Audio Analysis: notebooklm.google.com/notebook/c811e0e5-3821-416a-8fcc-d6d43bf1cac8/audio

Below is an **integrated Fundamental and Technical Analysis** report on Palantir Technologies (PLTR), with a particular focus on the **bear case** and considerations for a **short sell** opportunity. Please note this is a **professional-level overview** intended for the trading floor manager, drawing upon both the high-level fundamentals and recent technical signals.

---

## 1. **Fundamental Analysis Recap**

1. **Sky-High Valuation Multiples**

- **Trailing P/E**: ~583×, which is extremely elevated versus historical and industry norms.

- **Forward P/E**: ~200× (based on ~$0.55 forward EPS), still far above typical high-growth tech peers and well beyond the ~20× S&P 500 average forward P/E.

- **Price/Sales**: ~87×, highlighting that revenue growth needs to stay exceptionally strong to justify current levels.

2. **Growth & Profitability**

- **Revenue Growth**: Q4 2024 revenue up 36% YoY; 2025 guidance at ~$3.75B (+31% YoY).

- **Margins**: Net margin around 18%—solid, but not extraordinary enough to sustain a 200× P/E if growth slows.

3. **Market Expectations & Analyst Targets**

- Consensus 12-month price target near $69–$70 implies ~37% downside from current levels ($110+).

- Stock price incorporates **aggressive AI-driven growth assumptions**, meaning any miss on guidance or shift in sentiment could trigger multiple compression.

4. **Overreliance on AI Hype**

- Palantir is benefiting from enthusiasm around its AI platform (AIP). Overreliance on a single narrative can inflate valuations—if the AI hype fades or competition intensifies, shares may correct sharply.

**Key Bearish Fundamental Takeaway**: **PLTR’s valuation appears stretched** relative to both broad market metrics and even other high-growth tech names. While growth remains robust, the current price suggests *near-flawless* execution for many years, creating a higher risk of a downside re-rating if sentiment changes.

---

## 2. **Technical Analysis Summary**

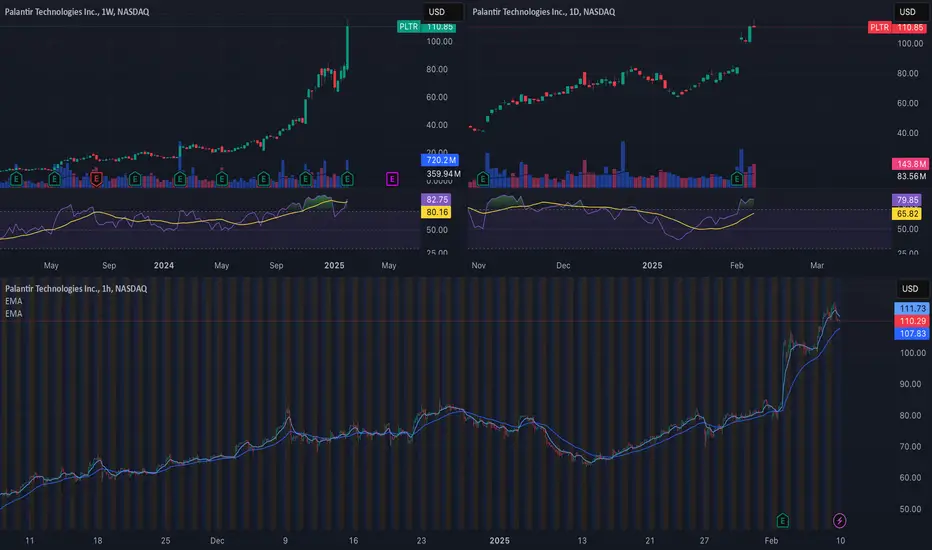

1. **Weekly Chart**

- **Extended Uptrend**: Price has risen parabolically, with weekly RSI above 80 (signaling overbought conditions).

- **Volume**: Surging volumes indicate strong buying, but watch for a volume spike on any significant down week, which could confirm selling pressure.

2. **Daily Chart**

- **Overbought Momentum**: Daily RSI also hovers in the high-70s to low-80s range—historically prone to consolidation or pullbacks.

- **Elevated Price vs. Moving Averages**: The stock is trading well above the 10-day and 20-day MAs. A break below these short-term MAs often triggers momentum traders to exit.

3. **Intraday (1-Hour) Chart**

- **Sharp Run-Up**: Price has advanced rapidly, with minimal pauses.

