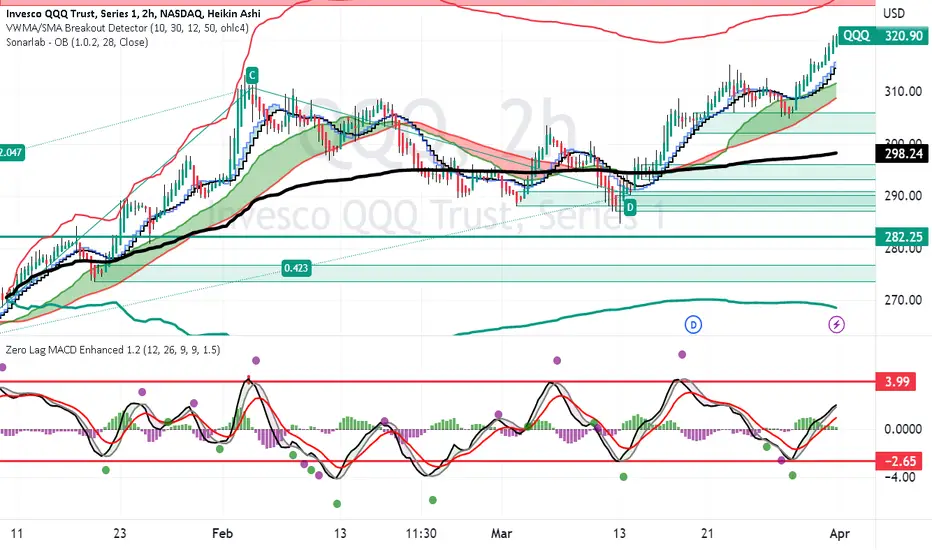

QQQ has weathered federal action and the banking meltdown quite well.

It has trended upward from a double-bottom pivot March 1 to March 13.

The MACD has held steady without any bearish divergence from price action.

Sell order blocks are lurking at 325. QQQ is trending above its anchored

VWAP showing that buying pressure exceeds selling pressure.

I will trade the QQQ with call options in TQQQ expiring Friday April 6th.

Getting several of them will allow for partial position closures as the call

values rise as a form of risk management.

It has trended upward from a double-bottom pivot March 1 to March 13.

The MACD has held steady without any bearish divergence from price action.

Sell order blocks are lurking at 325. QQQ is trending above its anchored

VWAP showing that buying pressure exceeds selling pressure.

I will trade the QQQ with call options in TQQQ expiring Friday April 6th.

Getting several of them will allow for partial position closures as the call

values rise as a form of risk management.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.