🚀 The Yield Curve Just Turned Bullish — So Did $RAI’s Future

Why This AI Token Could Be the Biggest Beneficiary of the Bull Steepening Cycle

"When the curve steepens, capital doesn’t trickle — it floods into risk. And $RAI is perfectly positioned."

📈 Macro Setup: Bull Steepening Means Risk-On

The story starts with rates. Here's the shift:

Where we were: Bear steepening — long-end rates spiked on inflation fears while short-end stayed high. Liquidity was scarce. Risk was punished.

Where we are now: Bull steepening — short-end rates are falling faster than long-end rates rise. This signals reflation and the beginning of a capital rotation into growth and risk.

Historically, this phase fuels massive runs in:

Small caps (Russell 2000)

Narrative-driven tech

Crypto

And especially AI-powered, low-float tokens like $RAI

🤖 Why Reploy AI ($RAI)?

$RAI isn’t just an AI meme coin — it’s an infrastructure layer for decentralized AI inference. With only 10M tokens, it’s one of the most scarce, utility-based plays in Web3 AI.

And now, macro tailwinds + chart setup + capital rotation = asymmetric upside.

🎯 Updated Upside Targets

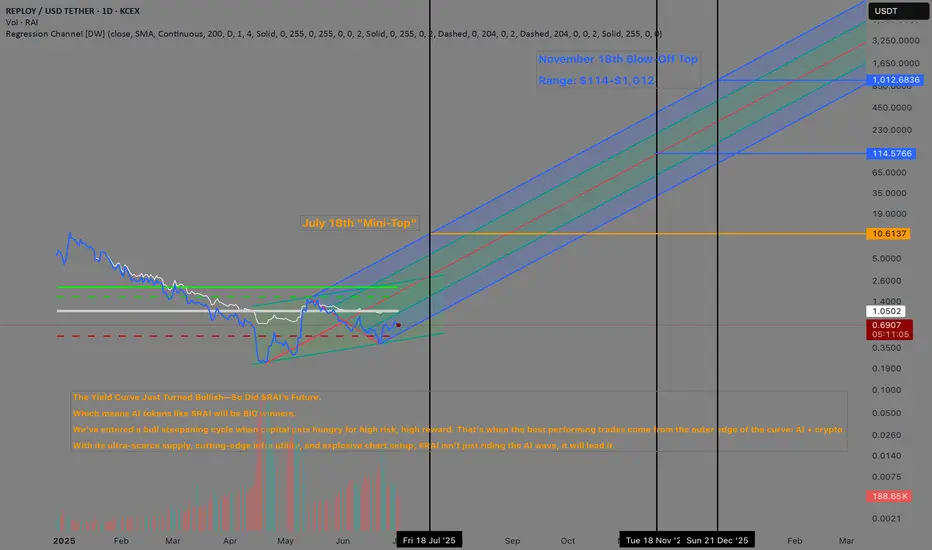

✅ Mini-Top: $10.61 by July 18

This target aligns with:

The top of the current regression band.

Mid-summer capital rotation.

Historical pre-breakout behavior from 2020/2021 AI-coins like FET and $OCEAN.

FET and $OCEAN.

🧮 From today’s ~$0.69: That’s a 15x move in ~3 weeks.

💥 Blow-Off Top: $114 to $1,012 by Dec 21

This is the big one — and your chart now reflects the most important extension:

A 5-week window from Nov 18 to Dec 21, aligning with prior cycle tops.

Price range between $114 and $1,012.

Implies a market cap of $1.14B to $10.12B (fully diluted) — still modest compared to likely peers if AI mania peaks.

Think LINK in 2021 or

LINK in 2021 or  SOL in late 2020. $RAI has the same structure — now layered with macro rocket fuel.

SOL in late 2020. $RAI has the same structure — now layered with macro rocket fuel.

🧠 Why It Matters

In bull steepening cycles, capital chases asymmetry. The whole framework flips:

Safe → Speculative

Yield → Growth

Real → Narrative

AI + Web3 sits at the intersection of the two hottest macro themes. $RAI is the leading microcap expression of both.

If you're looking to allocate based on macro structure + narrative rotation + price action, this chart is screaming.

📣 Summary for Readers:

We're in the early innings of a reflationary, risk-on regime shift. If the blow-off top hits by December as expected, tokens like $RAI could become the top performers of the entire cycle.

With a $0.69 entry price, the risk-to-reward is wildly asymmetric.

📈 Don’t just follow the trend. Front-run it.

💡 $RAI is where narrative, structure, and scarcity converge.

Why This AI Token Could Be the Biggest Beneficiary of the Bull Steepening Cycle

"When the curve steepens, capital doesn’t trickle — it floods into risk. And $RAI is perfectly positioned."

📈 Macro Setup: Bull Steepening Means Risk-On

The story starts with rates. Here's the shift:

Where we were: Bear steepening — long-end rates spiked on inflation fears while short-end stayed high. Liquidity was scarce. Risk was punished.

Where we are now: Bull steepening — short-end rates are falling faster than long-end rates rise. This signals reflation and the beginning of a capital rotation into growth and risk.

Historically, this phase fuels massive runs in:

Small caps (Russell 2000)

Narrative-driven tech

Crypto

And especially AI-powered, low-float tokens like $RAI

🤖 Why Reploy AI ($RAI)?

$RAI isn’t just an AI meme coin — it’s an infrastructure layer for decentralized AI inference. With only 10M tokens, it’s one of the most scarce, utility-based plays in Web3 AI.

And now, macro tailwinds + chart setup + capital rotation = asymmetric upside.

🎯 Updated Upside Targets

✅ Mini-Top: $10.61 by July 18

This target aligns with:

The top of the current regression band.

Mid-summer capital rotation.

Historical pre-breakout behavior from 2020/2021 AI-coins like

🧮 From today’s ~$0.69: That’s a 15x move in ~3 weeks.

💥 Blow-Off Top: $114 to $1,012 by Dec 21

This is the big one — and your chart now reflects the most important extension:

A 5-week window from Nov 18 to Dec 21, aligning with prior cycle tops.

Price range between $114 and $1,012.

Implies a market cap of $1.14B to $10.12B (fully diluted) — still modest compared to likely peers if AI mania peaks.

Think

🧠 Why It Matters

In bull steepening cycles, capital chases asymmetry. The whole framework flips:

Safe → Speculative

Yield → Growth

Real → Narrative

AI + Web3 sits at the intersection of the two hottest macro themes. $RAI is the leading microcap expression of both.

If you're looking to allocate based on macro structure + narrative rotation + price action, this chart is screaming.

📣 Summary for Readers:

We're in the early innings of a reflationary, risk-on regime shift. If the blow-off top hits by December as expected, tokens like $RAI could become the top performers of the entire cycle.

With a $0.69 entry price, the risk-to-reward is wildly asymmetric.

📈 Don’t just follow the trend. Front-run it.

💡 $RAI is where narrative, structure, and scarcity converge.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.