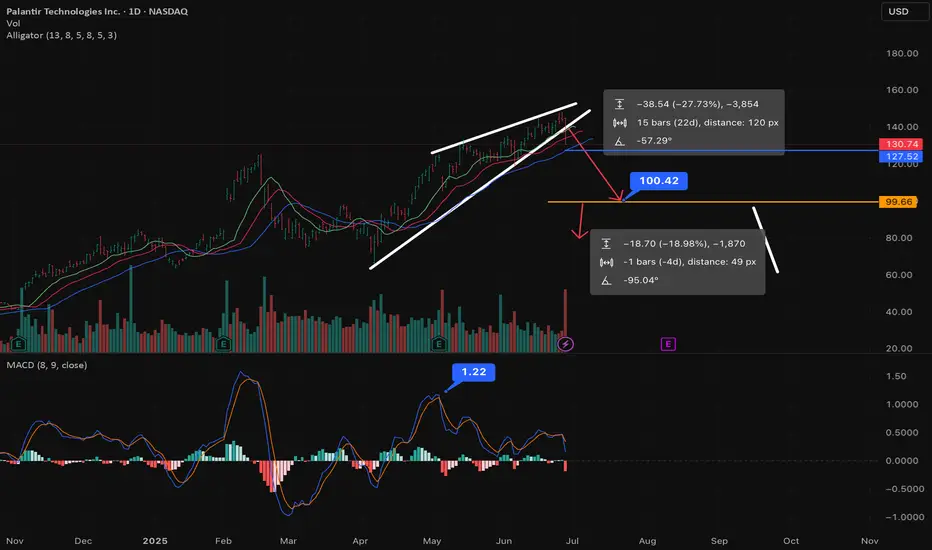

As of Friday, June 27, 2025, at 9:19:58 PM PDT, here's an analysis of PLTR:

Current Price & Performance:

Last Price: $130.74 (as of 4:00 PM ET on June 27, 2025)

Today's Change: Down $15.57 (-10.64%)

After-hours price: $134.52 (up 2.89% as of 7:59 PM ET on June 27, 2025)

Previous Close: $146.31

Today's Range: $130.54 - $144.97

52-Week Range: $21.23 - $148.22

Williams Alligator Analysis (Daily Chart):

The Williams Alligator indicator uses three smoothed moving averages, often referred to as the Jaw (blue line), Teeth (red line), and Lips (green line), with specific periods and shifts. The common default settings are:

Lips (Green Line): 5-period Smoothed Moving Average (SMMA), shifted 3 bars into the future.

Teeth (Red Line): 8-period SMMA, shifted 5 bars into the future.

Jaw (Blue Line): 13-period SMMA, shifted 8 bars into the future.

Interpreting the Alligator:

"Sleeping" Alligator: When the three lines are intertwined or very close together, it indicates a non-trending or consolidating market. This is often a period to avoid trading or to take profits.

"Awakening" Alligator: When the lines start to diverge, with the Lips (green) crossing the Teeth (red) and Jaw (blue), it signals a potential new trend forming.

Green crossing above Red and Blue: Suggests a bullish awakening.

Green crossing below Red and Blue: Suggests a bearish awakening.

"Eating" Alligator (Mouth Wide Open): When the lines are fanning out and moving in a clear direction (e.g., Green > Red > Blue for an uptrend, or Blue > Red > Green for a downtrend), it indicates a strong trending market.

Current PLTR Alligator State (Based on recent price action):

Palantir experienced a significant pullback today (-10.64%), which followed a period of strong upward movement and nearing its 52-week high.

Recent Trend: Prior to today's drop, PLTR was in a strong uptrend, likely characterized by the Alligator's mouth being "open" upwards (Green above Red, Red above Blue).

Today's Action: A sharp drop like today's could cause the Lips (green line) to cross below the Teeth (red line), and potentially even the Jaw (blue line), or at least begin to converge. This would indicate:

Potential "Sating" or "Sleeping": The sharp drop suggests the Alligator might be moving from an "eating" phase (uptrend) towards a "sated" or "sleeping" phase, where the trend is losing momentum or consolidating.

