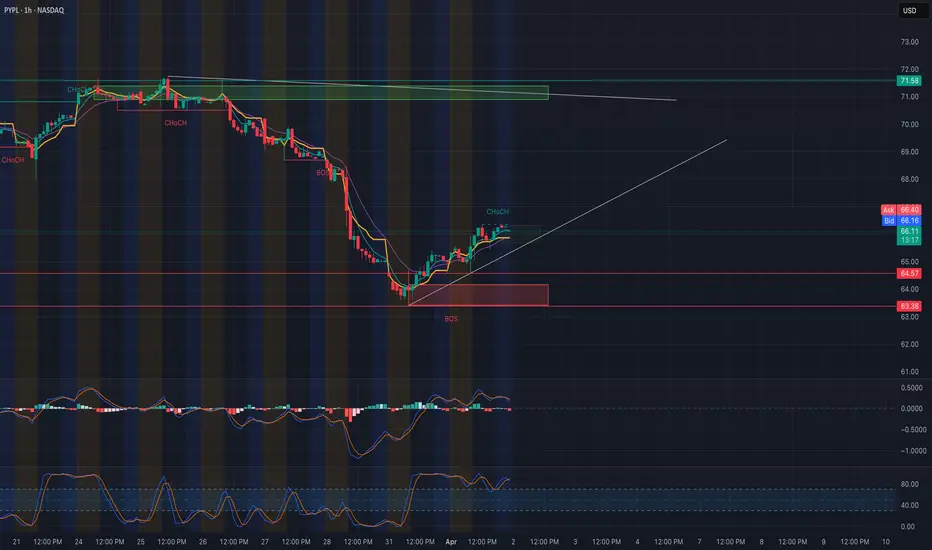

Market Structure & Price Action

PayPal (PYPL) is showing early signs of a potential reversal after forming a CHoCH (Change of Character) near the $66 level following a prior BOS (Break of Structure) and key demand reaction around $63.38. The price is now trading inside a retest range from a previous order block and pushing higher with a bullish structure of higher lows. A clean ascending trendline supports the move, with price respecting the diagonal base.

MACD is showing light momentum to the upside, and Stoch RSI is coiled just under overbought — signaling possible short-term consolidation before continuation or a breakout.

Key Levels to Watch:

* Resistance Zone (Supply): $71.50 – $72.00

* Support Zone (Demand): $63.38 – $64.57

* Breakout Trigger: Over $66.50 with volume

* Breakdown Trigger: Below $63.38 BOS zone

GEX & Options Flow Sentiment

* GEX Walls (Gamma Exposure):

* Highest Call Wall / Resistance: $72.00

* Put Wall / Support: $63.00

* Options Oscillator (Pro):

* IVR: 39.7

* IVx avg: 45.3

* Call$: 12.6%

* GEX: 🟢🟢🟢

* Bias: Slightly Bullish into resistance, volatility could expand above $67.

Trade Setup Ideas Bullish: If price holds above $65.50 and breaks $66.50, we may see a squeeze toward $69 and eventually $71.

* Entry: $66.50

* Stop: $64.70

* Targets: $69 / $71.50

Bearish: Failure to break $66.50 with rejection + bearish divergence may offer a put opportunity toward $63.

* Entry: $65.70 rejection or breakdown below $64.50

* Stop: $66.60

* Target: $63.50 / $62.80

Conclusion PYPL is bouncing within a consolidating range, and the CHoCH suggests possible accumulation. A breakout above $66.50 confirms strength; otherwise, it’s a fade back to support. Watch the trendline and volume closely this week.

Disclaimer This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.

MACD is showing light momentum to the upside, and Stoch RSI is coiled just under overbought — signaling possible short-term consolidation before continuation or a breakout.

Key Levels to Watch:

* Resistance Zone (Supply): $71.50 – $72.00

* Support Zone (Demand): $63.38 – $64.57

* Breakout Trigger: Over $66.50 with volume

* Breakdown Trigger: Below $63.38 BOS zone

GEX & Options Flow Sentiment

* GEX Walls (Gamma Exposure):

* Highest Call Wall / Resistance: $72.00

* Put Wall / Support: $63.00

* Options Oscillator (Pro):

* IVR: 39.7

* IVx avg: 45.3

* Call$: 12.6%

* GEX: 🟢🟢🟢

* Bias: Slightly Bullish into resistance, volatility could expand above $67.

Trade Setup Ideas Bullish: If price holds above $65.50 and breaks $66.50, we may see a squeeze toward $69 and eventually $71.

* Entry: $66.50

* Stop: $64.70

* Targets: $69 / $71.50

Bearish: Failure to break $66.50 with rejection + bearish divergence may offer a put opportunity toward $63.

* Entry: $65.70 rejection or breakdown below $64.50

* Stop: $66.60

* Target: $63.50 / $62.80

Conclusion PYPL is bouncing within a consolidating range, and the CHoCH suggests possible accumulation. A breakout above $66.50 confirms strength; otherwise, it’s a fade back to support. Watch the trendline and volume closely this week.

Disclaimer This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.