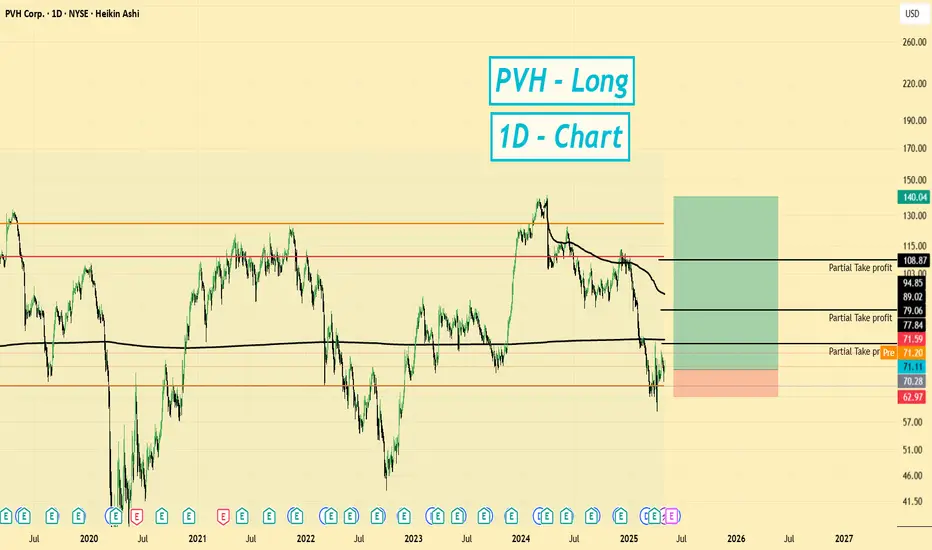

PVH | Long | Value Rebound + Seasonal Strength | (May 2025)

1️⃣ Short Insight Summary:

PVH is a legacy fashion company showing potential for a seasonal recovery and value-driven upside. After months of consolidation, money is starting to flow in again.

2️⃣ Trade Parameters:

Bias: Long

Entry: Based on 4H structure and money inflow seen on the 30-min chart

Stop Loss: Below the recent range low, ideally under $68 (to be confirmed on LTFs)

TP1: $77 — Near 4H VWAP and recent high

TP2: $89 — Previous resistance zone

TP3: $108 — Long-term value target

3️⃣ Key Notes:

✅ Fundamentals:

Revenue: $8.6B | Net Income: ~$600M

Market Cap: $3.7B (cheap compared to earnings)

Free Cash Flow: $582M | Cash: $748M

Debt: $3.4B (manageable vs FCF and cash)

Dividend Yield: 0.21%

Tangible Book Value: -$2.64 (intangible-heavy biz, normal for fashion)

Price to Cash Flow: ~5.2x (value territory)

P/S ratio: ~0.45 — very low, points to undervaluation

✅ Seasonality & Timing:

Since 2020, PVH often consolidates until November, then rallies — 2021 being the exception.

Entering Q2–Q3, it's approaching the usual setup for accumulation before a potential Q4 breakout.

✅ Business Overview:

PVH owns Calvin Klein and Tommy Hilfiger, operating in both North America and International markets. The brand strength and global reach remain strong despite macro challenges.

4️⃣ Follow-up Note:

This idea will be updated if the price reacts strongly near TP1 or shows reversal patterns at major levels.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

1️⃣ Short Insight Summary:

PVH is a legacy fashion company showing potential for a seasonal recovery and value-driven upside. After months of consolidation, money is starting to flow in again.

2️⃣ Trade Parameters:

Bias: Long

Entry: Based on 4H structure and money inflow seen on the 30-min chart

Stop Loss: Below the recent range low, ideally under $68 (to be confirmed on LTFs)

TP1: $77 — Near 4H VWAP and recent high

TP2: $89 — Previous resistance zone

TP3: $108 — Long-term value target

3️⃣ Key Notes:

✅ Fundamentals:

Revenue: $8.6B | Net Income: ~$600M

Market Cap: $3.7B (cheap compared to earnings)

Free Cash Flow: $582M | Cash: $748M

Debt: $3.4B (manageable vs FCF and cash)

Dividend Yield: 0.21%

Tangible Book Value: -$2.64 (intangible-heavy biz, normal for fashion)

Price to Cash Flow: ~5.2x (value territory)

P/S ratio: ~0.45 — very low, points to undervaluation

✅ Seasonality & Timing:

Since 2020, PVH often consolidates until November, then rallies — 2021 being the exception.

Entering Q2–Q3, it's approaching the usual setup for accumulation before a potential Q4 breakout.

✅ Business Overview:

PVH owns Calvin Klein and Tommy Hilfiger, operating in both North America and International markets. The brand strength and global reach remain strong despite macro challenges.

4️⃣ Follow-up Note:

This idea will be updated if the price reacts strongly near TP1 or shows reversal patterns at major levels.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

2 Ways I can help you | Real Trades. Real Edge

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

2 Ways I can help you | Real Trades. Real Edge

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

1️⃣ The 4 Steps to Improve Your Trading Immediately: tradinggen.services/mohamad-link/

2️⃣ Get trade setups & breakdowns Here: t.me/TradeSimple_with_Mo

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.