Bearish Crossover (Possible): If the green line has crossed below the red and blue lines, it would be a bearish signal, indicating a potential reversal or the start of a downtrend. It's crucial to see the actual chart to confirm the precise line positioning. However, a 10%+ drop from a recent high strongly implies such a shift.

MACD (Moving Average Convergence Divergence) (8,13):

The MACD uses two Exponential Moving Averages (EMAs) to identify momentum and potential trend changes. The standard MACD settings are typically 12-period EMA, 26-period EMA, and a 9-period Signal Line. You've requested (8,13) which means:

MACD Line: (8-period EMA of Close - 13-period EMA of Close)

Signal Line: 9-period EMA of the MACD Line

MACD Histogram: MACD Line - Signal Line

Interpreting MACD:

MACD Line crossing above Signal Line: Bullish crossover, suggests upward momentum.

MACD Line crossing below Signal Line: Bearish crossover, suggests downward momentum.

MACD Histogram: Positive and increasing indicates strengthening bullish momentum. Negative and decreasing indicates strengthening bearish momentum.

Current PLTR MACD (8,13) State:

While specific MACD (8,13) values aren't readily available without a real-time chart for today's close, we can infer based on the significant price drop:

Prior to Today: Given PLTR's recent upward trend, the MACD (8,13) was likely positive, with the MACD line above its signal line, and a positive histogram.

Today's Action: A sharp 10%+ decline would almost certainly cause a bearish crossover on the MACD (8,13). This means the MACD line would have likely crossed below its signal line, and the MACD histogram would have turned negative and started to decrease, indicating strong bearish momentum and a potential shift in the short-term trend.

Combined Analysis for PLTR:

Today's significant drop in Palantir's stock price strongly suggests a shift from a bullish trend to a more bearish or consolidating phase.

Williams Alligator: The "mouth" of the Alligator, which was likely open upwards, has probably begun to close or even reverse, with the green Lips line potentially crossing below the red Teeth line, signaling a weakening or reversal of the uptrend. The Alligator is likely moving towards a "sated" or "sleeping" state.

MACD (8,13): A bearish MACD crossover is highly probable, with the MACD line falling below its signal line and the histogram turning negative, confirming the strong downward momentum.

Conclusion:

Based on the daily chart analysis using Williams Alligator and MACD (8,13) indicators, Palantir's current price action indicates a significant loss of bullish momentum and a potential short-term reversal or consolidation. Both indicators likely point to a bearish shift following today's sharp decline.

Important Disclaimer: This analysis is based on available data and general interpretations of these indicators. Technical analysis is not foolproof and should be used in conjunction with fundamental analysis and other forms of research. Market conditions can change rapidly. Always consult with a qualified financial advisor before making any investment decisions.

Current Price & Performance:

Last Price: $130.74 (as of 4:00 PM ET on June 27, 2025)

Today's Change: Down $15.57 (-10.64%)

After-hours price: $134.52 (up 2.89% as of 7:59 PM ET on June 27, 2025)

Previous Close: $146.31

Today's Range: $130.54 - $144.97

52-Week Range: $21.23 - $148.22

Williams Alligator Analysis (Daily Chart):

The Williams Alligator indicator uses three smoothed moving averages, often referred to as the Jaw (blue line), Teeth (red line), and Lips (green line), with specific periods and shifts. The common default settings are:

Lips (Green Line): 5-period Smoothed Moving Average (SMMA), shifted 3 bars into the future.

Teeth (Red Line): 8-period SMMA, shifted 5 bars into the future.

Jaw (Blue Line): 13-period SMMA, shifted 8 bars into the future.

Interpreting the Alligator:

"Sleeping" Alligator: When the three lines are intertwined or very close together, it indicates a non-trending or consolidating market. This is often a period to avoid trading or to take profits.

