

We're now in the cool-down phase, with momentum indicators rolling over. The red box around 0.0185–0.0200 is key support. If that holds (Wave 1 high), structure remains valid for a Wave 5 extension.

Wave 5 Upside Targets are

0️⃣ $0.0438 – $0.0473 (Base case recovery)

1️⃣ $0.0523 (Typical Wave 5 projection)

2️⃣ $0.0640 (Extended Wave 5)

3️⃣ $0.0880 Parabolic (FOMO scenario, 10% chance)

Breakdown below Wave 1 invalidates the count (red box region).

This Wave 4 is likely the last dip before a clean leg up. Unless macro FUD derails the market, we expect continuation into Wave 5.

Patience is key. Let the retrace finish. Then… maybe moon. 🌝

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.