In our search for solid long term investments in the coming years we have decided to share our long term outlook on Platinum.

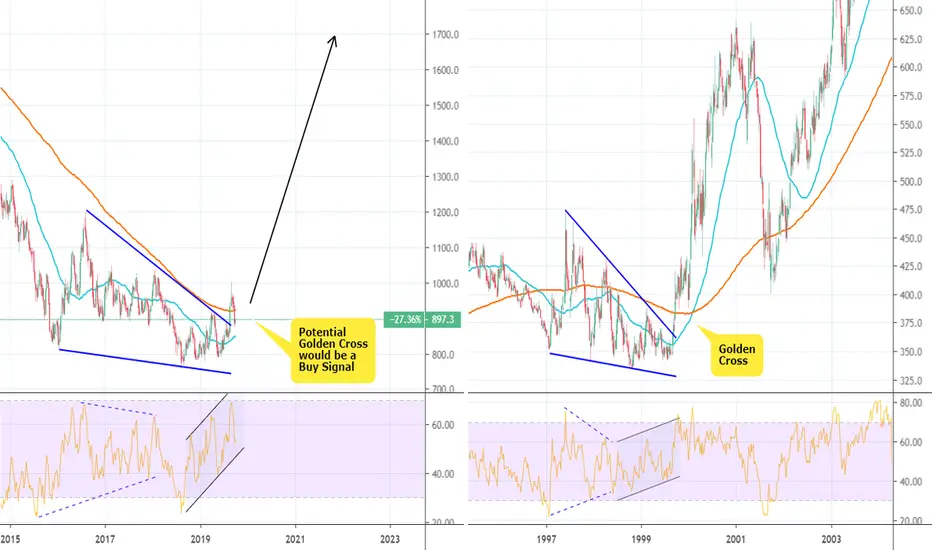

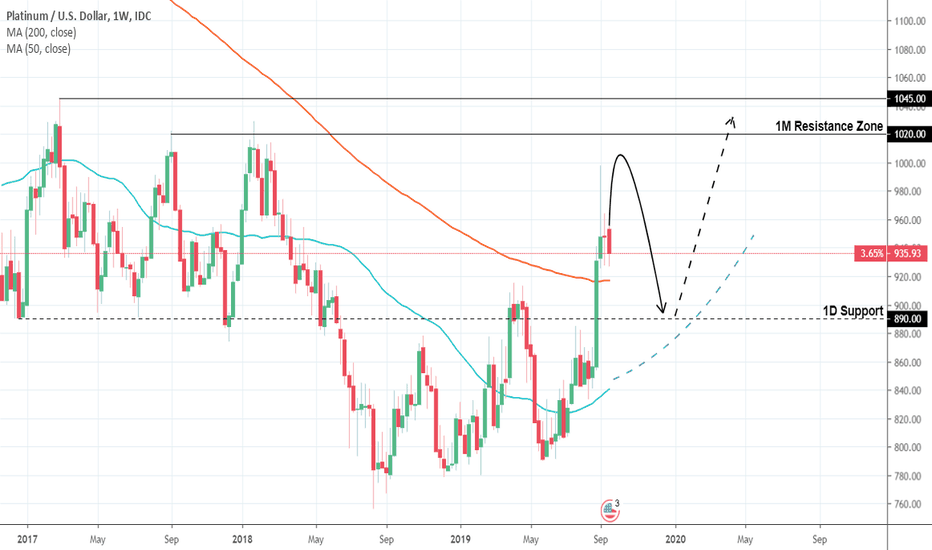

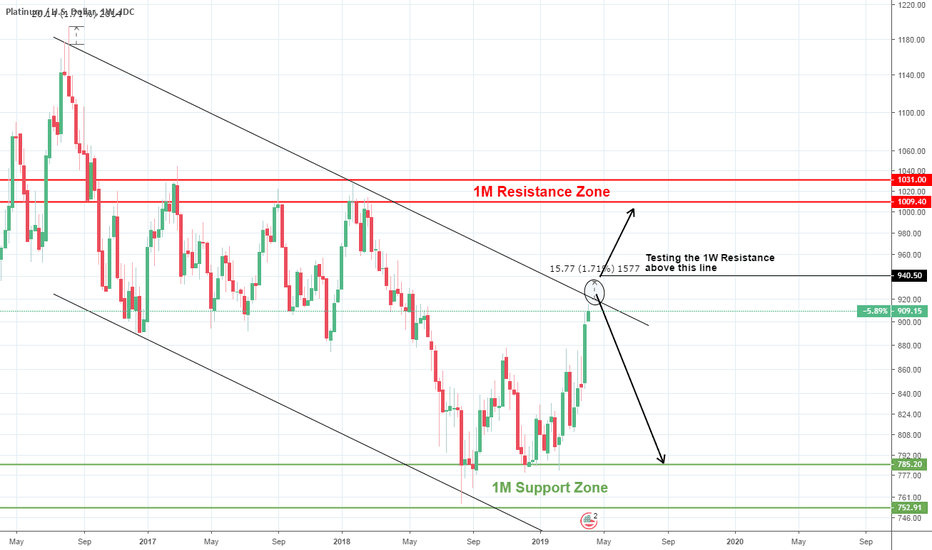

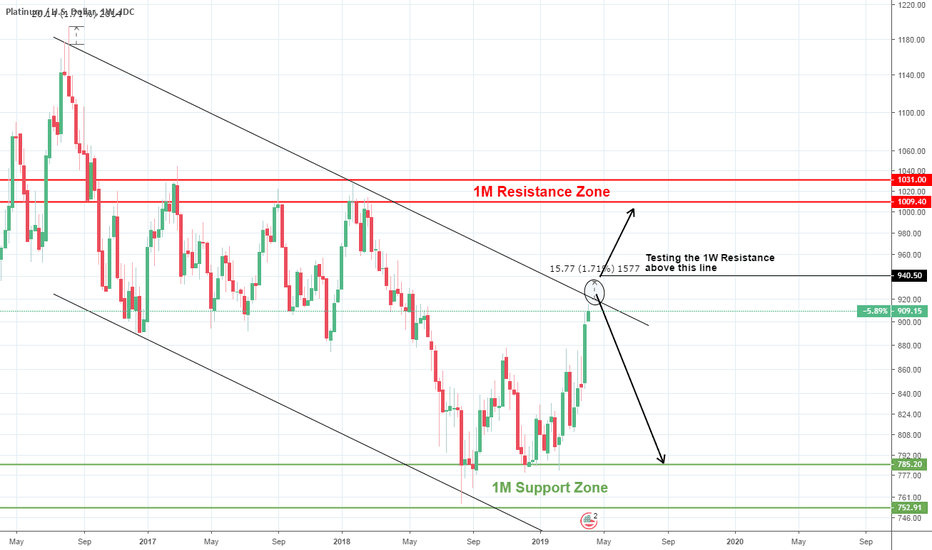

