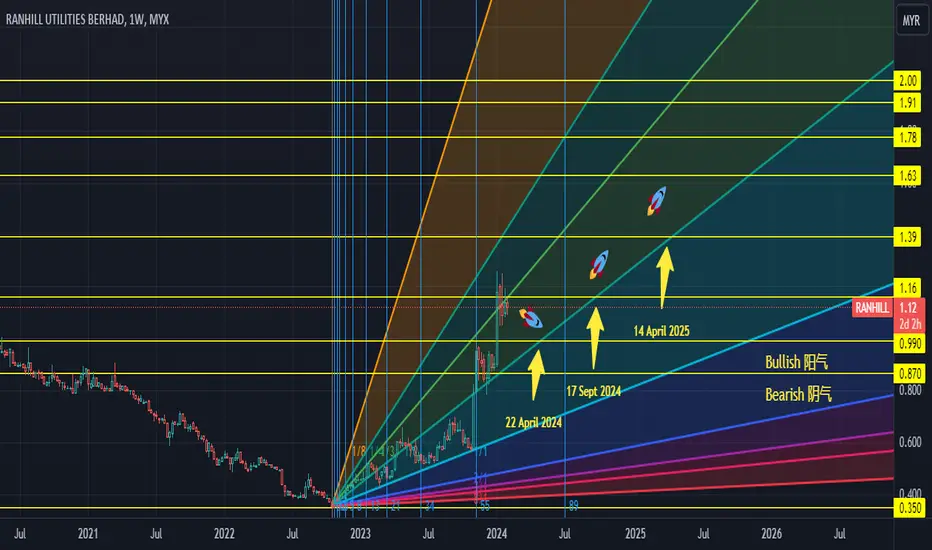

Ranhill, above 0.87 is bullish, below 0.87 is bearish. Key date to watch 22 April 2024, 17 Sept 2024, 14 April 2025.

As of 2024-01-31, the Fair Value of Ranhill Utilities Bhd (RANHILL.KL) is 2.03 MYR. This value is based on the Peter Lynch's Fair Value formula. With the current market price of 1.13 MYR, the upside of Ranhill Utilities Bhd is 80%.

Peter Lynch's formula: RANHILL.KL Fair Value = Earnings Growth Rate x TTM EPS

source: valueinvesting.io/RANHILL.KL/valuation/fair-value

As of 2024-01-31, the Fair Value of Ranhill Utilities Bhd (RANHILL.KL) is 2.03 MYR. This value is based on the Peter Lynch's Fair Value formula. With the current market price of 1.13 MYR, the upside of Ranhill Utilities Bhd is 80%.

Peter Lynch's formula: RANHILL.KL Fair Value = Earnings Growth Rate x TTM EPS

source: valueinvesting.io/RANHILL.KL/valuation/fair-value

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.