- **Profit-Taking Signs**: Slight cooling in the 1-hour RSI and the formation of small-bodied candles with upper wicks, hinting at short-term distribution or indecision.

**Key Bearish Technical Takeaway**: PLTR appears **technically overextended** in multiple timeframes. This increases the likelihood of a pullback or correction, especially if broader market sentiment towards high-multiple stocks worsens.

---

## 3. **Bear Case Rationale**

1. **Valuation Compression Risk**

- With P/E > 200× forward earnings, even a moderate downward revision in growth expectations could spur multiple contraction—potentially sending the stock sharply lower.

2. **Overbought Technicals**

- Weekly and daily RSIs in the 80s are historically unsustainable. Overbought conditions often precede consolidations or corrections, providing a window for short sellers to capitalize.

3. **Macro Factors & Rising Rates**

- Growth stocks with high valuations are particularly sensitive to interest rates. Any hint of tighter monetary policy can diminish risk appetite for stocks priced at extreme multiples.

4. **Analyst & Institutional Rotation**

- If institutional investors choose to rotate out of high-growth, high-valuation names into more defensive sectors, PLTR could see accelerated selling.

- The stated 12-month analyst consensus target implies substantial downside, suggesting limited support from the sell-side in the near term.

5. **AI Hype Vulnerability**

- Overreliance on an AI-driven narrative can be a double-edged sword. In the event that AI adoption or contract wins slow, the stock might face a severe revaluation.

---

## 4. **Potential Short-Sell Setups**

Below are two illustrative ways a short-seller might engage, each with varying risk levels:

1. **Momentum Shift Entry**

- **Trigger**: Wait for price to close below the 10-day or 20-day moving average on the daily chart with a confirmed pickup in sell volume.

- **Stop-Loss Consideration**: Place stops above the recent swing high (e.g., above $116–$120) to protect from a short squeeze if the bullish run persists.

- **Target Zones**: A price retracement toward the $90–$95 area (recent pivot/support) or the round number $100 could be initial downside targets.

2. **Rally Fade / Overbought Condition**

- **Trigger**: Enter a short position into a relief bounce back toward the prior highs if momentum indicators show a clear negative divergence (e.g., RSI making lower highs).

- **Stop-Loss Placement**: Just above the new local high—if price unexpectedly breaks higher, exit quickly.

- **Target Zones**: Scale out partial profits around the 50-day MA or psychological levels like $100. If broader market conditions worsen, a deeper move below $90 could be possible.

**Risk Management**: Shorting a high-momentum, high-volatility stock is inherently risky. Tight stops, position sizing, and continuous monitoring are essential. **Cover** promptly if price action contradicts the bearish thesis.

---

## 5. **Conclusion & Manager Summary**

**Fundamental Snapshot**:

- Palantir’s valuation is pricing in extraordinary future growth (P/E > 200× forward). Any slowdown or miss may induce significant downside.

- Analysts are cautious; consensus targets are below current price.

**Technical Situation**:

- Price is extended across multiple timeframes, with **overbought RSI** readings and a near-vertical price trajectory—historically indicative of potential pullbacks.

- A correction to technical support (near $100, or possibly $90–$95) may be in the cards if bullish momentum wanes.

**Bear Thesis / Short Opportunity**:

- **Rationale**: Extreme valuation + Overbought technicals + Potential macro headwinds = Elevated risk of a downside re-rating.

- **Strategy**: Look for a shift in short-term momentum (closing below key moving averages) or negative RSI divergence as a **potential short entry** signal. Set stops carefully above recent highs to cap losses.

Given the stock’s **hyper-bullish** sentiment, timing is crucial. If bullish momentum persists longer than expected, short positions risk facing quick squeezes. Nonetheless, the **probability of a meaningful correction** grows with each new leg higher, offering an appealing **risk/reward** profile for experienced traders prepared to manage volatility.

---

### **Final Note**

This combined **Fundamental + Technical** perspective suggests **caution** for long investors at these elevated levels and **potential opportunity** for short sellers anticipating a reversion to more sustainable valuation metrics. Proper risk controls—such as **position sizing, stop-loss orders, and regular re-evaluation** of the thesis—remain paramount.

Below is an **integrated Fundamental and Technical Analysis** report on Palantir Technologies (PLTR), with a particular focus on the **bear case** and considerations for a **short sell** opportunity. Please note this is a **professional-level overview** intended for the trading floor manager, drawing upon both the high-level fundamentals and recent technical signals.

---

## 1. **Fundamental Analysis Recap**

1. **Sky-High Valuation Multiples**

- **Trailing P/E**: ~583×, which is extremely elevated versus historical and industry norms.

