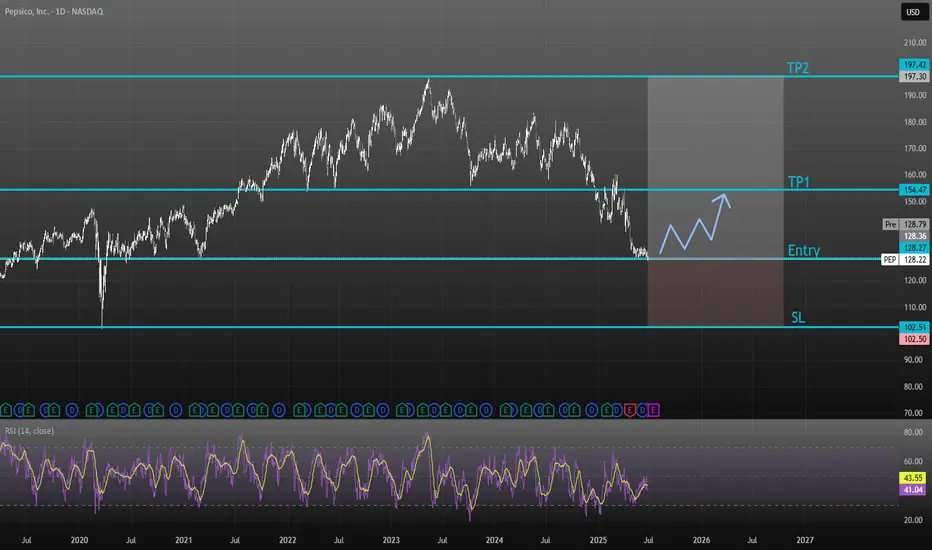

PepsiCo ( PEP) is sitting at a major long-term support after a deep pullback — this could be a strong opportunity for a risk-defined bounce. Here's what the chart is signaling:

PEP) is sitting at a major long-term support after a deep pullback — this could be a strong opportunity for a risk-defined bounce. Here's what the chart is signaling:

🔹 Entry Zone: Price is currently near $128 — a historically significant level that acted as resistance in the past and now aligns with a potential support flip.

🔹 Oversold & Stretched: After a consistent downtrend, PEP is looking oversold. A bounce is likely as sellers exhaust and dip buyers return at this key level.

PEP is looking oversold. A bounce is likely as sellers exhaust and dip buyers return at this key level.

🔹 Reversal Structure Building: Early signs of a bottoming pattern are emerging, with potential higher lows forming. If the current structure holds, we could see a climb toward the next resistance zones.

🎯 Targets:

TP1: $154 – minor resistance and previous consolidation zone.

TP2: $197 – major resistance and range high, aligning with earlier highs.

🛡️ Stop Loss: Below $102 — invalidates the support thesis and breaks structure.

💡 Why Price May Rise:

PEP is a defensive name with strong fundamentals, often benefiting during uncertain macro cycles.

Valuation is now more attractive after the sell-off.

The setup offers a high reward-to-risk ratio, especially if broader markets stabilize.

⚖️ Setup Summary:

Entry: ~$128

SL: $102

TP1: $154

TP2: $197

📌 Watching for confirmation with volume or bullish candle structure over the next few sessions.

🚫 Not financial advice — just a technical outlook based on structure and probability.

🔹 Entry Zone: Price is currently near $128 — a historically significant level that acted as resistance in the past and now aligns with a potential support flip.

🔹 Oversold & Stretched: After a consistent downtrend,

🔹 Reversal Structure Building: Early signs of a bottoming pattern are emerging, with potential higher lows forming. If the current structure holds, we could see a climb toward the next resistance zones.

🎯 Targets:

TP1: $154 – minor resistance and previous consolidation zone.

TP2: $197 – major resistance and range high, aligning with earlier highs.

🛡️ Stop Loss: Below $102 — invalidates the support thesis and breaks structure.

💡 Why Price May Rise:

PEP is a defensive name with strong fundamentals, often benefiting during uncertain macro cycles.

Valuation is now more attractive after the sell-off.

The setup offers a high reward-to-risk ratio, especially if broader markets stabilize.

⚖️ Setup Summary:

Entry: ~$128

SL: $102

TP1: $154

TP2: $197

📌 Watching for confirmation with volume or bullish candle structure over the next few sessions.

🚫 Not financial advice — just a technical outlook based on structure and probability.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.