Plug Power Reports $337 million in Gross Billings for

2020, Up 42.5% Year over Year

Announced Multiple Partnerships and Executed Strategic Acquisitions,

Establishing Global Platform as a Green Hydrogen Solutions Company

Well Positioned to Leverage Industry Leadership and Capture Meaningful

Share of in the $10T Hydrogen Economy

● 2020 marked a record year in gross billings, with Q4 gross billings of $96.3 million and

$337 million for the full year reflecting the Company’s strong value proposition in the

growing hydrogen industry

● As previously announced, reported revenue and results were negatively impacted by

certain costs of $456 million recorded in the fourth quarter, the majority being non-cash

charges related to the accelerated vesting of a customer’s remaining warrants. Given

the expenses for this customer program have been fully expensed, the Company’s goforward reported results should be easier to understand. This resulted in reported

revenue of negative $316 million for the quarter and negative $100 million for the full

year.

● Plan to make continued investment during 2021 to deliver on substantial growth

opportunity in the green hydrogen economy on a global basis

● Strong balance sheet with now over $5 billion in cash to execute on its global growth

strategy and objectives

● On track to deliver on recently raised 2021 and 2024 financial targets

● Added a fourth pedestal customer and selected site for gigafactory to drive scale

● Executed strategic acquisitions of United Hydrogen and Giner ELX positioning Plug

Power as a fully vertically green hydrogen generation company

● Announced global joint ventures and strategic partnerships with Renault, SK Group and

ACCIONA

(source: PLUG quarterly shareholder letter)

Do your own due diligence, your risk is 100% your responsibility. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Small incremental steps work : If you double a penny a day for a month it = $5,368,709. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, risk management

Beware of analysts motives

Emotions & Opinions

FOMO : bad timing

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

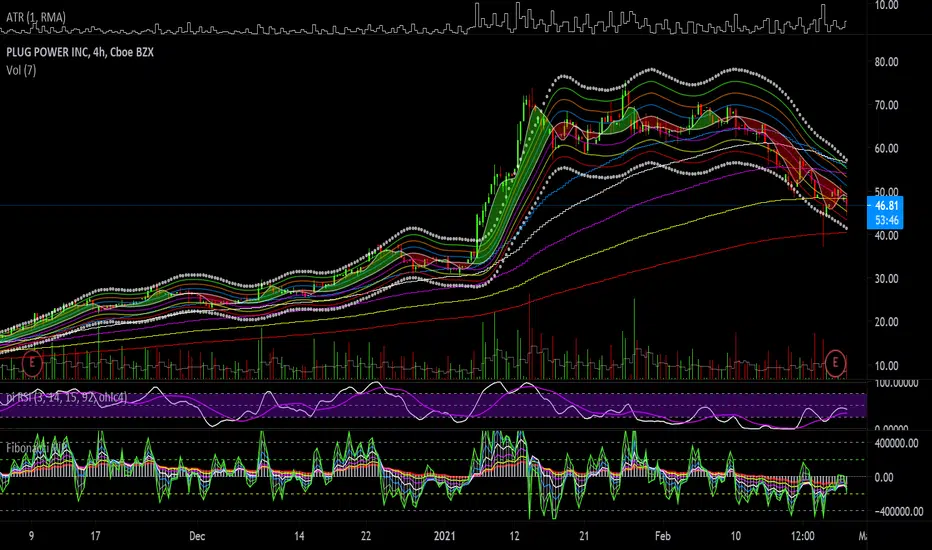

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tradingview.com/u/growerik/

2020, Up 42.5% Year over Year

Announced Multiple Partnerships and Executed Strategic Acquisitions,

Establishing Global Platform as a Green Hydrogen Solutions Company

Well Positioned to Leverage Industry Leadership and Capture Meaningful

Share of in the $10T Hydrogen Economy

● 2020 marked a record year in gross billings, with Q4 gross billings of $96.3 million and

$337 million for the full year reflecting the Company’s strong value proposition in the

growing hydrogen industry

● As previously announced, reported revenue and results were negatively impacted by

certain costs of $456 million recorded in the fourth quarter, the majority being non-cash

charges related to the accelerated vesting of a customer’s remaining warrants. Given

the expenses for this customer program have been fully expensed, the Company’s goforward reported results should be easier to understand. This resulted in reported

revenue of negative $316 million for the quarter and negative $100 million for the full

year.

● Plan to make continued investment during 2021 to deliver on substantial growth

opportunity in the green hydrogen economy on a global basis

● Strong balance sheet with now over $5 billion in cash to execute on its global growth

strategy and objectives

● On track to deliver on recently raised 2021 and 2024 financial targets

● Added a fourth pedestal customer and selected site for gigafactory to drive scale

● Executed strategic acquisitions of United Hydrogen and Giner ELX positioning Plug

Power as a fully vertically green hydrogen generation company

● Announced global joint ventures and strategic partnerships with Renault, SK Group and

ACCIONA

(source: PLUG quarterly shareholder letter)

Do your own due diligence, your risk is 100% your responsibility. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Small incremental steps work : If you double a penny a day for a month it = $5,368,709. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, risk management

Beware of analysts motives

Emotions & Opinions

FOMO : bad timing

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tradingview.com/u/growerik/

Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.