- **Forward P/E**: ~200× (based on ~$0.55 forward EPS), still far above typical high-growth tech peers and well beyond the ~20× S&P 500 average forward P/E.

- **Price/Sales**: ~87×, highlighting that revenue growth needs to stay exceptionally strong to justify current levels.

2. **Growth & Profitability**

- **Revenue Growth**: Q4 2024 revenue up 36% YoY; 2025 guidance at ~$3.75B (+31% YoY).

- **Margins**: Net margin around 18%—solid, but not extraordinary enough to sustain a 200× P/E if growth slows.

3. **Market Expectations & Analyst Targets**

- Consensus 12-month price target near $69–$70 implies ~37% downside from current levels ($110+).

- Stock price incorporates **aggressive AI-driven growth assumptions**, meaning any miss on guidance or shift in sentiment could trigger multiple compression.

4. **Overreliance on AI Hype**

- Palantir is benefiting from enthusiasm around its AI platform (AIP). Overreliance on a single narrative can inflate valuations—if the AI hype fades or competition intensifies, shares may correct sharply.

**Key Bearish Fundamental Takeaway**: **PLTR’s valuation appears stretched** relative to both broad market metrics and even other high-growth tech names. While growth remains robust, the current price suggests *near-flawless* execution for many years, creating a higher risk of a downside re-rating if sentiment changes.

---

## 2. **Technical Analysis Summary**

1. **Weekly Chart**

- **Extended Uptrend**: Price has risen parabolically, with weekly RSI above 80 (signaling overbought conditions).

- **Volume**: Surging volumes indicate strong buying, but watch for a volume spike on any significant down week, which could confirm selling pressure.

2. **Daily Chart**

- **Overbought Momentum**: Daily RSI also hovers in the high-70s to low-80s range—historically prone to consolidation or pullbacks.

- **Elevated Price vs. Moving Averages**: The stock is trading well above the 10-day and 20-day MAs. A break below these short-term MAs often triggers momentum traders to exit.

3. **Intraday (1-Hour) Chart**

- **Sharp Run-Up**: Price has advanced rapidly, with minimal pauses.

- **Profit-Taking Signs**: Slight cooling in the 1-hour RSI and the formation of small-bodied candles with upper wicks, hinting at short-term distribution or indecision.

**Key Bearish Technical Takeaway**: PLTR appears **technically overextended** in multiple timeframes. This increases the likelihood of a pullback or correction, especially if broader market sentiment towards high-multiple stocks worsens.

---

## 3. **Bear Case Rationale**

1. **Valuation Compression Risk**

- With P/E > 200× forward earnings, even a moderate downward revision in growth expectations could spur multiple contraction—potentially sending the stock sharply lower.

2. **Overbought Technicals**

- Weekly and daily RSIs in the 80s are historically unsustainable. Overbought conditions often precede consolidations or corrections, providing a window for short sellers to capitalize.

3. **Macro Factors & Rising Rates**

- Growth stocks with high valuations are particularly sensitive to interest rates. Any hint of tighter monetary policy can diminish risk appetite for stocks priced at extreme multiples.

4. **Analyst & Institutional Rotation**

- If institutional investors choose to rotate out of high-growth, high-valuation names into more defensive sectors, PLTR could see accelerated selling.

- The stated 12-month analyst consensus target implies substantial downside, suggesting limited support from the sell-side in the near term.

5. **AI Hype Vulnerability**

- Overreliance on an AI-driven narrative can be a double-edged sword. In the event that AI adoption or contract wins slow, the stock might face a severe revaluation.

---

## 4. **Potential Short-Sell Setups**

Below are two illustrative ways a short-seller might engage, each with varying risk levels:

1. **Momentum Shift Entry**

- **Trigger**: Wait for price to close below the 10-day or 20-day moving average on the daily chart with a confirmed pickup in sell volume.

- **Stop-Loss Consideration**: Place stops above the recent swing high (e.g., above $116–$120) to protect from a short squeeze if the bullish run persists.

- **Target Zones**: A price retracement toward the $90–$95 area (recent pivot/support) or the round number $100 could be initial downside targets.

2. **Rally Fade / Overbought Condition**

- **Trigger**: Enter a short position into a relief bounce back toward the prior highs if momentum indicators show a clear negative divergence (e.g., RSI making lower highs).

- **Stop-Loss Placement**: Just above the new local high—if price unexpectedly breaks higher, exit quickly.

