🔍 1-Hour GEX & Options Outlook

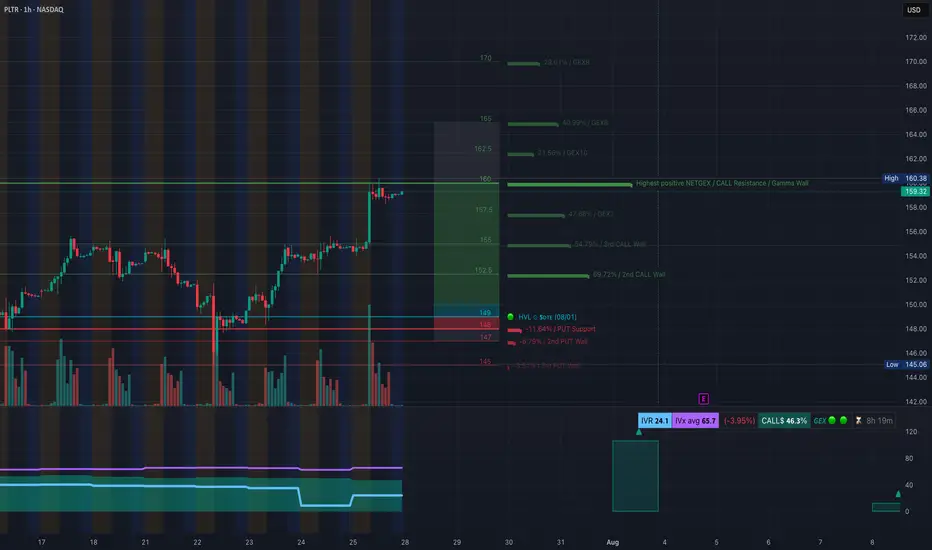

Palantir (PLTR) has reclaimed strength, now consolidating just below $160.38, which aligns with the Highest Positive GEX / Gamma Wall. The GEX stack gives us a powerful framework for potential options setups:

* $160.38 = Gamma Magnet – This is the wall where large call positioning accumulates. Price is currently pinned underneath, forming a short-term consolidation range.

* Above $160.38 opens the path toward:

* $162.5 (GEX10)

* $165 (GEX9)

* $170 (GEX9 top wall)

However, failure to break $160.38 cleanly could cause price to slide back to key support zones around:

* $157.5 (GEX Cluster, minor put wall zone)

* $152.5 (2nd Call Wall, liquidity pocket)

* $149–147 (High Volume Node + Put Support)

🧠 My thoughts: This is a textbook high gamma compression zone. If PLTR breaks and holds above $160.38 early in the week, it could trigger a gamma squeeze toward $165+. If it gets rejected again, short-term premiums may decay fast, and a move toward $152.5 is likely before any next leg.

🎯 Options Strategy:

* Bullish Setup:

* Entry: Over $160.50 with volume and confirmation.

* Target: $165, then $170.

* Contract: Aug 2nd or Aug 9th $165C.

* Stop: Below $157.5.

* Bearish Setup:

* If rejection from $160.38 with weakness.

* Target: $154.88 / $152.5.

* Contract: Aug 2nd $155P or $152.5P.

* Stop: Above $160.8.

🕒 15-Minute Intraday TA

We saw a sharp rally followed by sideways compression in a narrow range between $159.32 and $160.38. The breakout leg was supported by a clear CHoCH (Change of Character) in the NY morning session followed by a BOS (Break of Structure) up.

Price has since been flagging within a parallel channel, forming a minor order block between $158.29 and $159.32. As we head into Monday’s session, here’s what to look for:

🟢 Bullish Intraday Scenario

* Look for price to hold the OB or do a liquidity sweep down to $158.29, then break above the current flag.

* A break and retest of $160.38 with rising volume sets up a clean scalp toward $162.

* Bias remains bullish as long as price stays above the rising channel and $157.5.

🔴 Bearish Intraday Scenario

* A break below $158.29 could trigger a fade toward the next support around $154.88 / $153.97.

* A mid-morning failed breakout above $160.38 that quickly reverses would be a trap short setup.

* If price falls below $157.5 early in the day, expect downside acceleration.

📌 Scalper’s Zone to Watch:

* $158.29–$159.32 = Bullish OB + Liquidity Zone.

* $160.38 = Resistance + Gamma Wall.

* $154.88–$153.97 = Demand zone if flush occurs.

🧠 Final Thoughts:

PLTR is at a pivotal level with serious GEX heat. It's consolidating right beneath a gamma ceiling that could either trigger a breakout squeeze or unwind. Use the first 15–30 minutes Monday to judge strength. Watch the reaction to $160.38 carefully — that’s the gatekeeper.

⚠️ Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk responsibly.

Palantir (PLTR) has reclaimed strength, now consolidating just below $160.38, which aligns with the Highest Positive GEX / Gamma Wall. The GEX stack gives us a powerful framework for potential options setups:

* $160.38 = Gamma Magnet – This is the wall where large call positioning accumulates. Price is currently pinned underneath, forming a short-term consolidation range.

* Above $160.38 opens the path toward:

* $162.5 (GEX10)

* $165 (GEX9)

* $170 (GEX9 top wall)

However, failure to break $160.38 cleanly could cause price to slide back to key support zones around:

* $157.5 (GEX Cluster, minor put wall zone)

* $152.5 (2nd Call Wall, liquidity pocket)

* $149–147 (High Volume Node + Put Support)

🧠 My thoughts: This is a textbook high gamma compression zone. If PLTR breaks and holds above $160.38 early in the week, it could trigger a gamma squeeze toward $165+. If it gets rejected again, short-term premiums may decay fast, and a move toward $152.5 is likely before any next leg.

🎯 Options Strategy:

* Bullish Setup:

* Entry: Over $160.50 with volume and confirmation.

* Target: $165, then $170.

* Contract: Aug 2nd or Aug 9th $165C.

* Stop: Below $157.5.

* Bearish Setup:

* If rejection from $160.38 with weakness.

* Target: $154.88 / $152.5.

* Contract: Aug 2nd $155P or $152.5P.

* Stop: Above $160.8.

🕒 15-Minute Intraday TA

We saw a sharp rally followed by sideways compression in a narrow range between $159.32 and $160.38. The breakout leg was supported by a clear CHoCH (Change of Character) in the NY morning session followed by a BOS (Break of Structure) up.

Price has since been flagging within a parallel channel, forming a minor order block between $158.29 and $159.32. As we head into Monday’s session, here’s what to look for:

🟢 Bullish Intraday Scenario

* Look for price to hold the OB or do a liquidity sweep down to $158.29, then break above the current flag.

* A break and retest of $160.38 with rising volume sets up a clean scalp toward $162.

* Bias remains bullish as long as price stays above the rising channel and $157.5.

🔴 Bearish Intraday Scenario

* A break below $158.29 could trigger a fade toward the next support around $154.88 / $153.97.

* A mid-morning failed breakout above $160.38 that quickly reverses would be a trap short setup.

* If price falls below $157.5 early in the day, expect downside acceleration.

📌 Scalper’s Zone to Watch:

* $158.29–$159.32 = Bullish OB + Liquidity Zone.

* $160.38 = Resistance + Gamma Wall.

* $154.88–$153.97 = Demand zone if flush occurs.

🧠 Final Thoughts:

PLTR is at a pivotal level with serious GEX heat. It's consolidating right beneath a gamma ceiling that could either trigger a breakout squeeze or unwind. Use the first 15–30 minutes Monday to judge strength. Watch the reaction to $160.38 carefully — that’s the gatekeeper.

⚠️ Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk responsibly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.