Good Morning --

Last week we reviewed the potential of the S&P 500, this week let us take a look at the potential perspective of QQQ .

QQQ .

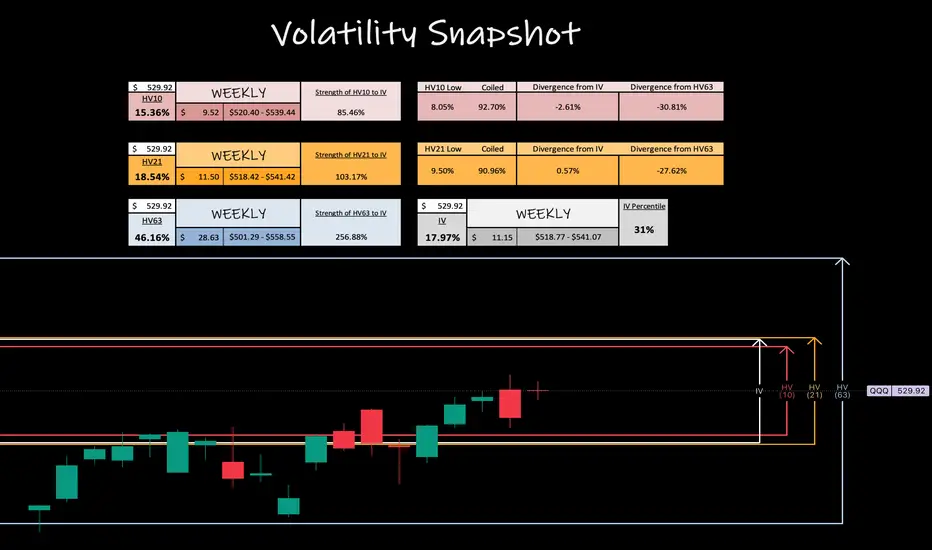

IV (17.97%) entering the week is trending 31% IVp on the year and has been gradually lowering as price action grinds higher and out of corrective territory -- This is +2.61% more volatile than near-term trending values of HV10 (15.36%) and only -0.57% under HV21 (18.54%), our monthly trending values.

Looking towards next week, I expect the VIX to continually soften IV values as the broader markets push towards all-time highs this week.

VIX to continually soften IV values as the broader markets push towards all-time highs this week.  QQQ historical values are coiling to where we will soon need a volatility spike, but not just yet -- my weekly price target here is simple (HV10 upper implied range) $539.44 with wicking potential above to monthly trends (HV21 upper implied ranges) at $541.42.

QQQ historical values are coiling to where we will soon need a volatility spike, but not just yet -- my weekly price target here is simple (HV10 upper implied range) $539.44 with wicking potential above to monthly trends (HV21 upper implied ranges) at $541.42.

Only time will tell, we can't control the markets but we sure can manage our own risk within them. Remember to always be hedged and come back to join me next weekend as we review the charts for what happened VS our expectation!

CHEERS

Last week we reviewed the potential of the S&P 500, this week let us take a look at the potential perspective of

IV (17.97%) entering the week is trending 31% IVp on the year and has been gradually lowering as price action grinds higher and out of corrective territory -- This is +2.61% more volatile than near-term trending values of HV10 (15.36%) and only -0.57% under HV21 (18.54%), our monthly trending values.

Looking towards next week, I expect the

Only time will tell, we can't control the markets but we sure can manage our own risk within them. Remember to always be hedged and come back to join me next weekend as we review the charts for what happened VS our expectation!

CHEERS

Trade closed: target reached

What an interesting fun packed week that was in the broader markets and Invesco, QQQ --We entered the week with upwards price action, only to be met with uncertainty due to war standoffs and negative news cycles, selling off into the end of the week and closing. Although feeling volatile, and a great weekly range to trade, the weekly candle had range contraction.

Stay tuned to see what the numbers into next week say!

Dive deeper into the world of volatility with me — Post a comment, ask a question, and BOOST the post if you’d like.

Make sure you 'Grab my Chart' weekly to pull my data onto your screen!

Find me over on the 'X' platform:

@askHVtobidIV

Make sure you 'Grab my Chart' weekly to pull my data onto your screen!

Find me over on the 'X' platform:

@askHVtobidIV

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Dive deeper into the world of volatility with me — Post a comment, ask a question, and BOOST the post if you’d like.

Make sure you 'Grab my Chart' weekly to pull my data onto your screen!

Find me over on the 'X' platform:

@askHVtobidIV

Make sure you 'Grab my Chart' weekly to pull my data onto your screen!

Find me over on the 'X' platform:

@askHVtobidIV

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.