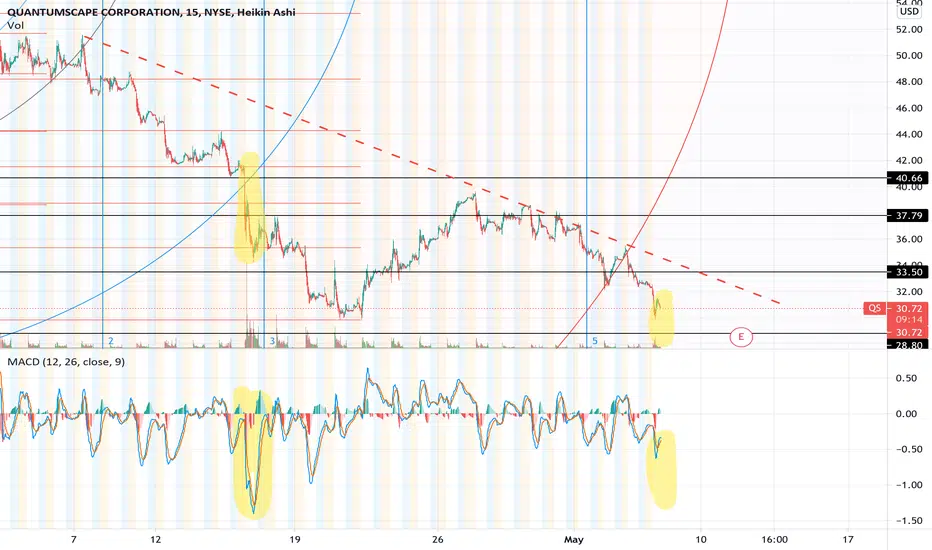

less than 300 employees in this company, unclear how many insiders get to sell into this overall weakness but apparently they're helping to see this thing tank sub 30. Pile on short sellers, eyeing a dead cat at $28.75, I own 75 shares of this thing, and a 31 put contract expiring tomorrow. With a little luck, it'll accrue some moneyness and fund an additional 25 shares in the mid 20s PT. Overall I'm long QS unless VW & B. Gates backs out. Then it's the short of the decade.

Why did it take 10 years to go public and then this hype parade. head scratcher. real curious what Elon thinks of the QS materiality separator approach

Why did it take 10 years to go public and then this hype parade. head scratcher. real curious what Elon thinks of the QS materiality separator approach

Trade active

rolling into a cheap 26 May 14 Put. My thesis is more protection in the face of the buying frenzy pre-earnings. I'm looking for more downside, gotta realize how expensive and a time-suck doing solid state lithium will be. There's a ton of de-spac'd shit out there trading at $8 now; gotta think even tho the Jagdeep tour helps lift shares, the AH will sell this thing hard because the shorts are out and lurking 🤙🏽

All that said, I want this company to do well, I own 75 shares near $50, I've been underwater, buy orders in around $22 for an additional 25 shares where I'll write calls against it going forward. We'll see....

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.