- **Target Zones**: Scale out partial profits around the 50-day MA or psychological levels like $100. If broader market conditions worsen, a deeper move below $90 could be possible.

**Risk Management**: Shorting a high-momentum, high-volatility stock is inherently risky. Tight stops, position sizing, and continuous monitoring are essential. **Cover** promptly if price action contradicts the bearish thesis.

---

## 5. **Conclusion & Manager Summary**

**Fundamental Snapshot**:

- Palantir’s valuation is pricing in extraordinary future growth (P/E > 200× forward). Any slowdown or miss may induce significant downside.

- Analysts are cautious; consensus targets are below current price.

**Technical Situation**:

- Price is extended across multiple timeframes, with **overbought RSI** readings and a near-vertical price trajectory—historically indicative of potential pullbacks.

- A correction to technical support (near $100, or possibly $90–$95) may be in the cards if bullish momentum wanes.

**Bear Thesis / Short Opportunity**:

- **Rationale**: Extreme valuation + Overbought technicals + Potential macro headwinds = Elevated risk of a downside re-rating.

- **Strategy**: Look for a shift in short-term momentum (closing below key moving averages) or negative RSI divergence as a **potential short entry** signal. Set stops carefully above recent highs to cap losses.

Given the stock’s **hyper-bullish** sentiment, timing is crucial. If bullish momentum persists longer than expected, short positions risk facing quick squeezes. Nonetheless, the **probability of a meaningful correction** grows with each new leg higher, offering an appealing **risk/reward** profile for experienced traders prepared to manage volatility.

---

### **Final Note**

This combined **Fundamental + Technical** perspective suggests **caution** for long investors at these elevated levels and **potential opportunity** for short sellers anticipating a reversion to more sustainable valuation metrics. Proper risk controls—such as **position sizing, stop-loss orders, and regular re-evaluation** of the thesis—remain paramount.

Trade active

Here’s a rewritten and organized version of your thoughts:---

**Observations and Analysis:**

1. **FOMO and Hype-Driven Buying**

- There is significant **fear of missing out (FOMO)** among investors, with many asking if it’s too late to buy into Palantir (PLTR).

- This emotional buying has pushed the stock to extreme levels that are not justified by its fundamentals.

2. **Valuation Concerns**

- Palantir’s current **P/E ratio of 583×** is **extremely elevated** compared to historical averages and industry norms.

- At \$110, the fundamentals do not support this price, and the stock is significantly overvalued.

3. **Market Sentiment and Risks**

- While the overall market remains bullish, a **bearish market shift** would likely trigger **emotional and psychological selling** in PLTR.

- The hype around the stock, combined with overbought technical conditions, could lead to a steep decline if sentiment shifts.

- **PLTR is not NVDA**: The valuation here is unjustifiable even with the strong growth narrative.

4. **Overbought Conditions**

- The **RSI is overbought**, indicating that the stock is extended and a correction or profit-taking is likely imminent.

- Momentum traders should be cautious, as a shift in sentiment could result in a sharp decline.

---

**Trading Strategy and Advice:**

1. **Patience and Discipline**

- Wait for **momentum shifts** and clear signs that buyers are losing control while sellers start stepping in.

- Stay disciplined and stick to a plan—emotions must be kept in check during such volatile periods.

2. **Risk Management**

- Use **tight stop losses**, as wide stops could expose you to unnecessary risk.

- If shorting, take profits incrementally on favorable moves, leaving **¼ of the position as a runner** to maximize gains against your entry.

- **Short selling is inherently risky**, but shorting at these elevated levels offers a higher probability of success compared to shorting near support levels.

3. **Watch for Market Maker Activity**

- Market makers are likely eyeing opportunities to short PLTR at these inflated levels. Be alert to price action that signals institutional selling.

---

**Conclusion:**

- While the company is fundamentally strong, the stock is **WAY overpriced** at its current valuation.

- A shift in market sentiment could cause PLTR to **drop like a rock**, as profit-taking and valuation concerns come into focus.

- Traders should be prepared, stay patient, and look for clues indicating a loss of buying momentum.

- Above all, **do your own research**, remain disciplined, and follow a well-structured plan.

Note

Trade is not active yet.Trade closed: stop reached

I put the short feeler on at 11.90i DCA lightly at 115, but quickly got stopped out.

The buyers are still strong. I anticipated a sell off, but the overall market was bullish. given the bullish sentiment into the CPI news thats coming up, I will not be planning to go short on PLTR yet until i see some news catalyst that suggests to sell that price in the future.

Note

Total loss for this trade $500Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.