PLTR — Testing Key Resistance, Eyes on 190 Breakout 🚀

GEX & Options Sentiment (1H) PLTR’s options board is showing concentrated call positioning between 185–190, with 96% call wall pressure at 187.5. This is the highest positive NetGEX zone, meaning market makers are more likely to hedge by buying if price breaks and holds above 187.7 — which could trigger a gamma squeeze toward 192.5–195.

Downside protection sits at 180–182 with heavy put walls at 170 and 160. Losing 180 could pull the stock quickly toward 172.5 HVL support. IVR is at 11.9, relatively low, suggesting calls remain cheap for momentum plays.

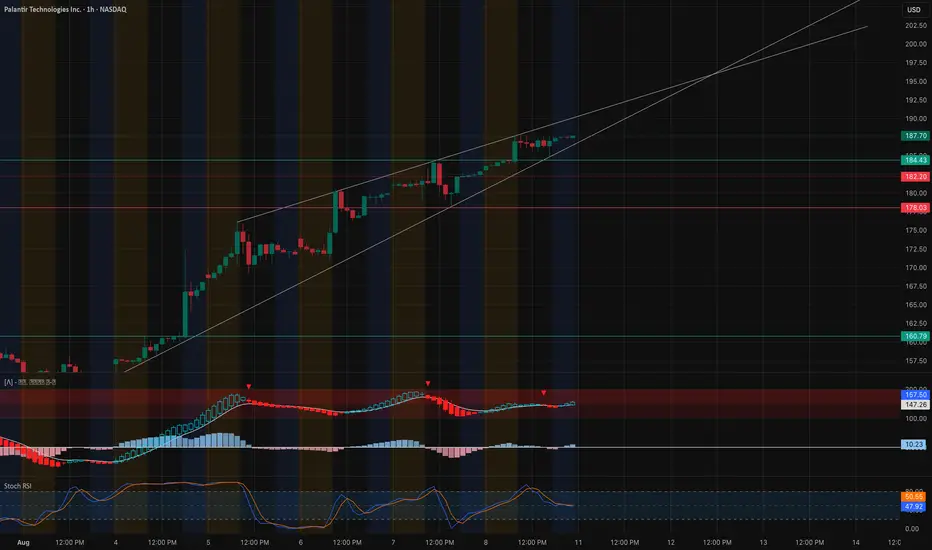

1H Technical Analysis Price has been respecting a rising channel with multiple touches on the trendline, currently consolidating just under 187.7 resistance. Momentum (MACD) is flat but still in positive territory, and Stoch RSI is mid-range — suggesting more room to run before overbought conditions kick in.

If bulls break 187.7 with volume, 190–192.5 is the next target. Failure to clear could trigger a pullback to retest 184.5 and possibly 182 before another leg higher.

Trade Plan

* Bullish Scenario: Break & hold above 187.7 → target 190, then 192.5. Options: Short-dated 190C for momentum or swing 192.5C if targeting the squeeze. Stop-loss: Below 184.5.

* Bearish Scenario: Rejection at 187.7 with heavy selling → target 184.5, then 182. Options: Short-dated 182P or 180P if momentum shifts down. Stop-loss: Above 188.5.

Thoughts PLTR is sitting at a key inflection point — break 187.7 and bulls control short term; reject here and bears can force a healthy pullback. The low IVR makes directional options attractive, but this is a “breakout or fade” setup — so patience until confirmation is key.

Disclaimer: This analysis is for educational purposes only and not financial advice. Always do your own research and manage risk accordingly.

GEX & Options Sentiment (1H) PLTR’s options board is showing concentrated call positioning between 185–190, with 96% call wall pressure at 187.5. This is the highest positive NetGEX zone, meaning market makers are more likely to hedge by buying if price breaks and holds above 187.7 — which could trigger a gamma squeeze toward 192.5–195.

Downside protection sits at 180–182 with heavy put walls at 170 and 160. Losing 180 could pull the stock quickly toward 172.5 HVL support. IVR is at 11.9, relatively low, suggesting calls remain cheap for momentum plays.

1H Technical Analysis Price has been respecting a rising channel with multiple touches on the trendline, currently consolidating just under 187.7 resistance. Momentum (MACD) is flat but still in positive territory, and Stoch RSI is mid-range — suggesting more room to run before overbought conditions kick in.

If bulls break 187.7 with volume, 190–192.5 is the next target. Failure to clear could trigger a pullback to retest 184.5 and possibly 182 before another leg higher.

Trade Plan

* Bullish Scenario: Break & hold above 187.7 → target 190, then 192.5. Options: Short-dated 190C for momentum or swing 192.5C if targeting the squeeze. Stop-loss: Below 184.5.

* Bearish Scenario: Rejection at 187.7 with heavy selling → target 184.5, then 182. Options: Short-dated 182P or 180P if momentum shifts down. Stop-loss: Above 188.5.

Thoughts PLTR is sitting at a key inflection point — break 187.7 and bulls control short term; reject here and bears can force a healthy pullback. The low IVR makes directional options attractive, but this is a “breakout or fade” setup — so patience until confirmation is key.

Disclaimer: This analysis is for educational purposes only and not financial advice. Always do your own research and manage risk accordingly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.