"Awakening" Alligator: When the lines start to diverge, with the Lips (green) crossing the Teeth (red) and Jaw (blue), it signals a potential new trend forming.

Green crossing above Red and Blue: Suggests a bullish awakening.

Green crossing below Red and Blue: Suggests a bearish awakening.

"Eating" Alligator (Mouth Wide Open): When the lines are fanning out and moving in a clear direction (e.g., Green > Red > Blue for an uptrend, or Blue > Red > Green for a downtrend), it indicates a strong trending market.

Current PLTR Alligator State (Based on recent price action):

Palantir experienced a significant pullback today (-10.64%), which followed a period of strong upward movement and nearing its 52-week high.

Recent Trend: Prior to today's drop, PLTR was in a strong uptrend, likely characterized by the Alligator's mouth being "open" upwards (Green above Red, Red above Blue).

Today's Action: A sharp drop like today's could cause the Lips (green line) to cross below the Teeth (red line), and potentially even the Jaw (blue line), or at least begin to converge. This would indicate:

Potential "Sating" or "Sleeping": The sharp drop suggests the Alligator might be moving from an "eating" phase (uptrend) towards a "sated" or "sleeping" phase, where the trend is losing momentum or consolidating.

Bearish Crossover (Possible): If the green line has crossed below the red and blue lines, it would be a bearish signal, indicating a potential reversal or the start of a downtrend. It's crucial to see the actual chart to confirm the precise line positioning. However, a 10%+ drop from a recent high strongly implies such a shift.

MACD (Moving Average Convergence Divergence) (8,13):

The MACD uses two Exponential Moving Averages (EMAs) to identify momentum and potential trend changes. The standard MACD settings are typically 12-period EMA, 26-period EMA, and a 9-period Signal Line. You've requested (8,13) which means:

MACD Line: (8-period EMA of Close - 13-period EMA of Close)

Signal Line: 9-period EMA of the MACD Line

MACD Histogram: MACD Line - Signal Line

Interpreting MACD:

MACD Line crossing above Signal Line: Bullish crossover, suggests upward momentum.

MACD Line crossing below Signal Line: Bearish crossover, suggests downward momentum.

MACD Histogram: Positive and increasing indicates strengthening bullish momentum. Negative and decreasing indicates strengthening bearish momentum.

Current PLTR MACD (8,13) State:

While specific MACD (8,13) values aren't readily available without a real-time chart for today's close, we can infer based on the significant price drop:

Prior to Today: Given PLTR's recent upward trend, the MACD (8,13) was likely positive, with the MACD line above its signal line, and a positive histogram.

Today's Action: A sharp 10%+ decline would almost certainly cause a bearish crossover on the MACD (8,13). This means the MACD line would have likely crossed below its signal line, and the MACD histogram would have turned negative and started to decrease, indicating strong bearish momentum and a potential shift in the short-term trend.

Combined Analysis for PLTR:

Today's significant drop in Palantir's stock price strongly suggests a shift from a bullish trend to a more bearish or consolidating phase.

Williams Alligator: The "mouth" of the Alligator, which was likely open upwards, has probably begun to close or even reverse, with the green Lips line potentially crossing below the red Teeth line, signaling a weakening or reversal of the uptrend. The Alligator is likely moving towards a "sated" or "sleeping" state.

MACD (8,13): A bearish MACD crossover is highly probable, with the MACD line falling below its signal line and the histogram turning negative, confirming the strong downward momentum.

Conclusion:

Based on the daily chart analysis using Williams Alligator and MACD (8,13) indicators, Palantir's current price action indicates a significant loss of bullish momentum and a potential short-term reversal or consolidation. Both indicators likely point to a bearish shift following today's sharp decline.

Important Disclaimer: This analysis is based on available data and general interpretations of these indicators. Technical analysis is not foolproof and should be used in conjunction with fundamental analysis and other forms of research. Market conditions can change rapidly. Always consult with a qualified financial advisor before making any investment decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.