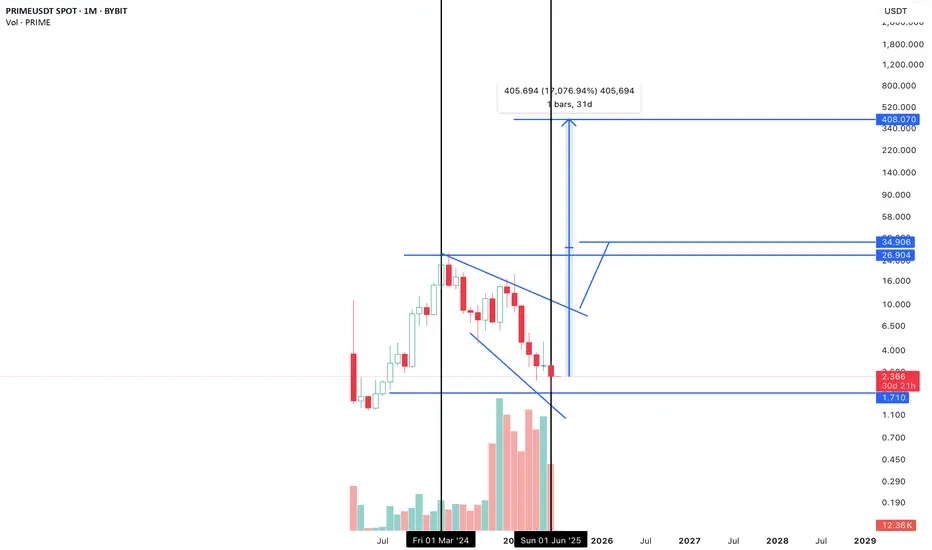

Ticker: PRIMEUSDT (Bybit)

Timeframe: Monthly

Structure: Falling Wedge

Bias: Ultra Bullish

Target: $35 → $100 → $400+

Market Cap @ $400: ~$7.48B

📉 The Setup: Falling Wedge on Monthly

PRIME is currently printing a textbook falling wedge pattern on the monthly chart, with declining volume, RSI bottoming near oversold, and price compressing tightly between converging trendlines.

Historically, falling wedges are powerful bullish reversal setups, especially on high timeframes like this. Volume compression + macro backdrop + narrative ignition = breakout fuel.

📊 RSI + Volume Context

RSI: Showing signs of hidden bullish divergence — lower RSI with flat price structure (early signal).

Volume: Decreasing throughout the wedge formation = typical pre-breakout compression.

🧠 Historical Analogs

This pattern has resolved explosively in the past for other major assets. Two key examples:

✅ Ethereum (2016–2017)

Fell from ~$21 to ~$6 in a wedge.

Broke out in early 2017 → ran to $1,400+ in less than 12 months.

Outcome: >200x move from bottom.

✅ Chainlink (2019–2020)

Dropped from $4 to $1.5 in a wedge.

Broke out Q2 2020 → surged >10x within a year.

We overlaid PRIME’s current wedge on these historical analogs — and the match is uncanny. PRIME is mirroring these structures with steeper post-breakout potential.

💰 Market Cap Math

Circulating Supply: ~18.7M PRIME

📈 Price @ $400 → Market Cap = $7.48 Billion

Still modest compared to other gaming/AI tokens with less utility and traction.

🎯 Measured Move Target

Using wedge math:

Initial Target: Base of wedge added to breakout point = ~$35+

Extended Cycle Targets: $100, $280, and even $400 possible if we enter true price discovery

🔥 What Triggers Breakout?

Macro tailwinds (Fed easing, ETH strength)

PRIME ecosystem news (Colony Game, AI integrations)

Rotation from majors → high beta alts

Volume confirmation on breakout candle

📌 Summary

PRIME is setting up like ETH in 2016 and LINK in 2019—large wedge, declining volume, early RSI divergence. If the breakout confirms, this could be one of the fastest asymmetric upside trades of the cycle.

📈 Monthly falling wedges don’t show up often—when they do, they don’t linger.

Let me know what your target is. Are you in?

#PRIME #Crypto #Altseason #TechnicalAnalysis #Ethereum #Chainlink #AI #Gaming #CryptoGems #FallingWedge

Timeframe: Monthly

Structure: Falling Wedge

Bias: Ultra Bullish

Target: $35 → $100 → $400+

Market Cap @ $400: ~$7.48B

📉 The Setup: Falling Wedge on Monthly

PRIME is currently printing a textbook falling wedge pattern on the monthly chart, with declining volume, RSI bottoming near oversold, and price compressing tightly between converging trendlines.

Historically, falling wedges are powerful bullish reversal setups, especially on high timeframes like this. Volume compression + macro backdrop + narrative ignition = breakout fuel.

📊 RSI + Volume Context

RSI: Showing signs of hidden bullish divergence — lower RSI with flat price structure (early signal).

Volume: Decreasing throughout the wedge formation = typical pre-breakout compression.

🧠 Historical Analogs

This pattern has resolved explosively in the past for other major assets. Two key examples:

✅ Ethereum (2016–2017)

Fell from ~$21 to ~$6 in a wedge.

Broke out in early 2017 → ran to $1,400+ in less than 12 months.

Outcome: >200x move from bottom.

✅ Chainlink (2019–2020)

Dropped from $4 to $1.5 in a wedge.

Broke out Q2 2020 → surged >10x within a year.

We overlaid PRIME’s current wedge on these historical analogs — and the match is uncanny. PRIME is mirroring these structures with steeper post-breakout potential.

💰 Market Cap Math

Circulating Supply: ~18.7M PRIME

📈 Price @ $400 → Market Cap = $7.48 Billion

Still modest compared to other gaming/AI tokens with less utility and traction.

🎯 Measured Move Target

Using wedge math:

Initial Target: Base of wedge added to breakout point = ~$35+

Extended Cycle Targets: $100, $280, and even $400 possible if we enter true price discovery

🔥 What Triggers Breakout?

Macro tailwinds (Fed easing, ETH strength)

PRIME ecosystem news (Colony Game, AI integrations)

Rotation from majors → high beta alts

Volume confirmation on breakout candle

📌 Summary

PRIME is setting up like ETH in 2016 and LINK in 2019—large wedge, declining volume, early RSI divergence. If the breakout confirms, this could be one of the fastest asymmetric upside trades of the cycle.

📈 Monthly falling wedges don’t show up often—when they do, they don’t linger.

Let me know what your target is. Are you in?

#PRIME #Crypto #Altseason #TechnicalAnalysis #Ethereum #Chainlink #AI #Gaming #CryptoGems #FallingWedge

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.