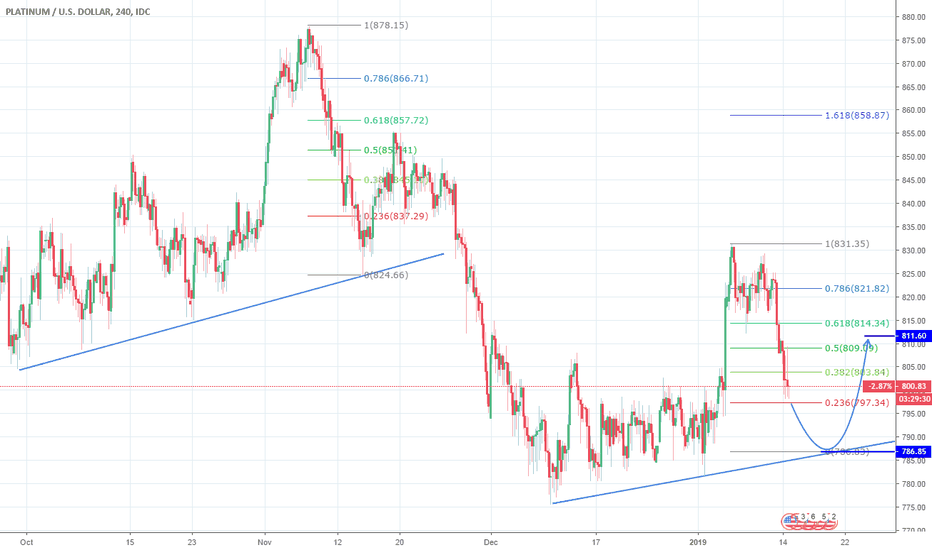

Technically it recently broke above a 3 year Falling Wedge turning bullish on the monthly chart an effect that has since receded as it pulled back on the 1,000 mark (RSI = 50.285, MACD = -8.660, ADX = 25.926, Highs/Lows = 11.4571).

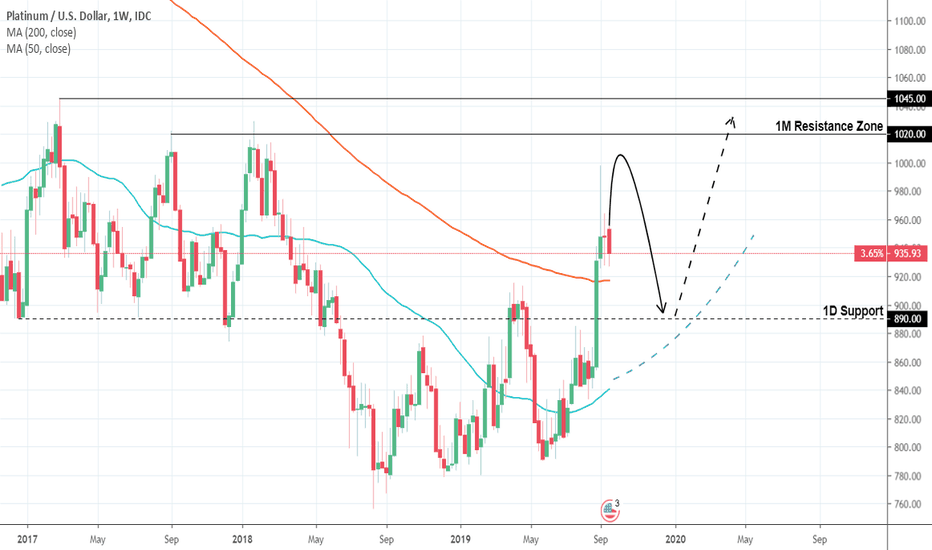

If the 1W MA50 holds this pull back and another spike prints a Golden Cross, then we may come across a unique multi year buy opportunity on Platinum as most parameters will be similar to the late 90's Golden Cross pattern when the metal entered a hyper strong Bull Cycle. The target will be 2-3 times the initial value.

