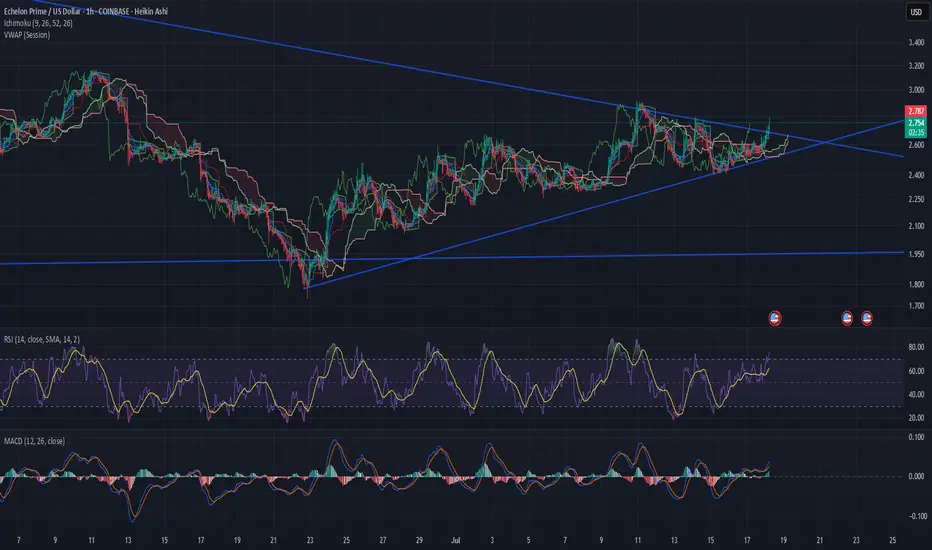

Everyone’s talking about “alt season,” but very few get in before the real moves begin.  PRIME is not just breaking out technically; it’s ticking all the right boxes fundamentally and socially. Here’s why I’m ultra bullish, why all-time highs are in play, and the hard maths on why

PRIME is not just breaking out technically; it’s ticking all the right boxes fundamentally and socially. Here’s why I’m ultra bullish, why all-time highs are in play, and the hard maths on why  PRIME in the top 100 is a realistic, not just hopium, call.

PRIME in the top 100 is a realistic, not just hopium, call.

1. Market Cap Maths

Current market cap: ~$100 million USD

Top 100 cut-off (as of July 2025): ~$700 million USD

To break into the top 100, PRIME needs to 7x from here.

PRIME needs to 7x from here.

2. Price Projection

Circulating supply: ~35.8M PRIME

To hit $700M market cap:

$700,000,000 / 35,800,000 = $19.55 per PRIME

To hit $1 billion (momentum likely carries it higher in a mania):

$1,000,000,000 / 35,800,000 = $27.90 per PRIME (that’s exactly the last all-time high in March 2024).

3. All-Time Highs and Blue Sky Potential

ATH: $28.08 – down 90% from the peak, but the tokenomics are tighter, awareness is far higher, and “AI gaming” is about to run.

A full-on FOMO extension, let’s say $5B market cap (not rare for top-tier narrative coins in a mania):

$5,000,000,000 / 35,800,000 = $139.66 per PRIME

With supply unlocks and broader distribution, a price of $100-$150+ USD per PRIME is on the table if the narrative and altcoin season go nuclear.

4. Why This Isn’t Just Hype

Altcoin season means the risk flows from Bitcoin/Ethereum into lower-cap, narrative-driven coins.

PRIME is at the intersection of AI and Web3 gaming – two of the strongest narratives in the next cycle.

PRIME is at the intersection of AI and Web3 gaming – two of the strongest narratives in the next cycle.

Volume, sentiment, and on-chain data all confirm smart money is rotating in early.

5. Strategic Play

No one gets rich waiting for confirmation from CNBC or the herd.

Early entries in these moments are what turn portfolios from average to legendary.

Reflection: If you believe in the cycle thesis, the time to act is before everyone else catches on.

#PRIME #AltcoinSeason #Tradeview #CryptoMaths #AI #Web3Gaming #Top100 #Breakout #CryptoBullrun #NotFinancialAdvice

1. Market Cap Maths

Current market cap: ~$100 million USD

Top 100 cut-off (as of July 2025): ~$700 million USD

To break into the top 100,

2. Price Projection

Circulating supply: ~35.8M PRIME

To hit $700M market cap:

$700,000,000 / 35,800,000 = $19.55 per PRIME

To hit $1 billion (momentum likely carries it higher in a mania):

$1,000,000,000 / 35,800,000 = $27.90 per PRIME (that’s exactly the last all-time high in March 2024).

3. All-Time Highs and Blue Sky Potential

ATH: $28.08 – down 90% from the peak, but the tokenomics are tighter, awareness is far higher, and “AI gaming” is about to run.

A full-on FOMO extension, let’s say $5B market cap (not rare for top-tier narrative coins in a mania):

$5,000,000,000 / 35,800,000 = $139.66 per PRIME

With supply unlocks and broader distribution, a price of $100-$150+ USD per PRIME is on the table if the narrative and altcoin season go nuclear.

4. Why This Isn’t Just Hype

Altcoin season means the risk flows from Bitcoin/Ethereum into lower-cap, narrative-driven coins.

Volume, sentiment, and on-chain data all confirm smart money is rotating in early.

5. Strategic Play

No one gets rich waiting for confirmation from CNBC or the herd.

Early entries in these moments are what turn portfolios from average to legendary.

Reflection: If you believe in the cycle thesis, the time to act is before everyone else catches on.

#PRIME #AltcoinSeason #Tradeview #CryptoMaths #AI #Web3Gaming #Top100 #Breakout #CryptoBullrun #NotFinancialAdvice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.