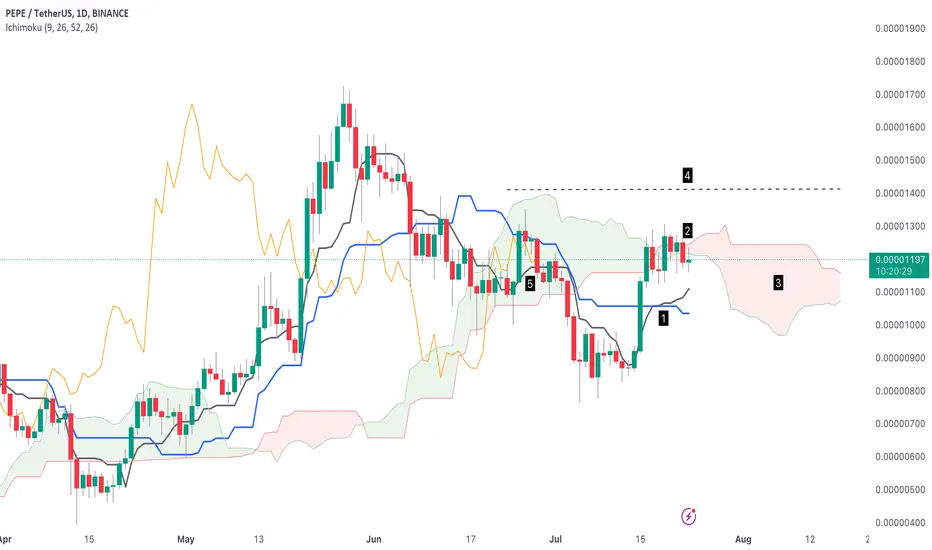

Why I Don't Consider Trading Pepe Right Now — An Ichimoku Deep Dive Into Pepe 🔍

I received a couple of requests to provide some more Ichimoku analyses. I am happy to do so since Ichimoku is one of the most reliable indicator systems available. It can provide tons of insights about an asset, trade signals, and parameters for a successful trade setup.

So, let's dive into Pepe's Ichimoku state of the nation.

💡 Overall, the Ichimoku indicators do not support a trade setup regarding Pepe. However, there are bullish signs that could quickly change the status.

1️⃣ Let's start with a bullish aspect: Just four days ago, the so-called Base Line (blue) crossed the Conversion Line (Gray) to the upside. This is considered a bullish sign. However, since the cross happened below the cloud, it's a rather weak bullish signal.

2️⃣ Pepe is currently fighting to cross the resistance build of Span B (red line) and the cloud simultaneously ( ~0.000012). A close above this level would indicate further bullish momentum, and the second is the previously mentioned crossover.

3️⃣ Let's discuss the bearish signals. The future cloud indicates a bearish forecast (red cloud). Additionally, the space between the sides of the cloud is rather ample, so we can't expect a change soon.

4️⃣ Based on the horizontal movement of the cloud, Pepe does not have a strong trend at the moment. To trade the asset, you want a rising or falling cloud.

5️⃣ Often forgotten, yet so important. The so-called Chikou (orange line) isn't "free" — meaning it is almost at the same level as the price candle. Again, when trading an asset, you prefer this indicator to be above/below the price.

🧵 Summarized

Based on the missing trend and the rather bearish outlook, I would suggest trading Pepe now. To reevaluate this, we need the price to close clearly about the cloud and Span B (acting as major resistance).

PEPEUSDT

PEPEUSDT

I received a couple of requests to provide some more Ichimoku analyses. I am happy to do so since Ichimoku is one of the most reliable indicator systems available. It can provide tons of insights about an asset, trade signals, and parameters for a successful trade setup.

So, let's dive into Pepe's Ichimoku state of the nation.

💡 Overall, the Ichimoku indicators do not support a trade setup regarding Pepe. However, there are bullish signs that could quickly change the status.

1️⃣ Let's start with a bullish aspect: Just four days ago, the so-called Base Line (blue) crossed the Conversion Line (Gray) to the upside. This is considered a bullish sign. However, since the cross happened below the cloud, it's a rather weak bullish signal.

2️⃣ Pepe is currently fighting to cross the resistance build of Span B (red line) and the cloud simultaneously ( ~0.000012). A close above this level would indicate further bullish momentum, and the second is the previously mentioned crossover.

3️⃣ Let's discuss the bearish signals. The future cloud indicates a bearish forecast (red cloud). Additionally, the space between the sides of the cloud is rather ample, so we can't expect a change soon.

4️⃣ Based on the horizontal movement of the cloud, Pepe does not have a strong trend at the moment. To trade the asset, you want a rising or falling cloud.

5️⃣ Often forgotten, yet so important. The so-called Chikou (orange line) isn't "free" — meaning it is almost at the same level as the price candle. Again, when trading an asset, you prefer this indicator to be above/below the price.

🧵 Summarized

Based on the missing trend and the rather bearish outlook, I would suggest trading Pepe now. To reevaluate this, we need the price to close clearly about the cloud and Span B (acting as major resistance).

I'm Ben. Crypto lover, trader, and coder.

Join my free newsletter for insights and the hottest trade setups every weekday!

newsletter.bencrypto23.com

🔥 For exclusive content: newsletter.bencrypto23.com/exclusive

Join my free newsletter for insights and the hottest trade setups every weekday!

newsletter.bencrypto23.com

🔥 For exclusive content: newsletter.bencrypto23.com/exclusive

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I'm Ben. Crypto lover, trader, and coder.

Join my free newsletter for insights and the hottest trade setups every weekday!

newsletter.bencrypto23.com

🔥 For exclusive content: newsletter.bencrypto23.com/exclusive

Join my free newsletter for insights and the hottest trade setups every weekday!

newsletter.bencrypto23.com

🔥 For exclusive content: newsletter.bencrypto23.com/exclusive

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.