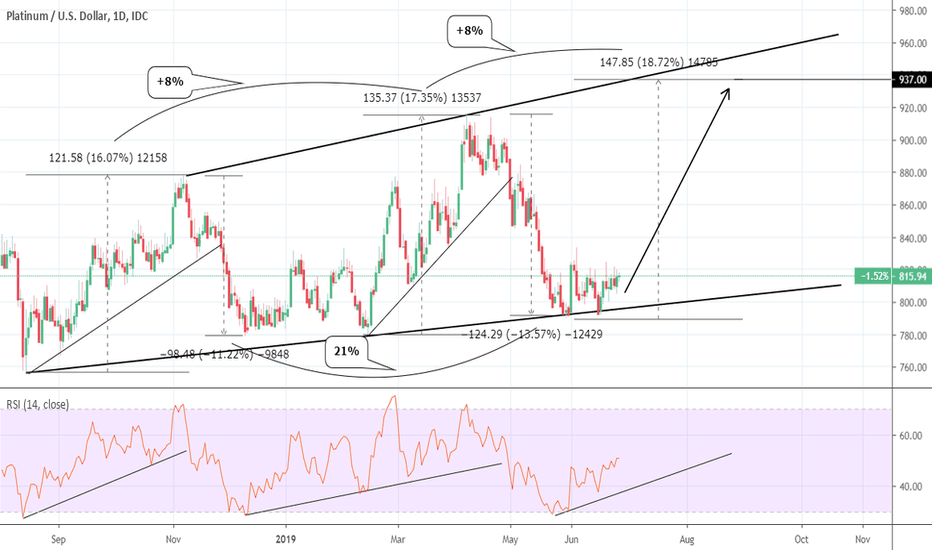

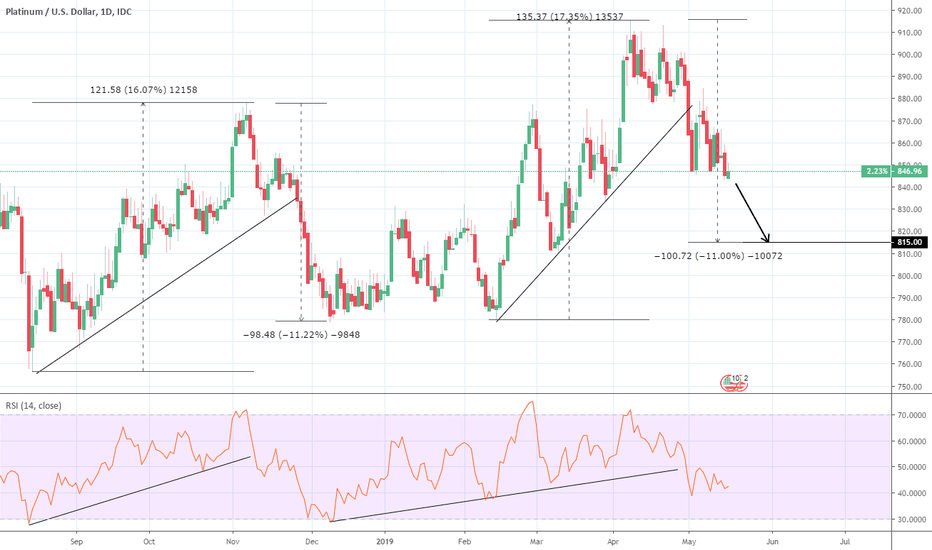

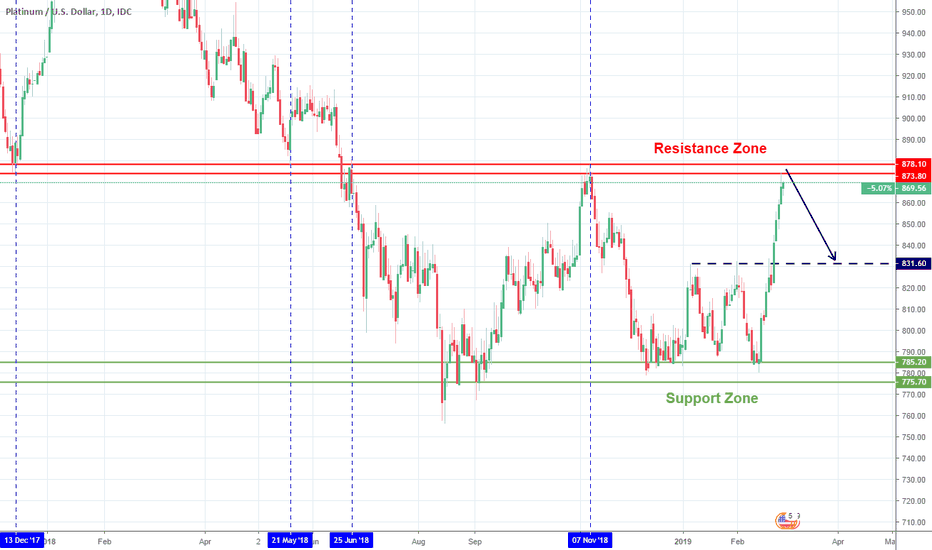

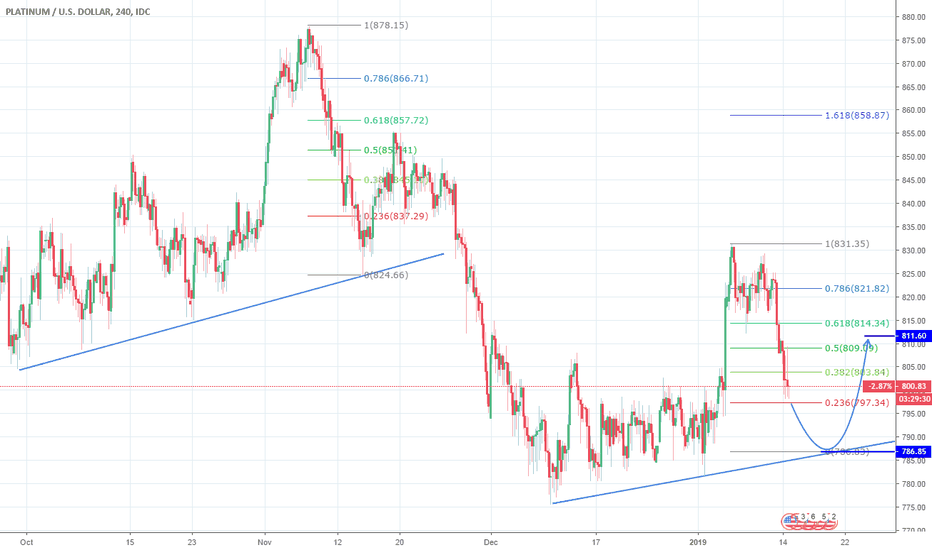

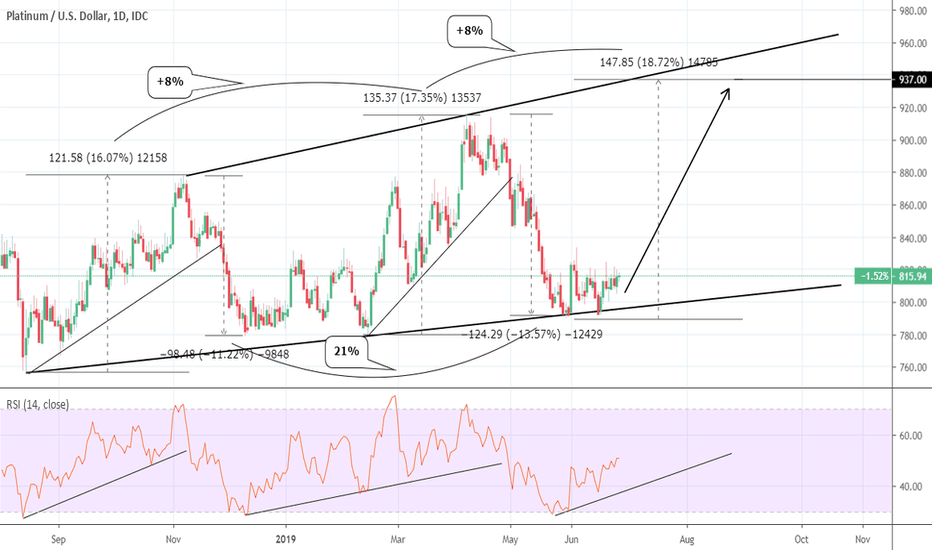

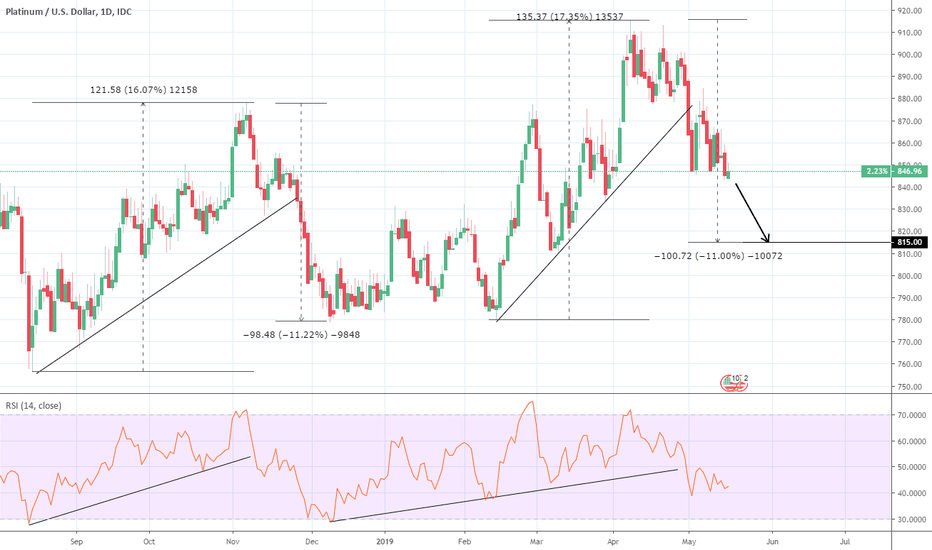

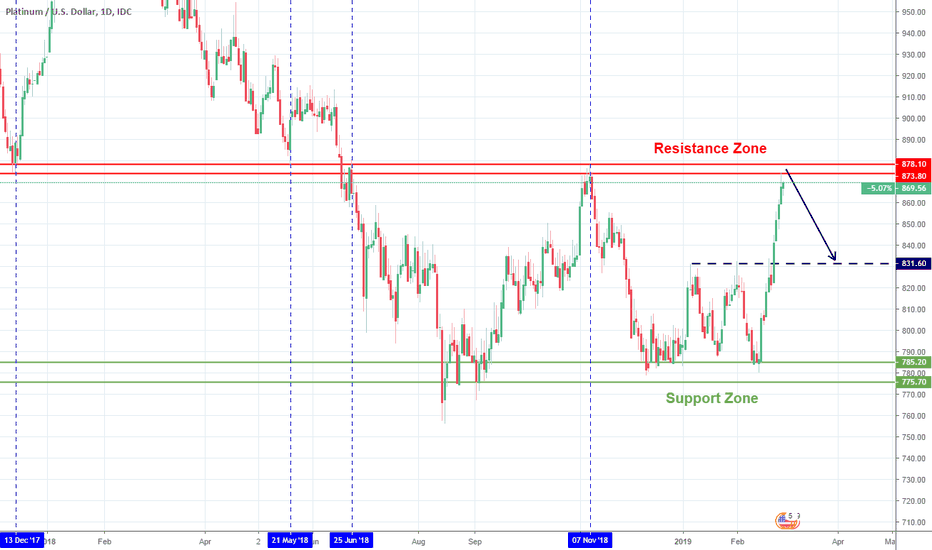

We wish to add at this point that Platinum has fairly reliable pointers both on the short and long term and thanks to that most of our latest XPTUSD signals have met their target on high quality patterns. You can get an idea of those below:

** If you like our free content follow our profile (tradingview.com/u/InvestingScope) to get more daily ideas. **

Comments and likes are greatly appreciated.

Technically it recently broke above a 3 year Falling Wedge turning bullish on the monthly chart an effect that has since receded as it pulled back on the 1,000 mark (RSI = 50.285, MACD = -8.660, ADX = 25.926, Highs/Lows = 11.4571).

If the 1W MA50 holds this pull back and another spike prints a Golden Cross, then we may come across a unique multi year buy opportunity on Platinum as most parameters will be similar to the late 90's Golden Cross pattern when the metal entered a hyper strong Bull Cycle. The target will be 2-3 times the initial value.

We wish to add at this point that Platinum has fairly reliable pointers both on the short and long term and thanks to that most of our latest XPTUSD signals have met their target on high quality patterns. You can get an idea of those below:

** If you like our free content follow our profile (tradingview.com/u/InvestingScope) to get more daily ideas. **

Comments and likes are greatly appreciated.

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.