📌 Summary & Trade Context

Element Status

Monthly Momentum Rebounding, bullish

Weekly Trend Breakout setup

Daily Confirmation Clean breakout, high RSI

Intraday Volume Rising, strong base

Entry (as per chart) ₹6170 -Not advise

Stop Loss (buffered) ₹6096

RR Setup Favorable (>2:1 if target is near 6300–6350)

✅ Multi-Timeframe Technical Outlook – POLYCAB Futures

Monthly Chart

- Trend: Still in a strong long-term uptrend after a clean pullback.

- Structure: Price recovering above moving averages (likely 10/20 EMA), bouncing off a long-term support.

- RSI: Turning upward, around 56.65, exiting bearish zone.

- Bias: ✅ Bullish reversal base forming.

Weekly Chart

- Trend: Sideways for a few weeks, but holding higher lows.

- Structure: Clear consolidation between 5893 and 6170, now breaking out of range.

- RSI: 76.34 – very strong.

- Bias: ✅ Momentum pickup underway, breaking past resistance zone.

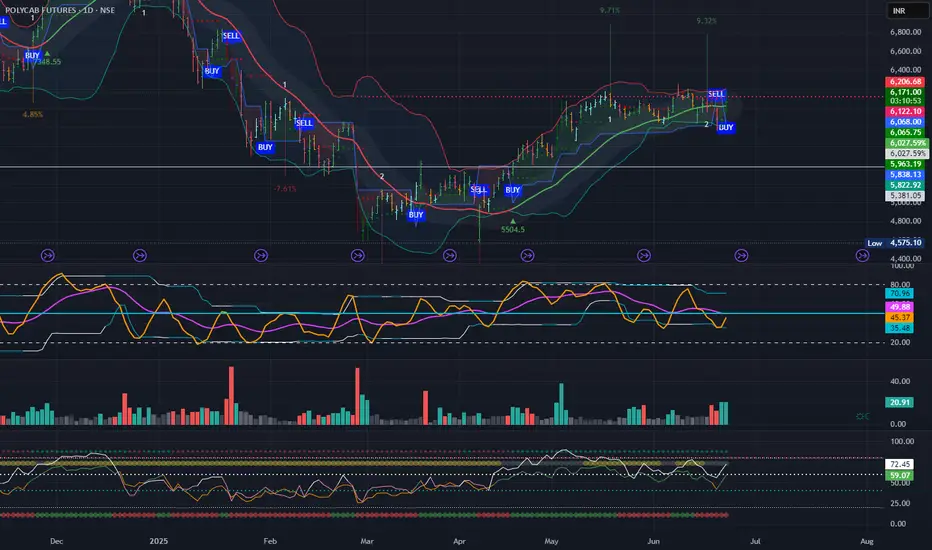

Daily Chart

- Structure: Breakout from congestion zone (around 6060–6080).

- Momentum: RSI near 72+, stochastic crossover; volume confirms breakout.

- Buy/Sell Labels: System shows prior buy confirmation recently.

- Bias: ✅ Strong bullish momentum with volume support.

75-min & 125-min Charts

- Structure: Clean reversal and rising structure from bottom. Volume pickup evident.

- Entry Highlighted: 6170; SL ~6096 – risk is ~74 pts.

- Stochastic RSI: Above 70; confirming bullish momentum.

- Volume Profile: Demand zone clearly visible around 6030–6070.

- Bias: ✅ Favorable risk-reward, supported by strong structure.

30-min Chart

- Volume Profile: POC and high volume nodes shifting higher – bullish confirmation.

- VWAP / EMA bounce: Pullbacks getting bought near 9/20 EMA.

- Bias: ✅ Good follow-through above 6122–6170.

3-min Chart

- Micro-structure: Strong impulse from ORH (Opening Range High) with higher lows.

- Trend: Following 20 EMA trail with confirmation from RSI > 70.

- Bias: ✅ Trend intact. Micro-pullbacks being bought.

I am not SEBI registered analyst and I am recommending any buy or sell, this is just my idea. Your investment should be based on your risk and advise of certified financial planners.

Element Status

Monthly Momentum Rebounding, bullish

Weekly Trend Breakout setup

Daily Confirmation Clean breakout, high RSI

Intraday Volume Rising, strong base

Entry (as per chart) ₹6170 -Not advise

Stop Loss (buffered) ₹6096

RR Setup Favorable (>2:1 if target is near 6300–6350)

✅ Multi-Timeframe Technical Outlook – POLYCAB Futures

Monthly Chart

- Trend: Still in a strong long-term uptrend after a clean pullback.

- Structure: Price recovering above moving averages (likely 10/20 EMA), bouncing off a long-term support.

- RSI: Turning upward, around 56.65, exiting bearish zone.

- Bias: ✅ Bullish reversal base forming.

Weekly Chart

- Trend: Sideways for a few weeks, but holding higher lows.

- Structure: Clear consolidation between 5893 and 6170, now breaking out of range.

- RSI: 76.34 – very strong.

- Bias: ✅ Momentum pickup underway, breaking past resistance zone.

Daily Chart

- Structure: Breakout from congestion zone (around 6060–6080).

- Momentum: RSI near 72+, stochastic crossover; volume confirms breakout.

- Buy/Sell Labels: System shows prior buy confirmation recently.

- Bias: ✅ Strong bullish momentum with volume support.

75-min & 125-min Charts

- Structure: Clean reversal and rising structure from bottom. Volume pickup evident.

- Entry Highlighted: 6170; SL ~6096 – risk is ~74 pts.

- Stochastic RSI: Above 70; confirming bullish momentum.

- Volume Profile: Demand zone clearly visible around 6030–6070.

- Bias: ✅ Favorable risk-reward, supported by strong structure.

30-min Chart

- Volume Profile: POC and high volume nodes shifting higher – bullish confirmation.

- VWAP / EMA bounce: Pullbacks getting bought near 9/20 EMA.

- Bias: ✅ Good follow-through above 6122–6170.

3-min Chart

- Micro-structure: Strong impulse from ORH (Opening Range High) with higher lows.

- Trend: Following 20 EMA trail with confirmation from RSI > 70.

- Bias: ✅ Trend intact. Micro-pullbacks being bought.

I am not SEBI registered analyst and I am recommending any buy or sell, this is just my idea. Your investment should be based on your risk and advise of certified financial planners.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.