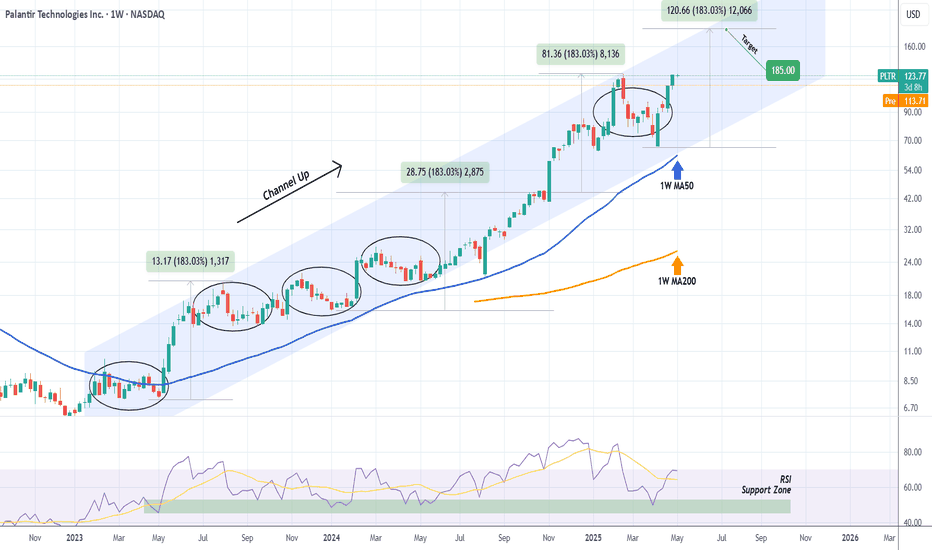

Last time we looked at Palantir (PLTR) was almost 4 months ago (May 06, see chart below), giving a buy signal that gradually but surely hit our $185 Target:

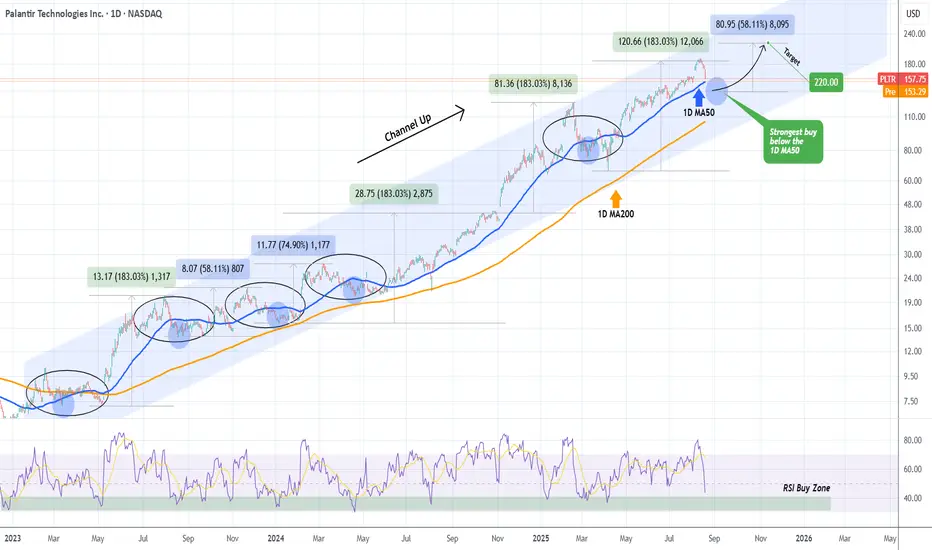

This time, the stock has found itself on a short-term pull-back that is about to hits its 1D MA50 (blue trend-line) for the first time since April 21 (4 months). This is far from alarming as the strongest buy signal within its long-term (since February 2023) Channel Up, has been below the 1D MA50.

At the same time, the 3-year RSI Buy Zone (40.00 - 30.00) is also close to being tested, so once it does, we will technically get the most optimal buy confirmation.

Even though another 183% rise from the potential bottom is possible, we will pursue a more modest Target this time, especially as we get close to the end of the year (and potentially the Cycle).

The minimum rise the market has delivered upon a 1D MA50 break has been +58.11%. As a result, our Target will be $220.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

This time, the stock has found itself on a short-term pull-back that is about to hits its 1D MA50 (blue trend-line) for the first time since April 21 (4 months). This is far from alarming as the strongest buy signal within its long-term (since February 2023) Channel Up, has been below the 1D MA50.

At the same time, the 3-year RSI Buy Zone (40.00 - 30.00) is also close to being tested, so once it does, we will technically get the most optimal buy confirmation.

Even though another 183% rise from the potential bottom is possible, we will pursue a more modest Target this time, especially as we get close to the end of the year (and potentially the Cycle).

The minimum rise the market has delivered upon a 1D MA50 break has been +58.11%. As a result, our Target will be $220.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.