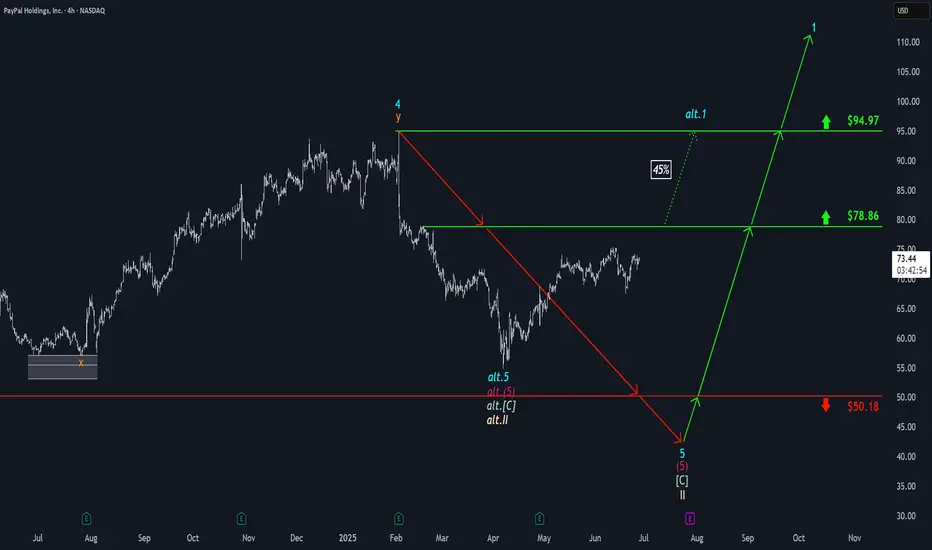

PayPal (PYPL) has faced renewed downside pressure since our last update, but the bears failed to maintain control for long. The stock quickly rebounded toward key resistance at $78.86. If this level is decisively breached, we will consider the broader correction complete with the alternative low of beige wave alt.II. This would position the stock in the early stages of a new bullish impulse – wave alt.1 – with a 45% probability assigned to this scenario. However, under our primary scenario, we still envision wave II reaching its regular low below support at $50.18. Thus, renewed selling pressure is expected to push the price beneath that level in the near term. Once the low is in place, we reckon with a new impulsive advance.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

📊 Free daily market insights combining macro + Elliott Wave analysis

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📊 Free daily market insights combining macro + Elliott Wave analysis

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

🚀 Spot trends early with momentum, sentiment & price structure

🌐 Join thousands trading smarter - full free analyses at dailymarketupdate.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.