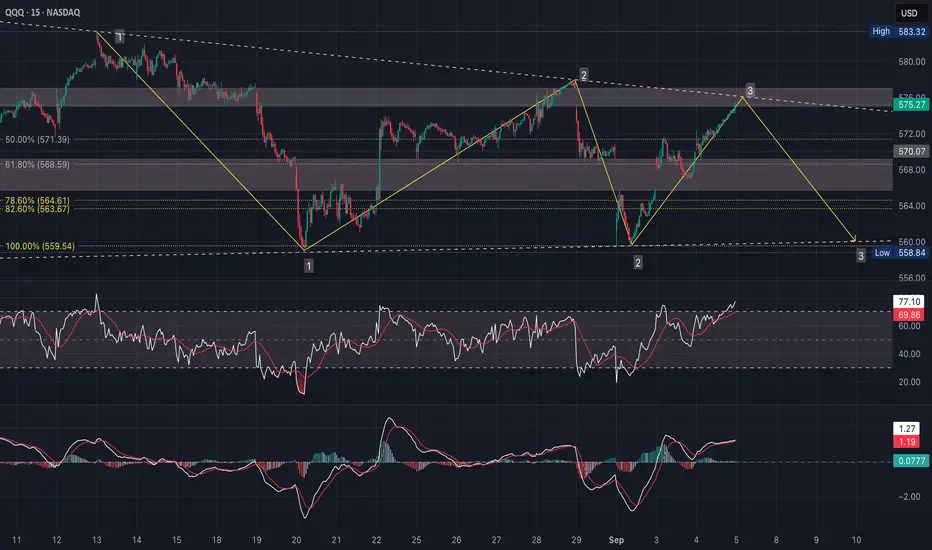

Today’s rally into resistance doesn’t cancel the bearish structure - it just tested the ceiling again, like the ball bouncing off the ceiling one more time

The deciding factor is whether tomorrow’s NFP release causes a breakout above $580 (bullish) or a breakdown below $562 (bearish)

The Fib retracements line up neatly,

The 1, 2 & 3 path into $559–$560 matches the 100% extension of the prior move

Trendline + Supply Zone + Symmetry + Fibonacci = high-probability short setup

Momentum: RSI + MACD both confirm sellers are in control of the bigger picture

- Price bounced, yes, but it stopped right at the descending trendline and supply zone

- Until QQQ clears $577–$580 on volume, this is just another lower high

- RSI still under 60 on the daily

- MACD still bearish crossover

- Bearish setups need bounces since sellers actually want rallies into supply

- Today’s move just brought price back to the spot where bears previously took control

The deciding factor is whether tomorrow’s NFP release causes a breakout above $580 (bullish) or a breakdown below $562 (bearish)

- Descending triangles usually resolve downward (break of the flat base)

- A clean daily close <$562 would trigger measured move targets

- Until $562 breaks on volume, it’s still just compression

- Sometimes triangles fake down, trap shorts & rip higher (especially with macro catalysts like NFP)

- If $576 rejects, short to $562–$558

- If $577–$580 breaks (bulls win), step aside or flip long toward $583+

The Fib retracements line up neatly,

- 50% = $571.39

- 61.8% = $568.59 (sits right inside that shaded demand area)

- 78.6% = $564.61 & 82.6% = $563.67 (exactly where buyers defended)

- 100% = $559.54

- This layering creates a ladder of potential supports, but also a measured path for shorts

The 1, 2 & 3 path into $559–$560 matches the 100% extension of the prior move

- This is where measured move & Fibonacci confluence meet

- Bears could take profit on the way down at $568.5 to $564.5 & $560

- If $559 breaks with volume, extension opens toward $547 (200d SMA) which would be the larger “unwinding” target

- Invalidation is simple, if daily close >$577–$580 trendline

- While in-play, each Fib level gives you a chance to trail stops down

Trendline + Supply Zone + Symmetry + Fibonacci = high-probability short setup

- Price = supply zone/descending trendline

- RSI = overbought on the 15m & below the midline slope & capped under 60 on the daily

- That’s a sign of weak momentum - each bounce fizzles out earlier

- The RSI trendline itself is descending, which mirrors price

- MACD = potentially topping on the 15m & still bearish crossover on the daily with it's histogram contracting slightly, so momentum is still in bear mode, with only a weak attempt at recovery

Momentum: RSI + MACD both confirm sellers are in control of the bigger picture

- If NFP or another catalyst sends QQQ through $577–$580, watch for RSI breaking above 60 (momentum shift) & MACD histogram flipping positive with a bullish cross

- That would negate the bearish triangle & turn this into a breakout squeeze toward $583+

Trade active

QQQ closed above my descending trend line near $575, which signals a short-term breakout from the recent downtrend, but since price is still sitting under $579–$582, it needs follow-through• A rejection back under $575 would turn this into a false breakout

I am not a licensed professional & these posts are for informational purposes only, not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I am not a licensed professional & these posts are for informational purposes only, not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.